Mt Bank Cashiers Check

How Long Does It Take For A Money Order To Be Available When Deposited Into My M T Bank Account Quora

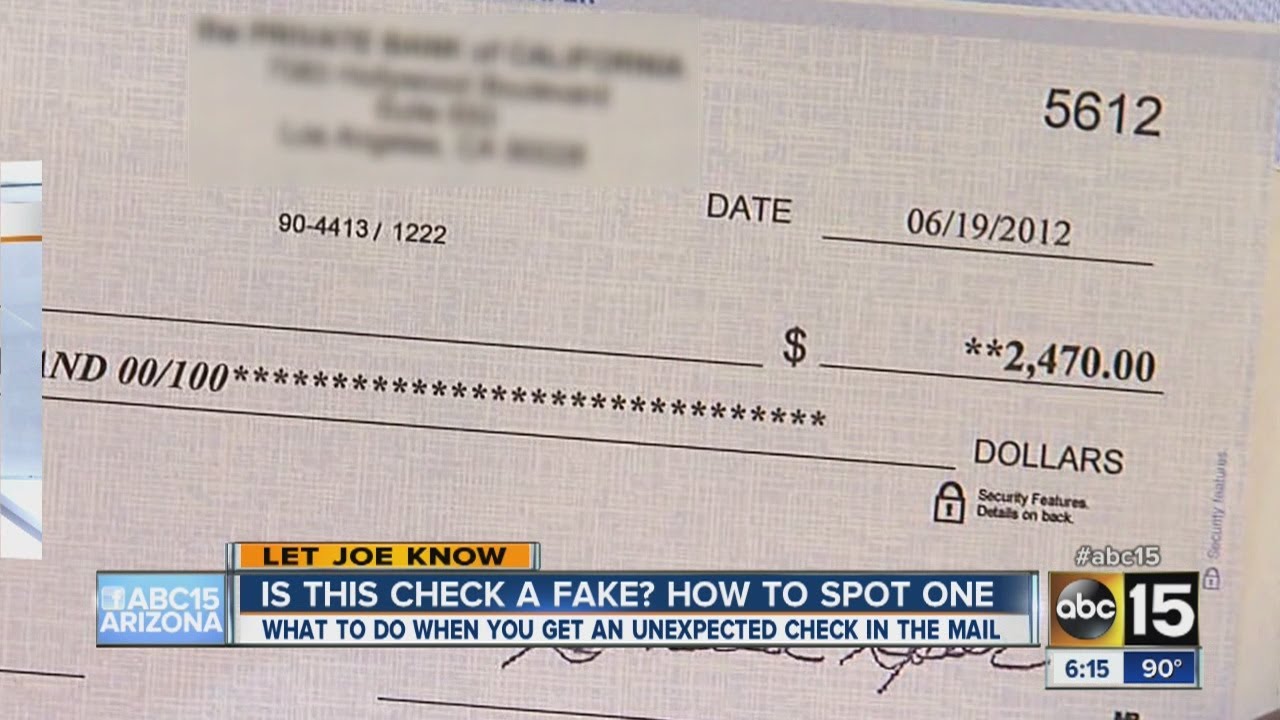

Got A Check In The Mail How To Make Sure It S The Real Deal Youtube

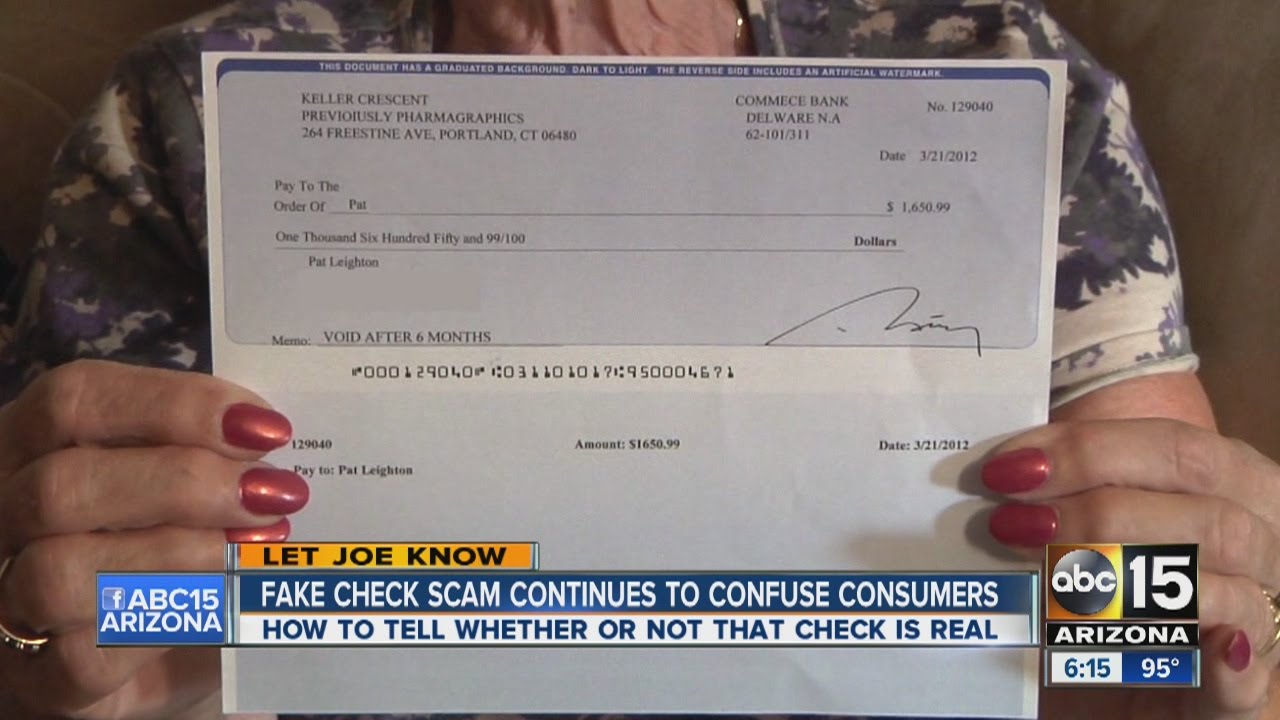

Fake Check Scam Continues To Confuse Consumers Youtube

M And T Bank Cashier Check Logo Page 1 Line 17qq Com

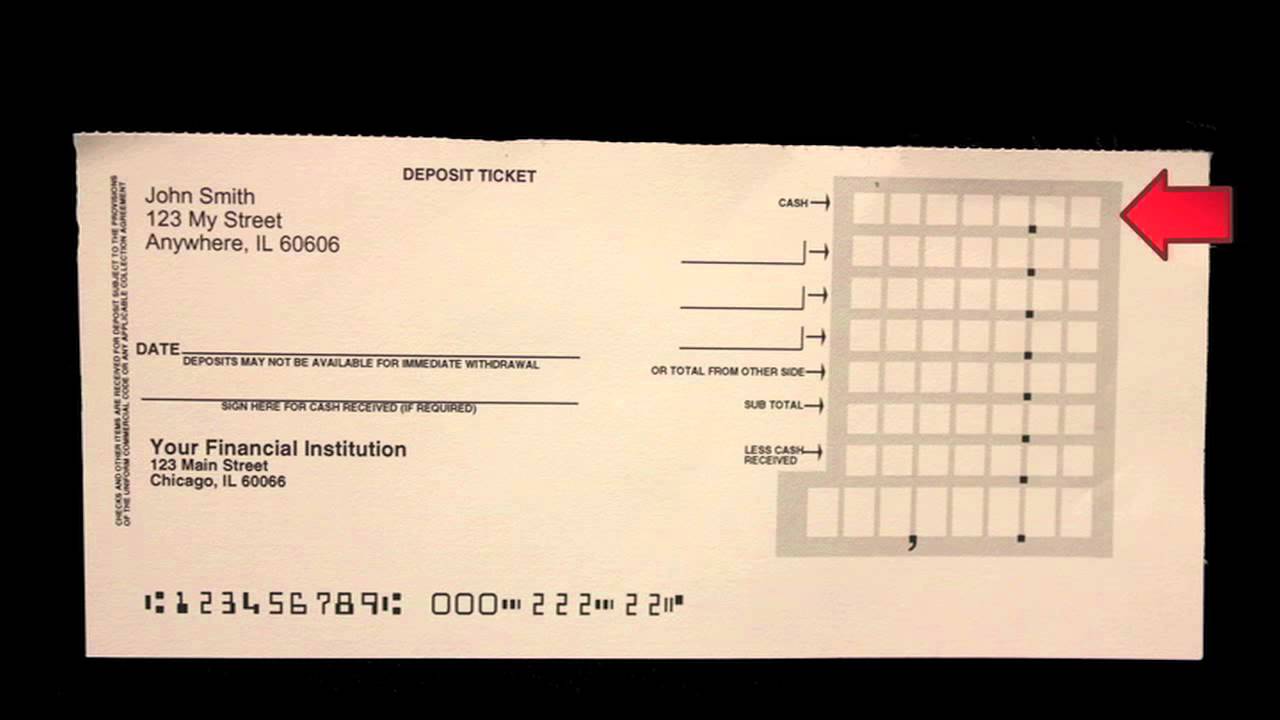

How To Fill Out A Deposit Slip Carousel Checks Youtube

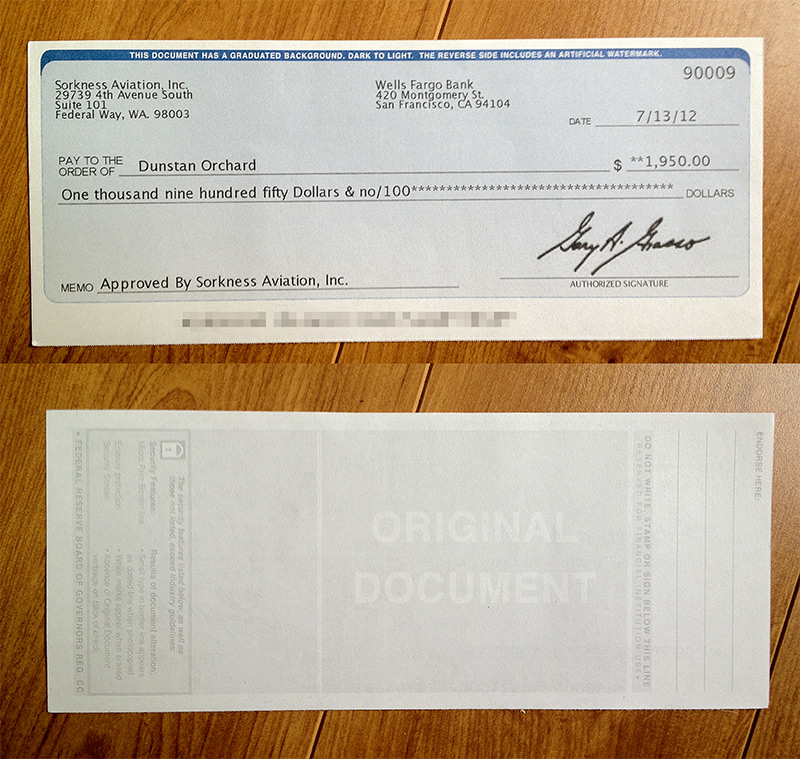

How To Get A Cashier S Check 10 Steps With Pictures Wikihow

Refer to the Personal Schedule of Fees for complete details) Don't have a checking or savings account with us?.

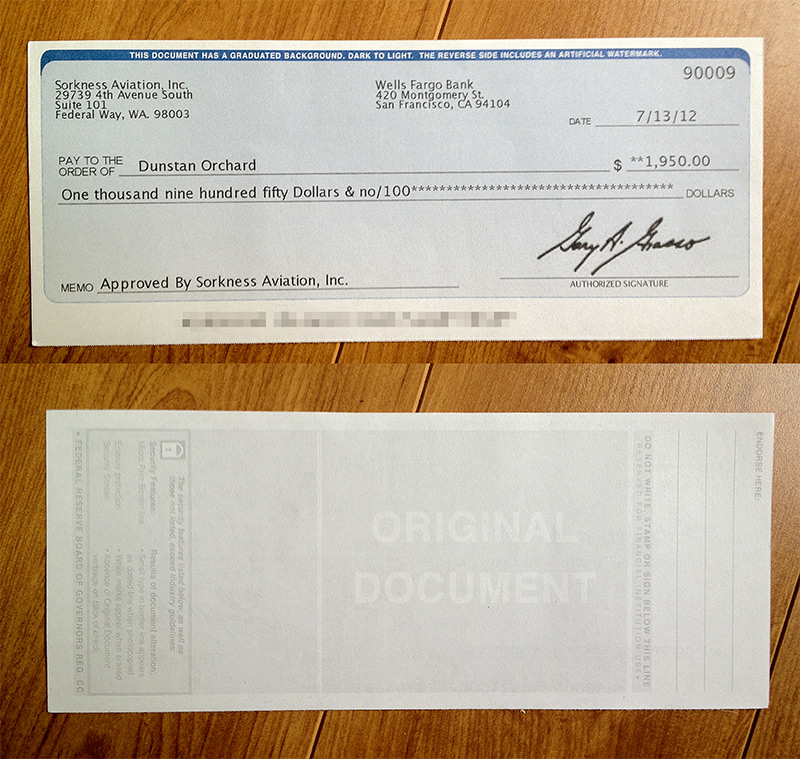

Mt bank cashiers check. A cashier’s check is when a bank withdraws available cash from your account and issues an official bank check from the bank made out to a certain person or business That money is guaranteed by. A bank representative then issues the cashier's check with the bank’s name and account information as well as the names of the payee and remitter The funds are usually then available to the. A cashier’s check, also known as an official bank check, is a payment instrument issued by a bank or credit union to a third party, usually on behalf of a bank customer who pays the bank the.

In This Section COVID19 Updates > Get the latest on our COVID19 response Contact M&T Bank > Get in touch with M&T Customer Service or access other helpful M&T Bank contact information tools and resources Current Rates > View and compare today's interest rates and fees for M&T Bank products F A Qs > Get answers, quickly and easily, to many frequently asked questions. If the person already obtained the cashier's check, ask her to go with you to the issuing bank so you can cash the check before handing over the goods Recognize the Signs Watch out if someone sends you a cashier's check for more than he owes and requests you to mail the excess funds back to him. Fake checks come in many forms They might look like business or personal checks, cashier’s checks, money orders, or a check delivered electronically Here’s what you need to know about fake check scams Types of Fake Checks Scams Fake checks are used in many types of scams Here are some examples Mystery shopping.

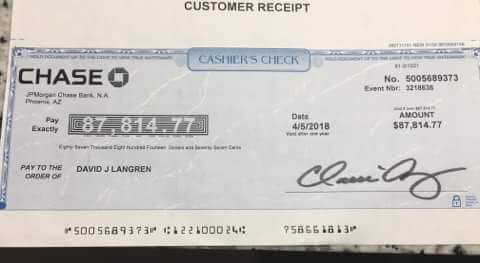

A cashier’s check is a check drawn from the bank’s own funds and signed by a cashier or teller Unlike a regular check, the bank, not the check writer, guarantees payment of a cashier’s check. FYI This is for a cashier's check, not a certified BBT $10 (cashier's check only) BBVA Compass $8 for cashier's checks for customers only No certified available Capital One Cashier's checks only and will be $10 for customers or $ for overnight shipping for online customers Chase Bank Free for all customers Cashier's checks only. A cashier's check was purchased and is considered “good funds", but it still has to traverse the same check processing that any other check does Most checks will clear in 48 hours If there is anything exceptional about the check and it requires.

FYI This is for a cashier's check, not a certified BBT $10 (cashier's check only) BBVA Compass $8 for cashier's checks for customers only No certified available Capital One Cashier's checks only and will be $10 for customers or $ for overnight shipping for online customers Chase Bank Free for all customers Cashier's checks only. 3 $10 Check order fee for 25 checks 4 $30 stop payment fee for each order to stop payment of a check or preauthorized payment to be made by an electronic fund transfer from the account, and for each renewal of such an order 5 $10 returned deposited item fee for each check or other item deposited in the account and returned unpaid. The next time you don’t want to pay with cash for a big purchase, consider using a cashier’s check And if you bank at Chase, you’ll likely find the Chase cashier’s check fee reasonable, if there are any at all Editorial Note This content is not provided by American Express Any opinions, analyses, reviews or recommendations expressed.

A cashier’s check, also known as an official bank check, is a payment instrument issued by a bank or credit union to a third party, usually on behalf of a bank customer who pays the bank the. Typical hours of operation. A cashier’s check is a check drawn from the bank’s own funds and signed by a cashier or teller Unlike a regular check, the bank, not the check writer, guarantees payment of a cashier’s check.

A cashier’s check is a check that is issued by a bank, and sold to its customer or another purchaser, that is a direct obligation of the bank Cashier’s checks are viewed as relatively riskfree instruments and, therefore, are often used as a trusted form of payment to consumers for goods and services. 2 Free cashier's checks and free money orders limited to 1 each per day 3 M&M Bank is a member of the MoneyPass ® SurchargeFree ATM network Use of any MoneyPass ® ATM will not result in a fee from M&M Bank, nor the owner of the MoneyPass ® ATM Transactions at nonparticipating foreign ATMs may result in a fee from the ATM owner. If you're a Bank of America customer with a checking or savings account, you can get a cashier's check for a $15 fee (which will be waived for customers enrolled in Preferred Rewards;.

Short Answer If your cashier’s check has been stolen, lost, or you no longer need it, you can cancel it and get the money returned to your bank account The steps for canceling a cashier’s check vary by bank but are typically similar Before canceling your cashier’s check, however, know that the refund process can take from 90 up to 180 days and you may be subject to a cancellation fee. Every bank will have different terms and requirements to cash checks that are tied to its institution The most foolproof option is to call ahead and ask about its policy and fees You’ll need 12 forms of valid ID to confirm the check is yours, so make sure to bring a driver’s license, passport, or another governmentissued ID card. FYI This is for a cashier's check, not a certified BBT $10 (cashier's check only) BBVA Compass $8 for cashier's checks for customers only No certified available Capital One Cashier's checks only and will be $10 for customers or $ for overnight shipping for online customers Chase Bank Free for all customers Cashier's checks only.

7 US Bank Large checks cashed for noncustomers US Bankissued checks. Refer to the Personal Schedule of Fees for complete details) Don't have a checking or savings account with us?. You can purchase a cashier’s check at a bank or a credit union, in person or online When you get a cashier’s check online, you may need to wait for it There are fees associated with getting a cashier’s check, so you might want to call ahead Usually, the best place to get a cashier’s check is at your own bank.

In person You can walk into most brickandmortar banks to get a check issued Within a few minutes, you should have a check in hand, and you can pay the recipient immediately Online Some banks—particularly online banks—allow you to request cashier’s checks online The bank might only mail checks to your verified mailing address, so you need to wait for the check and then forward it. Any check drawn on Bank of America;. Requirements Two forms of ID, including one valid, governmentissued photo ID;.

Fee for noncustomers Free for cashier’s checks or checks drawn on a government agency account;. A cashier’s check is a check that is issued by a bank, and sold to its customer or another purchaser, that is a direct obligation of the bank Cashier’s checks are viewed as relatively riskfree instruments and, therefore, are often used as a trusted form of payment to consumers for goods and services. In this case, you can request the bank create a “check” for you in the form of a money order or cashier’s check Once you receive the check, you can take it (or mail it with a deposit slip) to the bank and deposit it While it could take a few days to post to the depositing account, the benefit of this approach is that the bank will take.

Cashier's checks are a better option than a money order for larger payments, because money orders often have maximum limits, but there will be no maximum limit on a cashier's check amount Find a large bank that issues cashier's checks to the general public, and bring cash funds, if you do not have a bank account. In that instance, the bank generally must make the first $5,525 available according to the availability schedule The bank can place a hold on the entire amount of the cashier's check if it has reasonable cause to believe the check is uncollectible from the paying bank The bank may put a longer hold on the check if it was. If a bank refuses to pay its cashier's check, it may be liable to the presenting party for compensatory damages and consequential damages The bank has an "out" only if it can assert a claim or defense against the person entitled to enforce the instrument (and a couple of real technical loopholes) So, if the bank issued a cashier's check in.

Cashier's Checks A cashier's check is a draft drawn by a Bank on itself, which the Bank agrees to honor when properly presented for payment The Bank, not its customer, signs the check (UCC Sec 3104(3) (g)) This means that the Bank is liable to pay the check. Counter at an M&T branch, including withdrawals Checks Cashed at an M&T branch Transfers Includes transfers between M&T deposit accounts and payments to M&T loans, including Bank to Bank Transfers initiated through M&T Online Banking Wire Transfers Chronologically based on the date and time that our records indicate the transaction. To get a cashier's check, you must have the full amount of the check already available in your account When you visit the bank, the bank will issue the check using the funds from your account, sometimes charging a small fee Unless there’s clearly fraud involved (such as a forged endorsement), the bank will honor the check and make the funds.

Once a bank creates a cashier’s check, the bank guarantees to pay the amount printed on the check A legitimate cashier’s check will not bounce To get a cashier’s check, you need to bring the cash to the bank Or if you have an account there, you need to have the amount in your account and the bank will withdraw it, moving it to the bank. If you're a Bank of America customer with a checking or savings account, you can get a cashier's check for a $15 fee (which will be waived for customers enrolled in Preferred Rewards;. In that instance, the bank generally must make the first $5,525 available according to the availability schedule The bank can place a hold on the entire amount of the cashier's check if it has reasonable cause to believe the check is uncollectible from the paying bank The bank may put a longer hold on the check if it was.

Most checks printed with magnetic ink (meaning not on a home printer), such as payroll, government, tax refund, and cashier’s checks Fees for noncustomers $8 per check;. Cashier's Checks A cashier's check is a draft drawn by a Bank on itself, which the Bank agrees to honor when properly presented for payment The Bank, not its customer, signs the check (UCC Sec 3104(3) (g)) This means that the Bank is liable to pay the check. After giving someone a cashier's check, you can verify whether it has been cashed by contacting the issuing bank either in person or over the phone If you find it has not been cashed, and you fear the check has been lost or stolen, you may be abl.

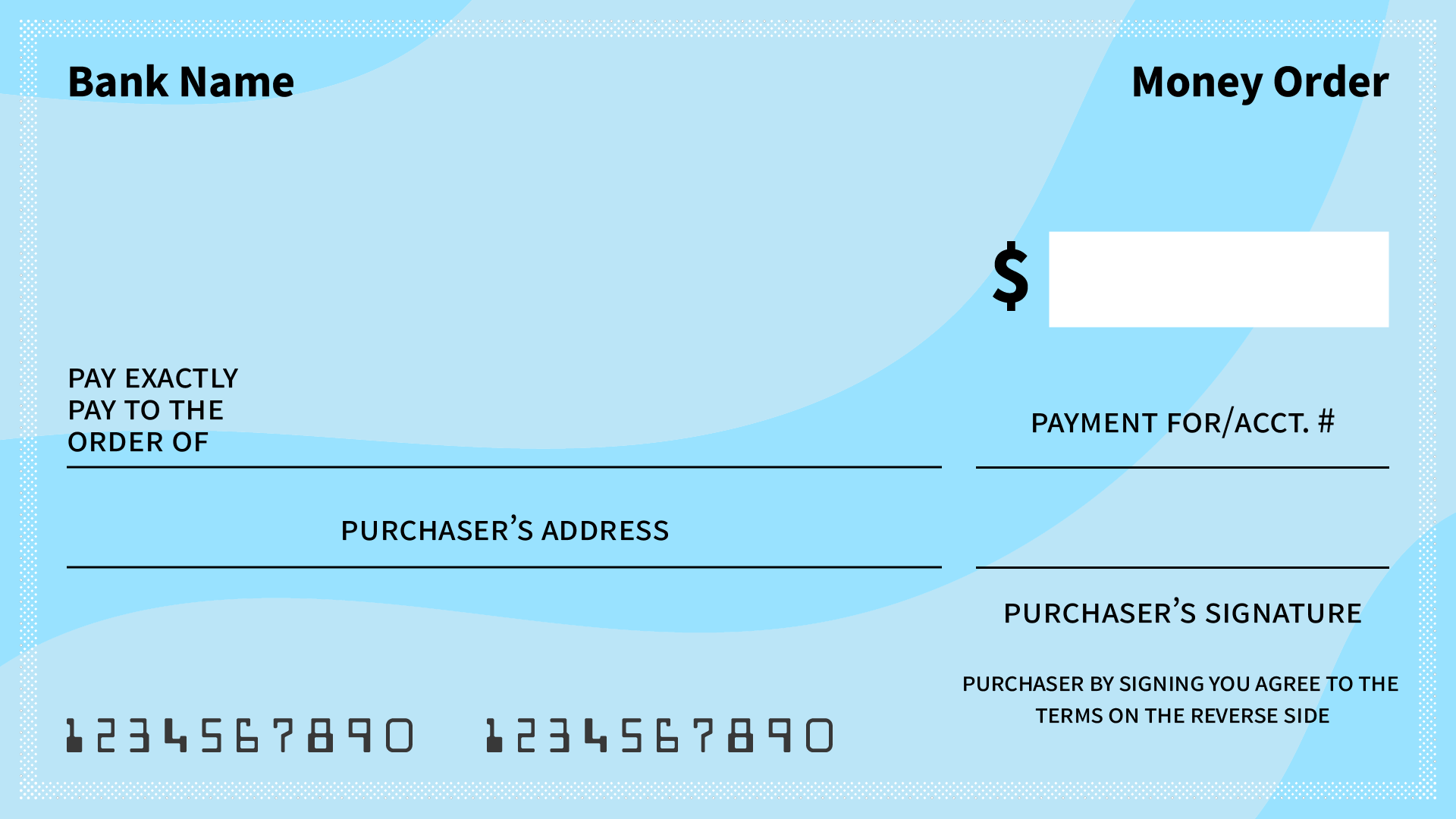

View and compare today's interest rates and fees for M&T Bank products Select an account type from the list below Rates are good as of March 16, Current M&T Bank Prime Rate 325%. Both cashier’s checks and money orders essentially do the same thing, but the difference is that a cashier’s check is written out by a bank, whereas a money order is not. Cashier's checks are a better option than a money order for larger payments, because money orders often have maximum limits, but there will be no maximum limit on a cashier's check amount Find a large bank that issues cashier's checks to the general public, and bring cash funds, if you do not have a bank account.

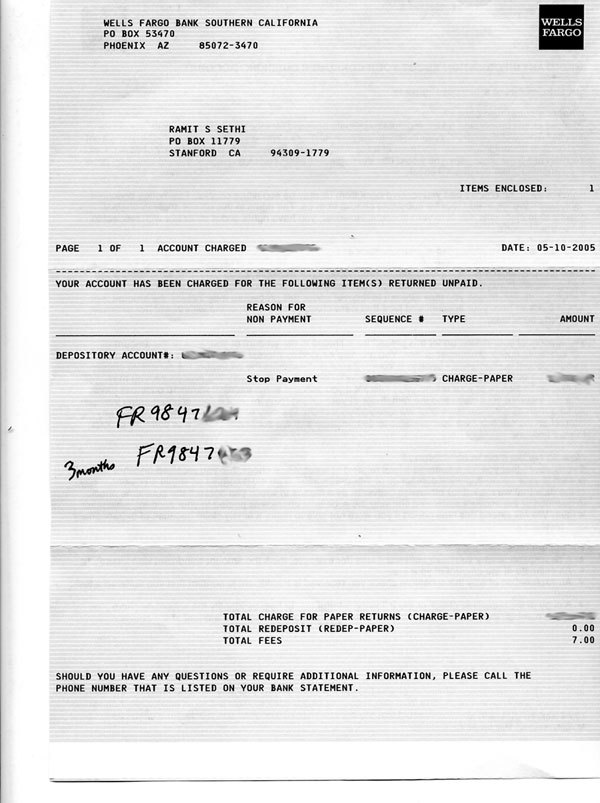

1 review of M&T Bank "They told me LIES to get me to open an account I went to this branch to open an account with CASHIER'S checks (same as cash, right?. WRONG!) I told Andrew (the man opening my account) that I was going to be wiring the money OUT of the account in time to close escrow on a house I told him the dates My escrow actually got pushed back a week, allowing even more time (but. The result of these scams is that the fraudulent check will be returned unpaid The bank will then deduct the amount of the check from your account or otherwise seek repayment from you, and you will lose either the goods that you sold, the money that you sent to the third party, or both How can you tell if a cashier’s check is fraudulent?.

$750 per check for all other large checks (Bank of the West checks under $50 are free) Requirements Valid photo ID;. Find a Bank of the West;. Before accepting a cashier’s check, contact the issuing financial institution to verify its authenticity But don’t use the phone number that’s printed on the check It could be a fake, too.

Check the status of an application call 8007BANK, contact your local branch or log in to the Application Status page Speak to someone about a Servicemembers Civil Relief Act (SCRA) request call , or if overseas, you can contact the Military Service Center using the international collect call number. Cashier’s Check Basics A cashier’s check (also known as an official check, teller’s cheque, bank cheque, etc) is a check that differs from regular checks because it is a more secure form. M&T is one of the worst bank me and wife have dealt with after getting a cashiers check for over $10,000 from another bank to opening a account m&t told us that there a hold 7 day because it was a new account and there was hold on it every though it a cashier's from ESL.

• Nonrefundable fee to M & T Bank in the form of a certified, cashier’s or other official bank check in the amount of (NYC properties) $1, or (outside of NYC) $ is due at application. The name "cashier's check" refers to the bank's teller, who may also be called a cashier Despite the name and the association with banks, it's not only banks that issue cashier's checks.

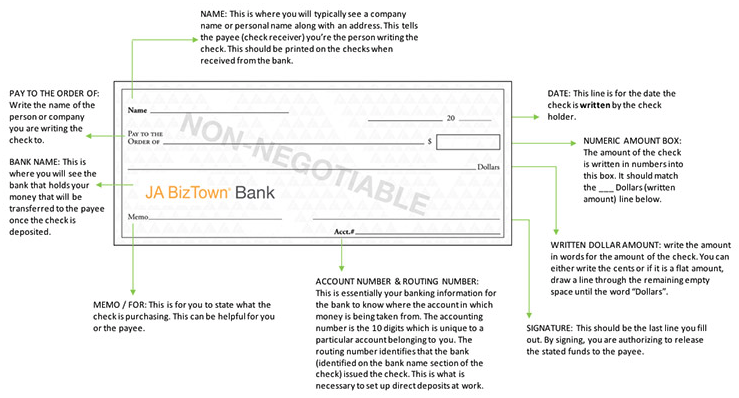

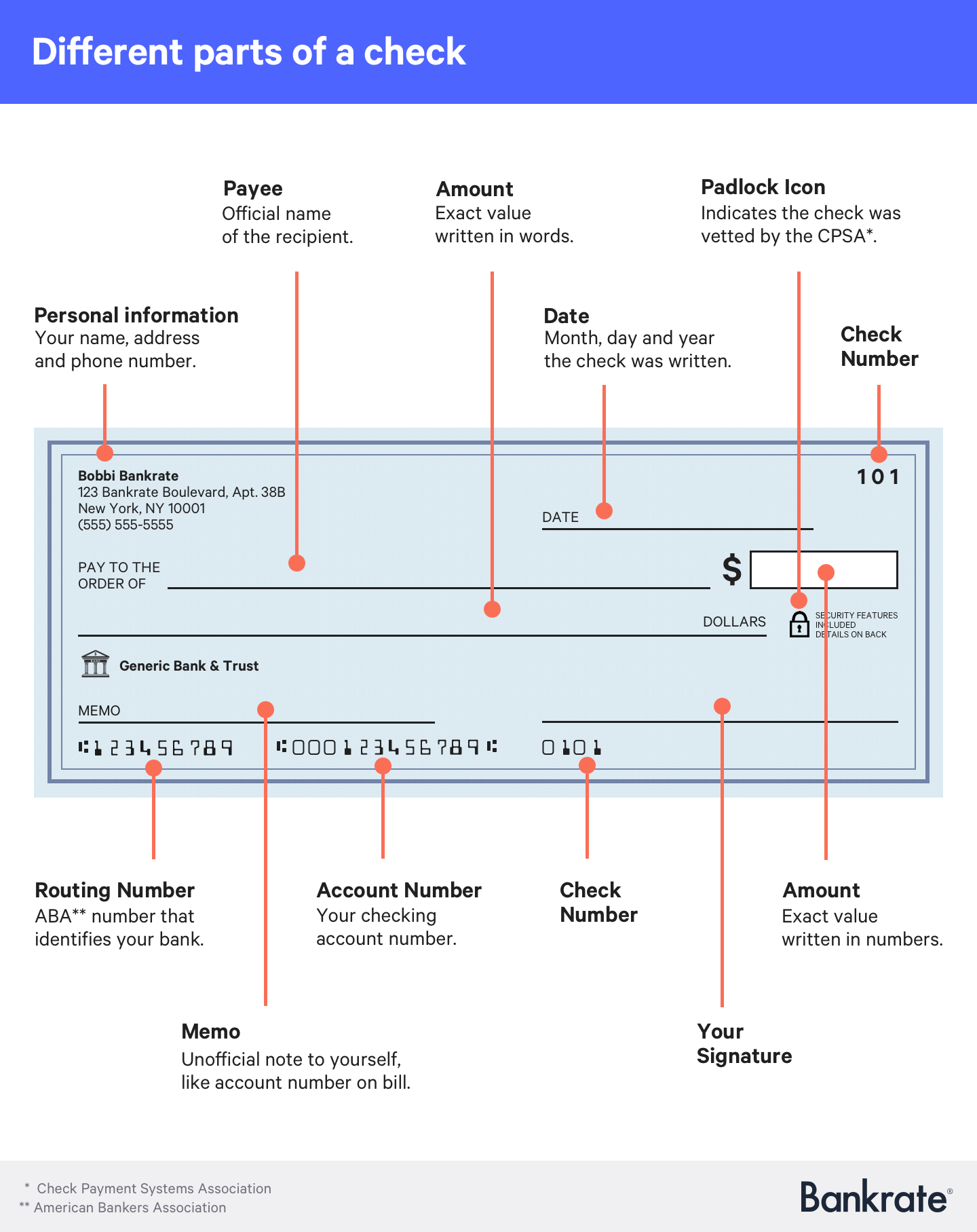

How To Write A Check Junior Achievement Of Northeastern Pennsylvania

Seacoast National Bank Have Sent Out Checks For 0 Doctor Of Credit

Bardy Cole Mark Dowell S Fake Check Craigslist Scam

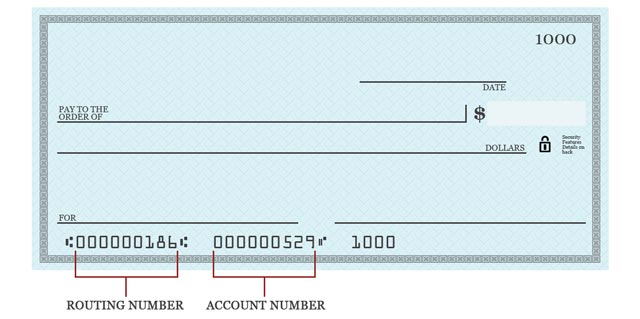

Routing Number What It Is And Where To Find It Magnifymoney

12 Banks That Accept Third Party Checks Fees Requirements Detailed First Quarter Finance

Got An Unexpected Check In The Mail It May Be Fake The New York Times

Quotes About Cheques 52 Quotes

15 Cheapest Place To Cash A Check In 21 The Wealth Circle

M T Offers Account Without Checking For Unbanked Customers Delaware Business Now

What Is A Certified Check And How Do You Get One Thestreet

Branch Operations Coordinator Resume Example M T Bank Corp Bloomsburg Pennsylvania

24 Hour Check Cashing Stores Located Near You

Check Scams 994 Complaints And Reviews Reportscam

Cashier S Check Vs Money Order What S The Difference Bankrate

M T Mobile Banking Apps On Google Play

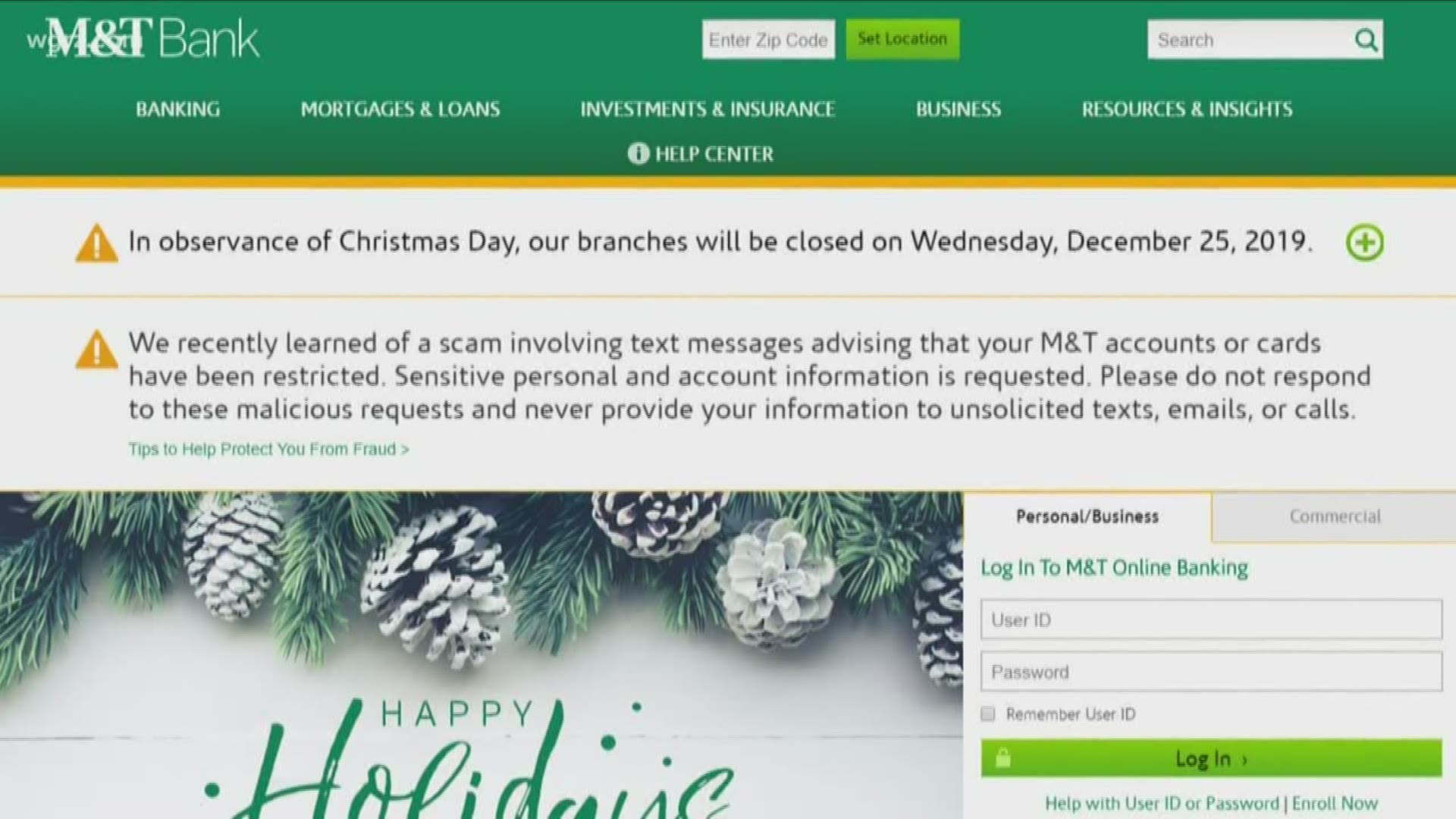

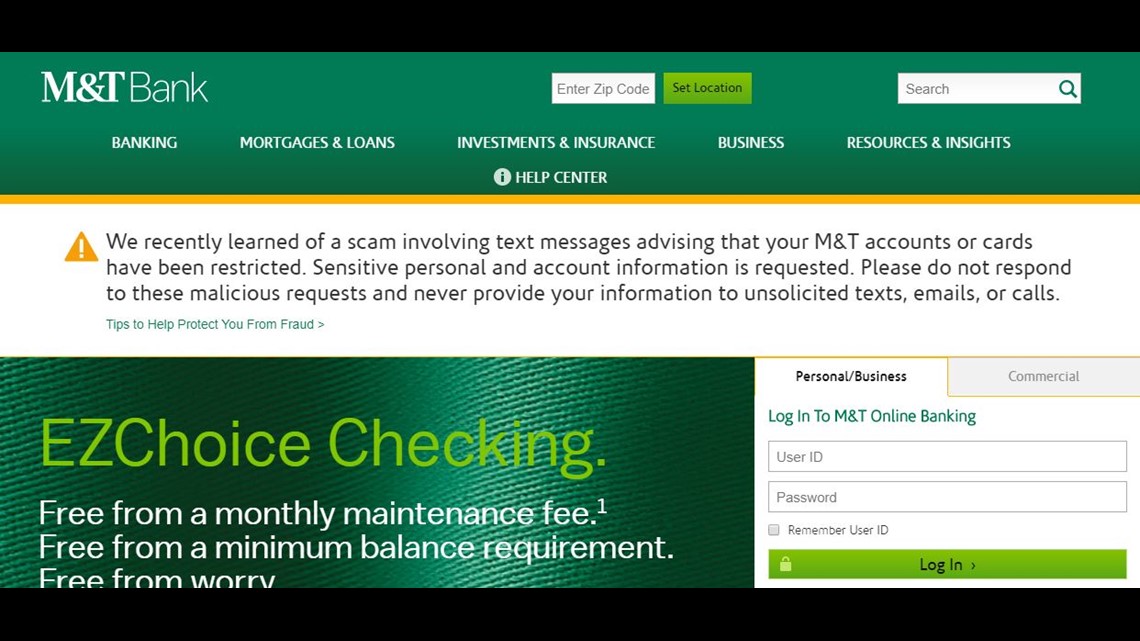

Beware Of M T Bank Scam Wgrz Com

M T Bank Rates Fees Review

How To Check Your Amazon Gift Card Balance July 18

Where Can I Cash A Third Party Check 18 Options Detailed First Quarter Finance

How To Find The Routing And Account Number On A Check Homestreet Bank

Wilmington Diversified Income Fund Pro Sai

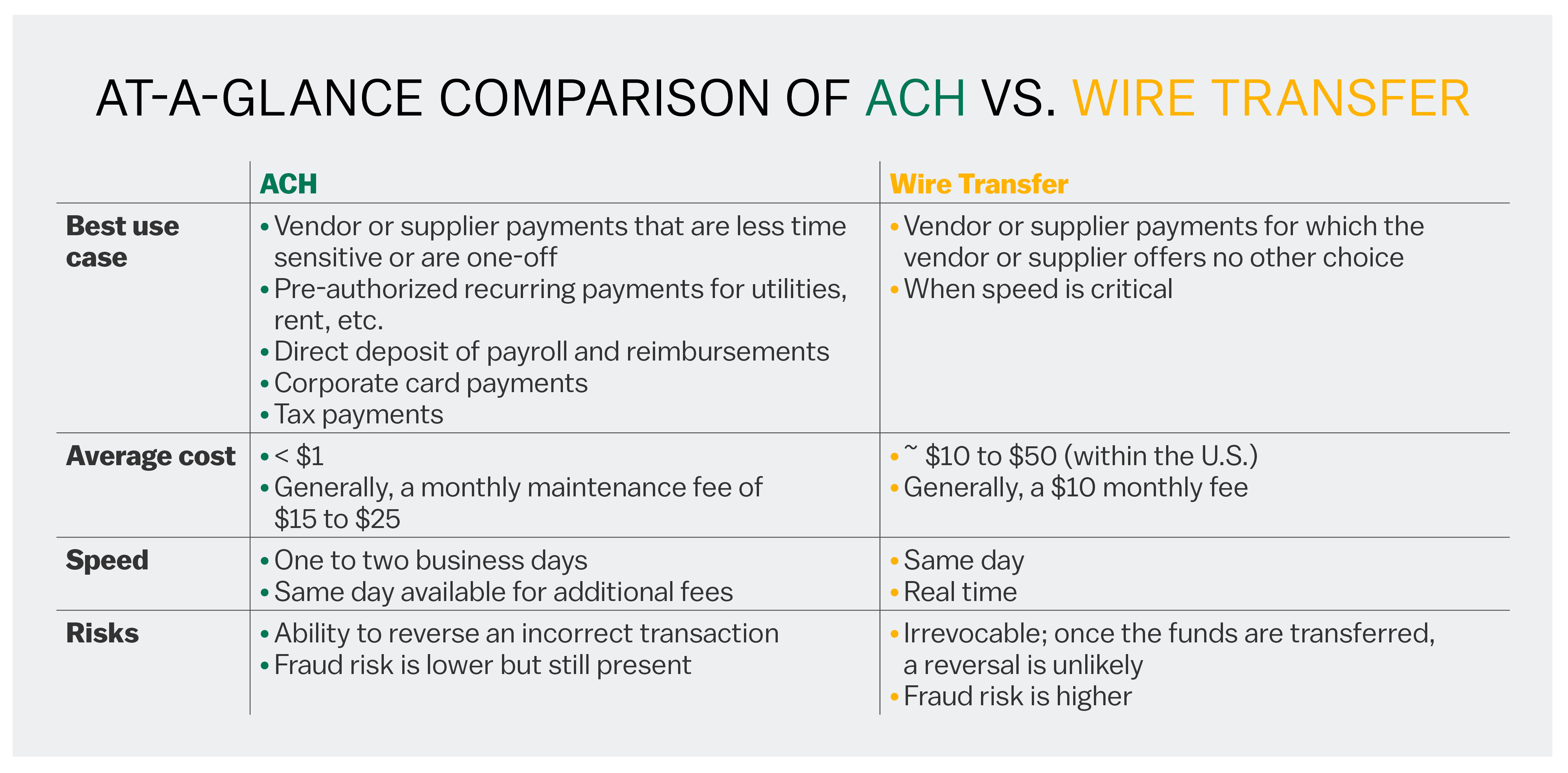

Ach Vs Wire Transfers Uses Costs And Risks M T Bank

Fees To Cash Checks For Non Customers At The Top Banks Mybanktracker

Why The Bank Cannot Scan My Check

Cashier S Check Fee Comparison At Top 10 U S Banks Mybanktracker

Lot 5 Pc Lot Of Vintage Bank Bags Commonwealth Nat L Bank M T Bank Federal Reserve More

M And T Bank Cashier Check Logo Page 1 Line 17qq Com

Here Is Something I Would Like To Share Milton Quick Stop Facebook

Routing Number What It Is And Where To Find It Magnifymoney

Commercial Deposit Account Terms And Conditions Pdf Free Download

Overdraft Fees Compare What Banks Charge Nerdwallet

Scam Victim Says Don T Cash Checks Fall For Secret Shopper Scheme

The Best National Banks Of 21

Bank Work From Home

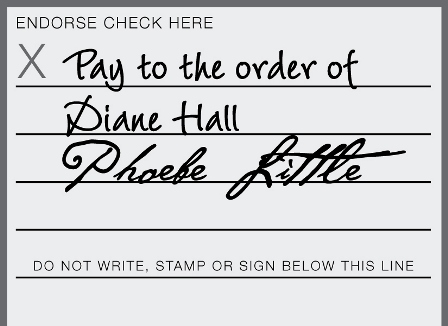

How To Sign Over A Check 12 Steps With Pictures Wikihow

Commercial Deposit Account Terms And Conditions Pdf Free Download

Cashier S Check Vs Money Order What S The Difference Bankrate

Bank Routing Number Routing Numbers On Check

Inslink Financial Inc Kristofer Brozio

/GettyImages-949219696-e4c7b0e0b92847cb91ac7cc928362bad.jpg)

Best Ways To Get A Cashier S Check

Cashier S Check 101 When You Need One And How To Get It The Motley Fool

/how-to-fill-out-a-deposit-slip-315429-FINAL-88cd427461ed43c6b5b7fc93d74030d2.png)

How To Fill Out A Deposit Slip

Can The Post Office Issue Money Orders And Checks My Post Office Location

How To Cash A Large Check Without A Hold Or Even A Bank Account First Quarter Finance

Certified Checks Everything You Need To Know Smartasset

In The United States District Court For The District Of Maryland Memorandum Pdf Free Download

Where To Buy Checks Avoid Your Bank To Save Money Bankrate

Explore The M T Bank Help Center M T Bank

How To Fill Out A Money Order 7 Easy Steps Gobankingrates

How Bank Transactions Are Processed M T Bank

Commercial Deposit Account Terms And Conditions Pdf Free Download

4 Ways To Order Checks Wikihow

/how-to-fill-out-a-deposit-slip-315429-FINAL-88cd427461ed43c6b5b7fc93d74030d2.png)

How To Fill Out A Deposit Slip

Wd7rcck9ksndqm

Enochnoland S Blog Film

Ally Bank Review High Interest Checking Savings More

Money Questions Answered Will A Bank Take A Ripped Check

M T Bank T Commercial Bank Branch T Text Branch Png Pngegg

How To Check Your Amazon Gift Card Balance July 18

M T Bank Checking Account Review Should You Open

Chase Bank Corporate Complaints Number 2 Hissingkitty Com

24 Hour Check Cashing Near Me Best Places To Cash A Check 24 7

Branch Operations Coordinator Resume Example M T Bank Corp Bloomsburg Pennsylvania

How Identifying Bogus Checks At M T Bank Is A Lot Like Hunting Cybercriminals Cyberscoop

How Long Does It Take For A Check To Deposit Clear Answers By Bank First Quarter Finance

The Best National Banks Of 21

How Long It Takes Check Funds Become Available Mybanktracker

M T Bank Vs Capital One Which Is Better

Beware Of M T Bank Scam Wgrz Com

Asaba Charles Cashier M T Bank Linkedin

Techchecks Net Resources

Expired Ct De Dc Md Nj Ny Pa Va Wv In Branch M T Bank 300 Business Checking Bonus Doctor Of Credit