Mt Cashiers Check

:max_bytes(150000):strip_icc()/cashier-s-check-79474537-5a1f063f7d4be80019ed3b90.jpg)

Best Ways To Get A Cashier S Check

M T Bank Opens Florida Commercial Banking Office Buffalo News

M T Bank Checking Account Review Should You Open

Cashier S Check Vs Certified Check What S The Difference Keybank

Cashier S Check Fee Comparison At Top 10 U S Banks Mybanktracker

In The United States District Court For The District Of Maryland Memorandum Pdf Free Download

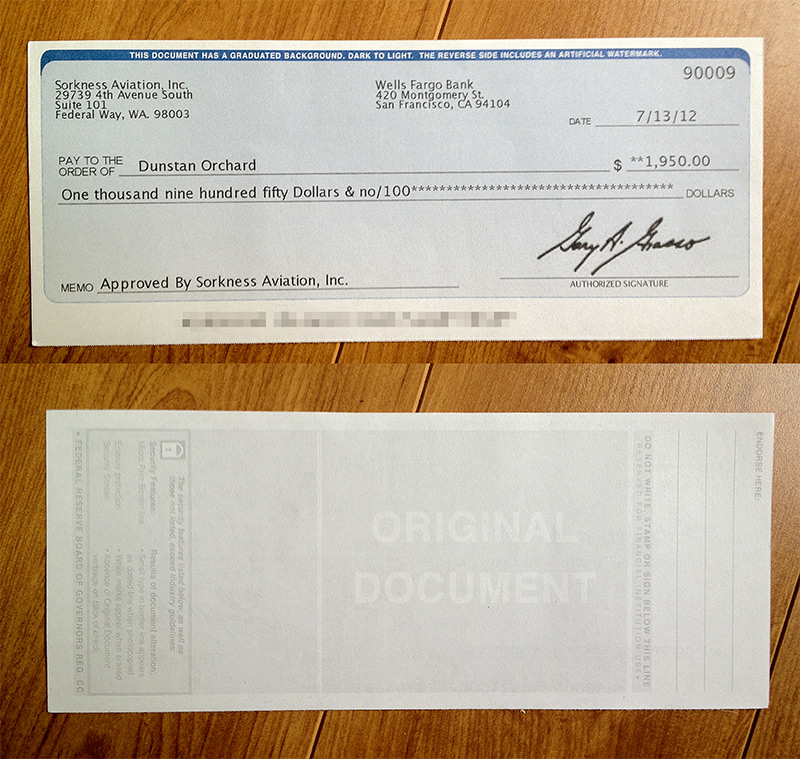

Cashier's Checks A cashier’s check is drawn against the bank’s funds, not the money in your checking account To get a cashier's check, you transfer funds from your checking or savings.

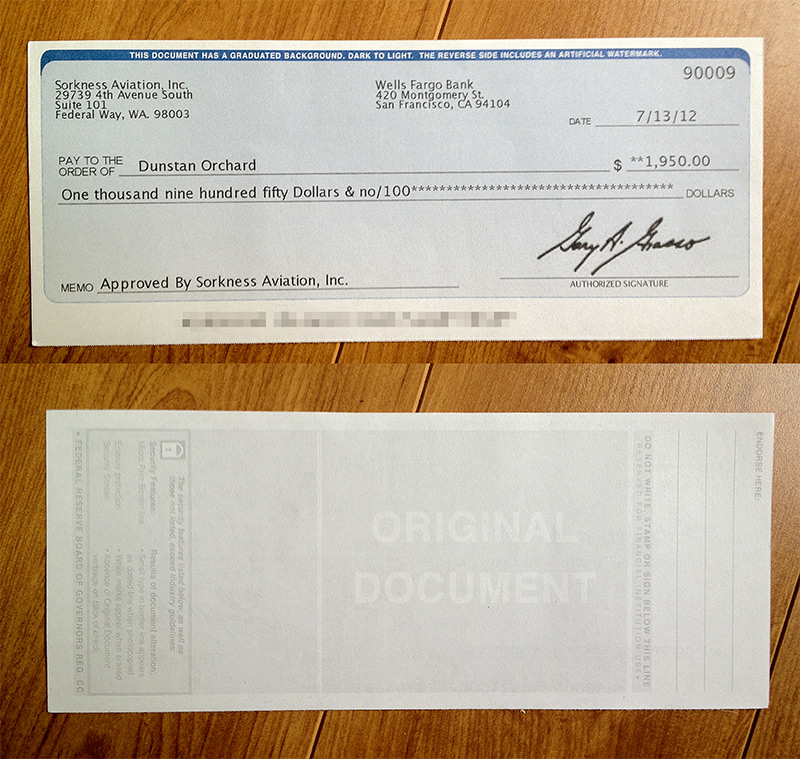

Mt cashiers check. Cashier's checks are drawn on a financial institution's funds, but you supply the check amount to your bank ahead of time And you need the name of the "payee," the business or person you are. A genuine cashier's check always includes a phone number for the issuing bank That number is often missing on a fake check or is fake itself Suspicious Communication Scammers often communicate with their victims using poor grammar/spelling or vague language They may also refuse to meet in person or send an email or a text message indicating. Fees and check limits will vary from store to store, but all will require a form of government ID Most won’t let you cash personal checks because of fraud risk, but if you’re trying to cash a government check, payroll check, cashier’s check, or money order, then your odds are good.

When the total amount of cashier's checks deposited in one day exceeds $5,525, the bank can place a hold on the amount deposited in excess of $5,525 In that instance, the bank generally must make the first $5,525 available according to the availability schedule. A cashier’s check, also known as an official bank check, is a payment instrument issued by a bank or credit union to a third party, usually on behalf of a bank customer who pays the bank the. A cashier's check is a paper check that's drawn against your bank's account rather than your personal account In effect, your bank stands behind the check and guarantees that the recipient, or.

When the total amount of cashier's checks deposited in one day exceeds $5,525, the bank can place a hold on the amount deposited in excess of $5,525 In that instance, the bank generally must make the first $5,525 available according to the availability schedule The bank can place a hold on the entire amount of the cashier's check if it has reasonable cause to believe the check is uncollectible from the paying bank. Cashier’s Checks The rules are different when it comes to cashier’s checks The good news is, it is more secure than a personal check, as the funds are held by a bank. The teller made me a cashier's check for the balance of my savings and then told me that I'd used my check card recently and had two pending transactions on my checking two trips to Price Chopper (supermarket) totaling to $17 or so combined I told her to leave enough money in the checking to cover pending check card transactions.

In This Section COVID19 Updates > Get the latest on our COVID19 response Contact M&T Bank > Get in touch with M&T Customer Service or access other helpful M&T Bank contact information tools and resources Current Rates > View and compare today's interest rates and fees for M&T Bank products F A Qs > Get answers, quickly and easily, to many frequently asked questions. A cashier’s check (also known as an official check, teller’s cheque, bank cheque, etc) is a check that differs from regular checks because it is a more secure form of payment With a cashier’s. When you accept a cashier's check from someone, you might assume the check is good because it looks official But that's not always the case, as scams involving fake cashier's checks are abundant Learning how to verify a cashier's check gives you the knowledge necessary to make sure you're truly getting paid and that the bank honors the check.

In person You can walk into most brickandmortar banks to get a check issued Within a few minutes, you should have a check in hand, and you can pay the recipient immediately Online Some banks—particularly online banks—allow you to request cashier’s checks online The bank might only mail checks to your verified mailing address, so you need to wait for the check and then forward it. A cashier’s check, also known as an official bank check, is a payment instrument issued by a bank or credit union to a third party, usually on behalf of a bank customer who pays the bank the. A cashier’s check is a type of check issued by a bank or credit union and signed by a cashier or teller Because the funds are drawn directly against the issuing bank’s cash reserves — not a customer’s personal account — the checks cannot bounce The cashier’s signature, or “endorsement,” on the checks represents this payment.

After giving someone a cashier's check, you can verify whether it has been cashed by contacting the issuing bank either in person or over the phone If you find it has not been cashed, and you fear the check has been lost or stolen, you may be abl. Are Official Checks and Cashier's Checks the Same?. For additional information, see our article for a detailed explanation of Bank of America’s thirdparty check policy 11 M&T Bank Requirements Noncustomers may only cash thirdparty checks drawn on M&T Must verify the identity of the original payee and the third party cashing the check in person Fee Account holder Free.

The teller made me a cashier's check for the balance of my savings and then told me that I'd used my check card recently and had two pending transactions on my checking two trips to Price Chopper (supermarket) totaling to $17 or so combined I told her to leave enough money in the checking to cover pending check card transactions. FYI This is for a cashier's check, not a certified BBT $10 (cashier's check only) BBVA Compass $8 for cashier's checks for customers only No certified available Capital One Cashier's checks only and will be $10 for customers or $ for overnight shipping for online customers Chase Bank Free for all customers Cashier's checks only. Refer to the Personal Schedule of Fees for complete details) Don't have a checking or savings account with us?.

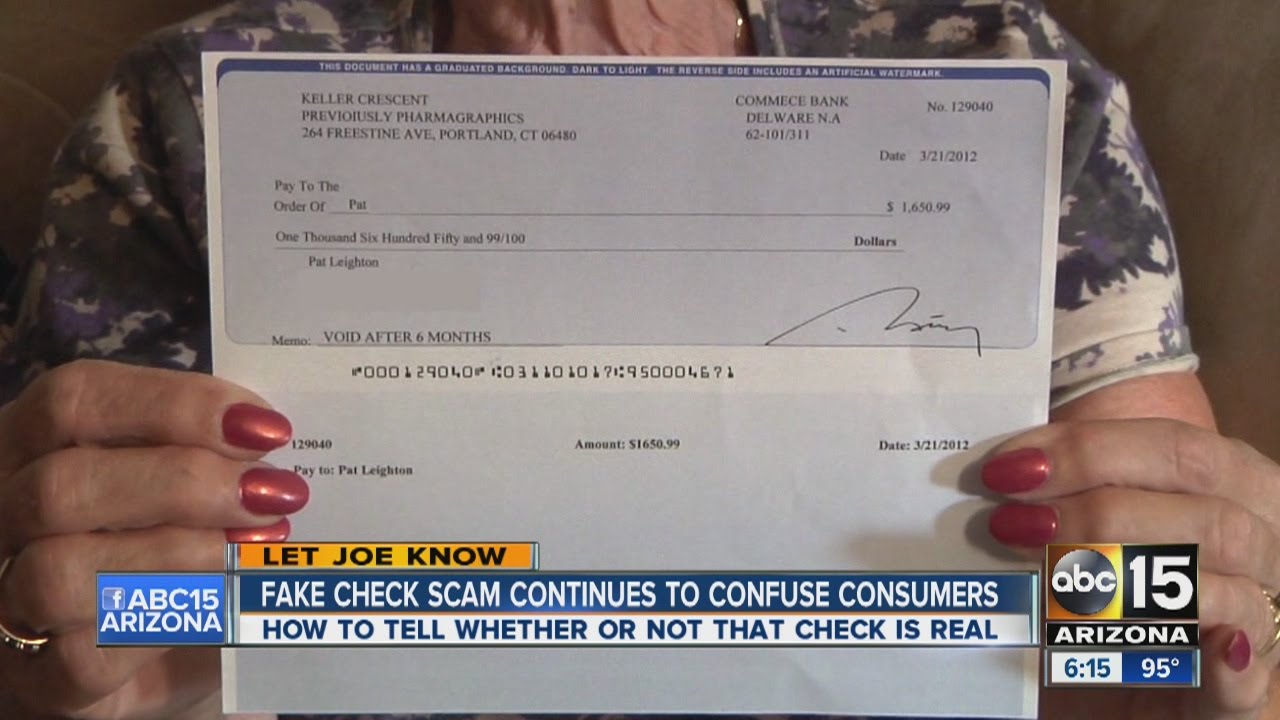

Cashier’s checks have historically been regarded as a trusted form of payment but recently, they have been used to scam consumers and sellers of goods, particularly over the Internet Most banks give you access to the funds represented by a cashier’s check the next day, but it can take several days to several weeks before your account is. An official bank check is not the same as a cashier's check Official bank check funds are withdrawn immediately from your account, whereas cashier check funds are withdrawn from the bank's account after you pay them the total face value of the cashier's check plus any fees. For additional information, see our article for a detailed explanation of Bank of America’s thirdparty check policy 11 M&T Bank Requirements Noncustomers may only cash thirdparty checks drawn on M&T Must verify the identity of the original payee and the third party cashing the check in person Fee Account holder Free.

These scams are usually violating multiple laws including Forgery, Mail Wire Fraud, and Check Fraud, which is a felony in most states Before you read this story, you should keep in mind that any person who tries to use a cashiers check is usually scamming you, even if the check looks legit. Risks of Using Cashier’s Checks Cashier’s checks offer a safe method of payment Security features printed onto the check prevent any possible forgery But counterfeiting scams do still occur, often where the victim receives a cashier’s check in the mail from an unknown person, who then asks the victim to send some of the money back. A cashier's check is a check that is a drawn on a bank's funds rather than your own personal funds It offers a secure way to pay in situations where a personal check is not appropriate, such as real estate transactions What makes a cashier's check different from a personal check is the guarantee.

Cashier’s checks, also known as teller’s checks, are checks that draw on the bank’s own funds to make the payment They’re as good as money in the bank because, well, they are the bank’s money in the bank Once a bank creates a cashier’s check, the bank guarantees to pay the amount printed on the check. A cashiers check is a prepaid check and unless it is drawn on the books of the same bank it is deposited in or cashed in, it clears exactly the same way any other check does That is because counterfeits exist Customers sometimes have to get a cashiers check because it is not likely to bounce, being prepaid. A cashier’s check works like a personal check With a cashier’s check, however, the bank itself guarantees and issues the funds after verifying that the account the check is drawn on has money to cover it The bank then transfers that money from your account into its own After drawing the funds, the cashier, or teller, signs the check.

View and understand the important features of your account At A Glance documents and Service Pricing Guides provide information about all banking products offered by BB&T in your state. If you're a Bank of America customer with a checking or savings account, you can get a cashier's check for a $15 fee (which will be waived for customers enrolled in Preferred Rewards;. Cashier's checks are drawn on a financial institution's funds, but you supply the check amount to your bank ahead of time And you need the name of the "payee," the business or person you are.

A cashier’s check is a check that is issued by a bank, and sold to its customer or another purchaser, that is a direct obligation of the bank Cashier’s checks are viewed as relatively riskfree instruments and, therefore, are often used as a trusted form of payment to consumers for goods and services. A cashier's check is a draft drawn by a Bank on itself, which the Bank agrees to honor when properly presented for payment The Bank, not its customer, signs the check ( UCC Sec 3104 (3) (g) ) This means that the Bank is liable to pay the check. Section of the Bank Secrecy Act requires financial institutions to verify a person's identity and to retain records for five years of certain information when bank checks and drafts, cashier's checks, money orders or traveler's checks are purchased with between $3,000 and $10,000 in cash.

A cashier’s check is a check issued directly by a bank rather than a person or company’s bank account The benefit of a check like this is that the funds are guaranteed since it’s coming from the. Cashier’s checks, also known as teller’s checks, are checks that draw on the bank’s own funds to make the payment They’re as good as money in the bank because, well, they are the bank’s money in the bank Once a bank creates a cashier’s check, the bank guarantees to pay the amount printed on the check. A Typical Cashier’s Check Scam The most common cashier’s check scam goes something like this A "buyer" wants to purchase a product with a cashier’s check or money order For whatever reason, the buyer sends a check issued for an amount above the purchase price.

At a larger bank, such as PenFed, cashier’s check verification would follow a set process There’s no charge to verify a cashier’s check If you can’t visit in person to trace a cashier’s check, independently confirm the phone number of the bank as listed on the check, then call the bank and ask to verify the check. 06/02/03 Is an Official Check considered the same as a Cashier's Check under the Reg CC next day availability rules?. A cashier’s check, also known as an official bank check, is a payment instrument issued by a bank or credit union to a third party, usually on behalf of a bank customer who pays the bank the.

A cashier's check is a check that is a drawn on a bank's funds rather than your own personal funds It offers a secure way to pay in situations where a personal check is not appropriate, such as real estate transactions What makes a cashier's check different from a personal check is the guarantee. SAMPLE PERSON Address City, State ZIP Phone TCF NATIONAL BANK MC PCC1BJ PLYMOUTH, MN /119 M&T Bank Citibank Capital One Bank. Cashier's checks are not held by the bank for verification, unless bank personnel suspect a scam is involved Unused Cashier's Check Take the cashier's check to a teller window at the bank at which it was drawn Inform the teller that you did not use the cashier's check as planned and you would like to receive the funds back into your account.

Verify a check from JPMORGANCHASE and use RoutingTool. View and compare today's interest rates and fees for M&T Bank products Select an account type from the list below Rates are good as of March 16, Current M&T Bank Prime Rate 325%. A cashier's check is a check that is a drawn on a bank's funds rather than your own personal funds It offers a secure way to pay in situations where a personal check is not appropriate, such as real estate transactions What makes a cashier's check different from a personal check is the guarantee.

Cashier’s Checks The rules are different when it comes to cashier’s checks The good news is, it is more secure than a personal check, as the funds are held by a bank. A cashier’s check can only be acquired from a bank, but a money order can be purchased at a variety of locations, including the post office, credit union, grocery store, and more. Checking The OFAC List, Official Checks, And Payees 02/03/03 We are having a discussion regarding OFAC and the checking names of payees for cashiers checks.

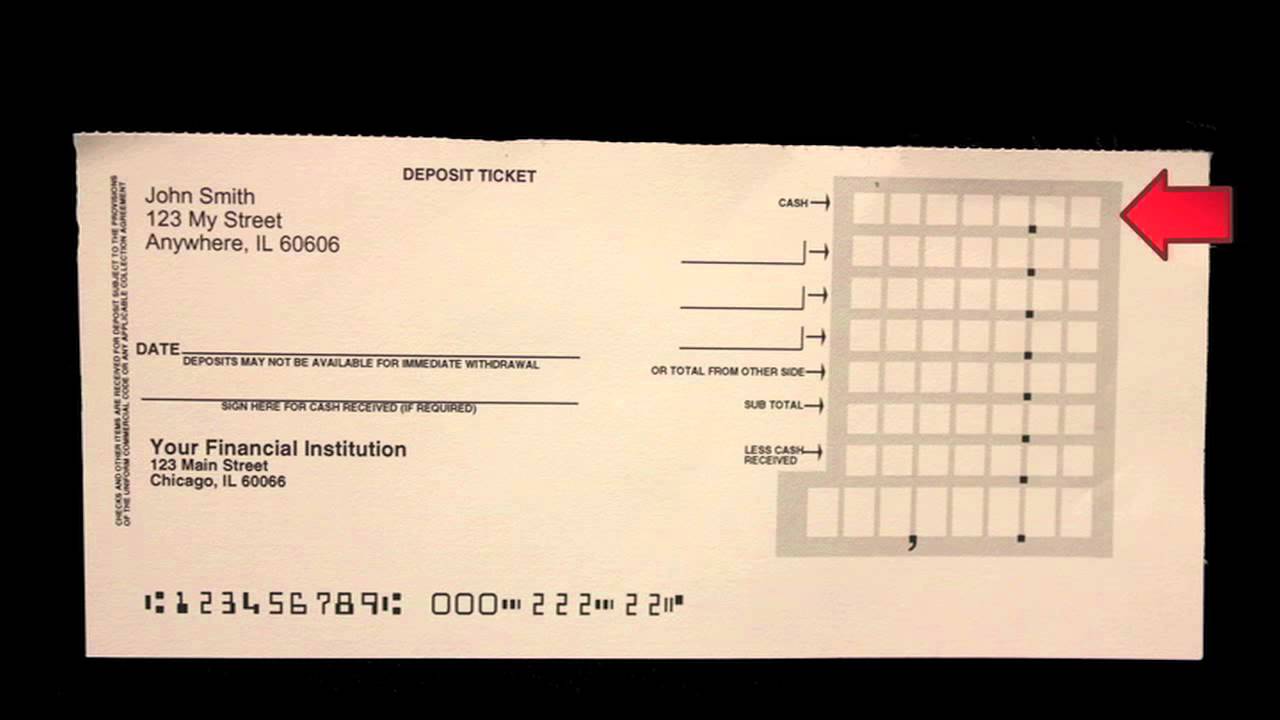

How To Fill Out A Checking Deposit Slip 12 Steps With Pictures

/how-to-fill-out-a-deposit-slip-315429-FINAL-88cd427461ed43c6b5b7fc93d74030d2.png)

How To Fill Out A Deposit Slip

Where To Go For Late Night Check Cashing 28 Options Listed First Quarter Finance

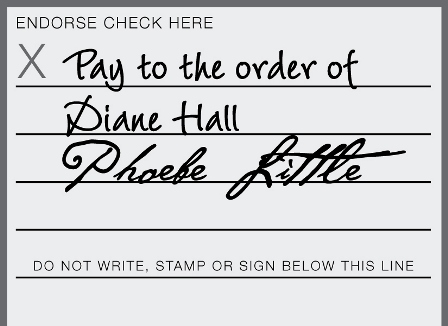

How To Sign Over A Check 12 Steps With Pictures Wikihow

M T Bank Stadium Jobs Baltimore Ravens Baltimoreravens Com

Cashier S Check Vs Money Order What S The Difference Bankrate

What Is A Certified Check And How Do You Get One Thestreet

How To Cash A Check At Walmart Mybanktracker

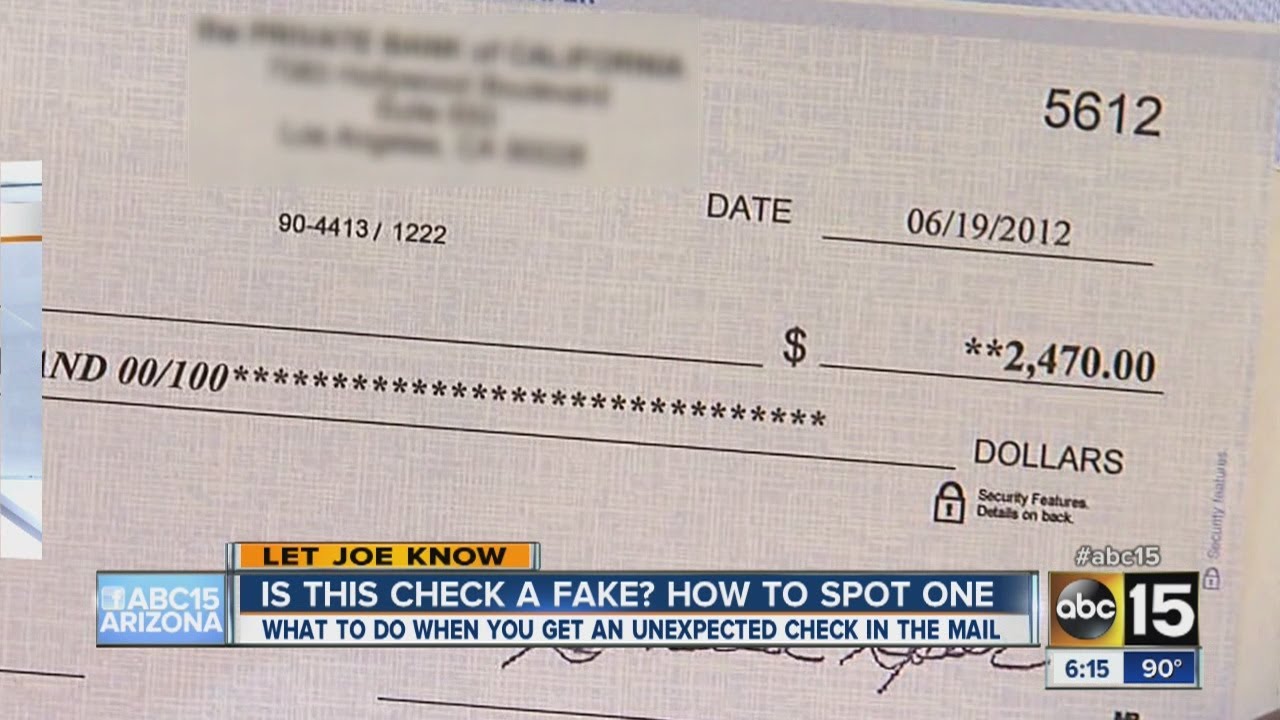

Fake Check Scam Continues To Confuse Consumers Youtube

Best 24 Hour Check Cashing Near Me 27 Best Places Open Now Frugal Living Coupons And Free Stuff

The Difference Between A Cashier S Check And Money Order Gobankingrates

Wd7rcck9ksndqm

Fees To Cash Checks For Non Customers At The Top Banks Mybanktracker

How Do I Order New Checks From M T Bank

M T Meat Company Posts Facebook

24 Hour Check Cashing Near Me Best Places To Cash A Check 24 7

Where To Get A Money Order Compare Usps Bank Fees Mybanktracker

How Bank Transactions Are Processed M T Bank

How To Cash A Large Check Without A Hold Or Even A Bank Account First Quarter Finance

12 Banks That Accept Third Party Checks Fees Requirements Detailed First Quarter Finance

How To Spot Avoid And Report Fake Check Scams Ftc Consumer Information

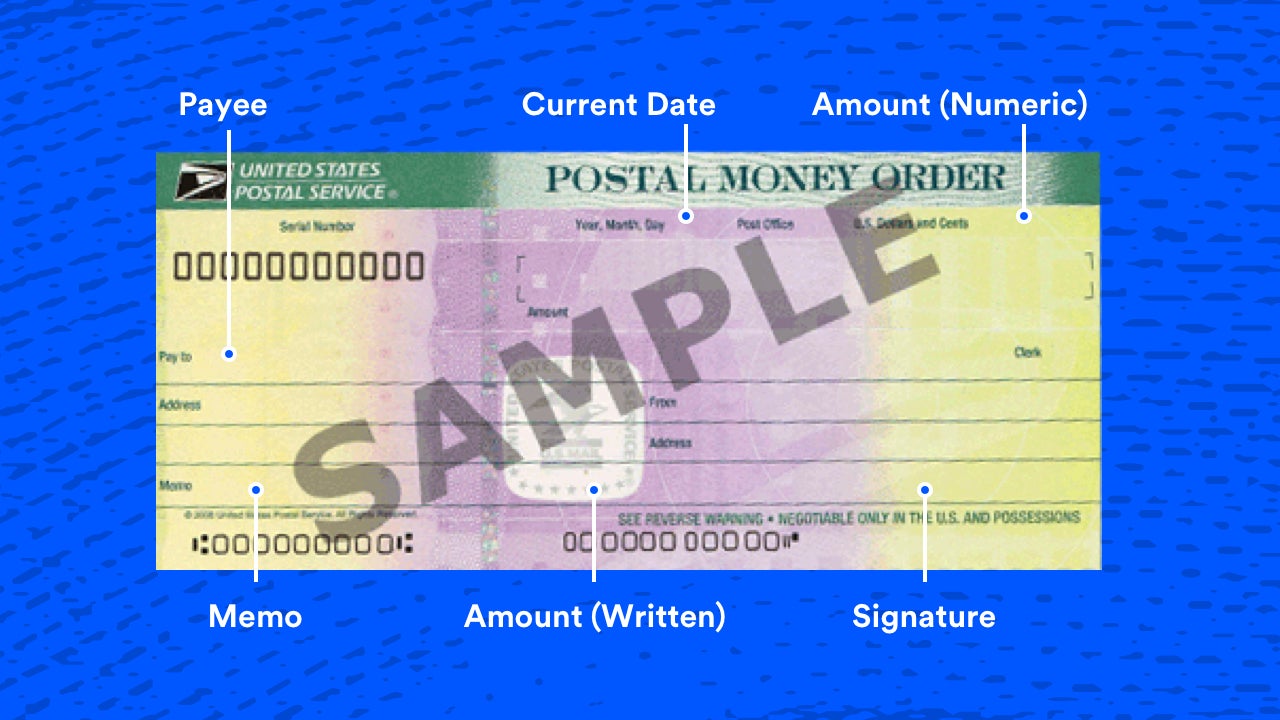

How To Fill Out A Money Order Step By Step Bankrate

How To Verify A Check Verification Options For Individuals Businesses First Quarter Finance

M T Meats

Cashier S Check 101 When You Need One And How To Get It The Motley Fool

M Amp T Insurance Claim Check

Covid 19 Resources Understanding Your Resilience Covid 19 Resources M T Bank

Cashier S Check Vs Money Order What S The Difference Bankrate

M T Meat Company Posts Facebook

Bardy Cole Mark Dowell S Fake Check Craigslist Scam

Asaba Charles Cashier M T Bank Linkedin

/how-to-fill-out-a-deposit-slip-315429-FINAL-88cd427461ed43c6b5b7fc93d74030d2.png)

How To Fill Out A Deposit Slip

Best Banks In Baltimore 21 Smartasset Com

M T Bank Careers Jobs Zippia

24 Hour Check Cashing Stores Located Near You

15 Cheapest Place To Cash A Check In 21 The Wealth Circle

Checking Accounts Cuonlineuhs

M And T Bank Cashier Check Logo Page 1 Line 17qq Com

M T Displays Floor Stand Universal Holder For Healthcare Product Box With 3 54 5 91x9 84 Inch Front Loading Opti Snap Frame Poster Sign Post Face Mask Disposable Glove Facial Tissue Hospital Amazon Com Industrial Scientific

M T Offers Account Without Checking For Unbanked Customers Delaware Business Now

M T Bank Rates Fees Review

M T Bank Stadium Jobs Baltimore Ravens Baltimoreravens Com

M T Bank Newburgh Hospital Interior Design Clinic Interior Design Hospital Interior

How Banks Are Supporting Businesses Impacted By Covid 19 Divvy

Where To Cash A Handwritten Check 37 Places To Choose From First Quarter Finance

Check Cashing Near Me Find A 24 Hour Location Zip Code Search

M T Bank Reviews

Us Bank Routing Number Locate Your Number Gobankingrates

Routing Number What It Is And Where To Find It Magnifymoney

How To Fill Out A Deposit Slip Carousel Checks Youtube

Got A Check In The Mail How To Make Sure It S The Real Deal Youtube

Inslink Financial Inc Kristofer Brozio

Techchecks Net Resources

Where Can I Cash A Third Party Check 18 Options Detailed First Quarter Finance

M T Bank Careers Jobs Zippia

Got An Unexpected Check In The Mail It May Be Fake The New York Times

M And T Bank Cashier Check Logo Page 1 Line 17qq Com

M T Bank Banks Credit Unions 67 Jackson St Fishkill Ny Phone Number Yelp

Where Can I Cash A Check Banking Advice Us News

/GettyImages-949219696-e4c7b0e0b92847cb91ac7cc928362bad.jpg)

Best Ways To Get A Cashier S Check

How To Sign Over A Check 12 Steps With Pictures Wikihow

12 Banks That Accept Third Party Checks Fees Requirements Detailed First Quarter Finance

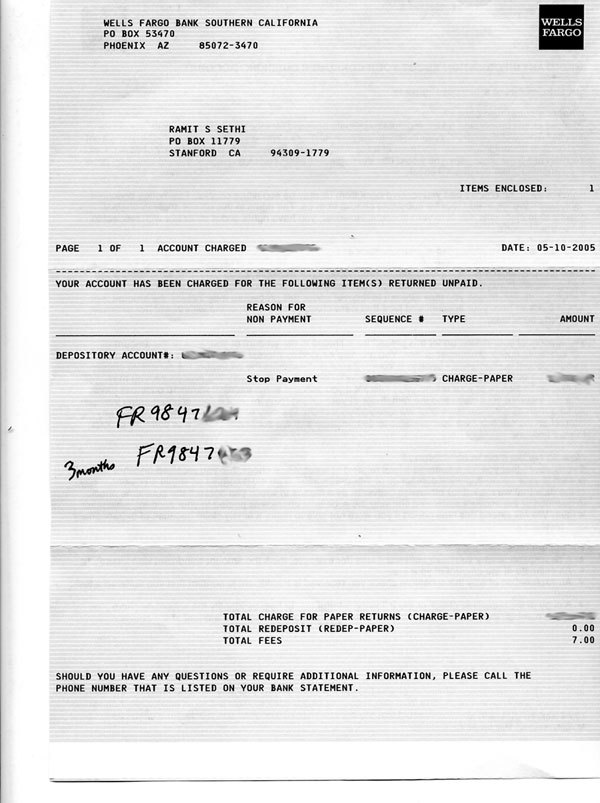

Commercial Deposit Account Terms And Conditions Pdf Free Download

Checking Accounts Cuonlineuhs

Enochnoland S Blog Film

How Banks Are Supporting Businesses Impacted By Covid 19 Divvy

Certified Checks Everything You Need To Know Smartasset

How To Find The Routing And Account Number On A Check Homestreet Bank

Cheap Personal Checks What Are My Options Nerdwallet

M T Bank Careers Jobs Zippia

Entrance Portal And Welcome Canopy Bank Interior Design Bank Design French Style Office

Cheapest Way To Cash A Personal Check Without A Bank Account

M T Mobile Banking Apps On Google Play

Where To Get A Money Order Compare Usps Bank Fees Mybanktracker

M T Bank Stadium Jobs Baltimore Ravens Baltimoreravens Com

How Long It Takes A Check To Clear At Regional Banks Mybanktracker

Citibank Routing Number Locate Your Number Gobankingrates

Quotes About Cheques 52 Quotes

Here Is Something I Would Like To Share Milton Quick Stop Facebook

M T Bank Stadium Jobs Baltimore Ravens Baltimoreravens Com

37 Places That Cash Personal Checks Fees Limits Etc Detailed First Quarter Finance

8 Ways Around The Wells Fargo No Cash Deposits Rule Mybanktracker

Bank Work From Home

Rising Bank Review Is It The Right Bank For You Gobankingrates

M And T Bank Cashier Check Logo Page 1 Line 17qq Com

Best Business Checking Accounts Camino Financial

Explore The M T Bank Help Center M T Bank

Scam Victim Says Don T Cash Checks Fall For Secret Shopper Scheme

24 Hour Check Cashing Stores Located Near You

How Identifying Bogus Checks At M T Bank Is A Lot Like Hunting Cybercriminals Cyberscoop

Covid 19 Personal Covid 19 Be Informed Help Center M T Bank