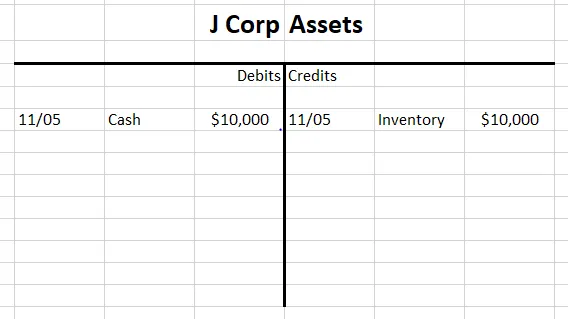

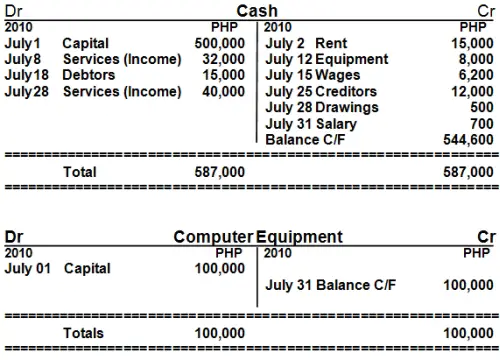

Cash T Chart Accounting

T Accounts A Guide To Understanding T Accounts With Examples

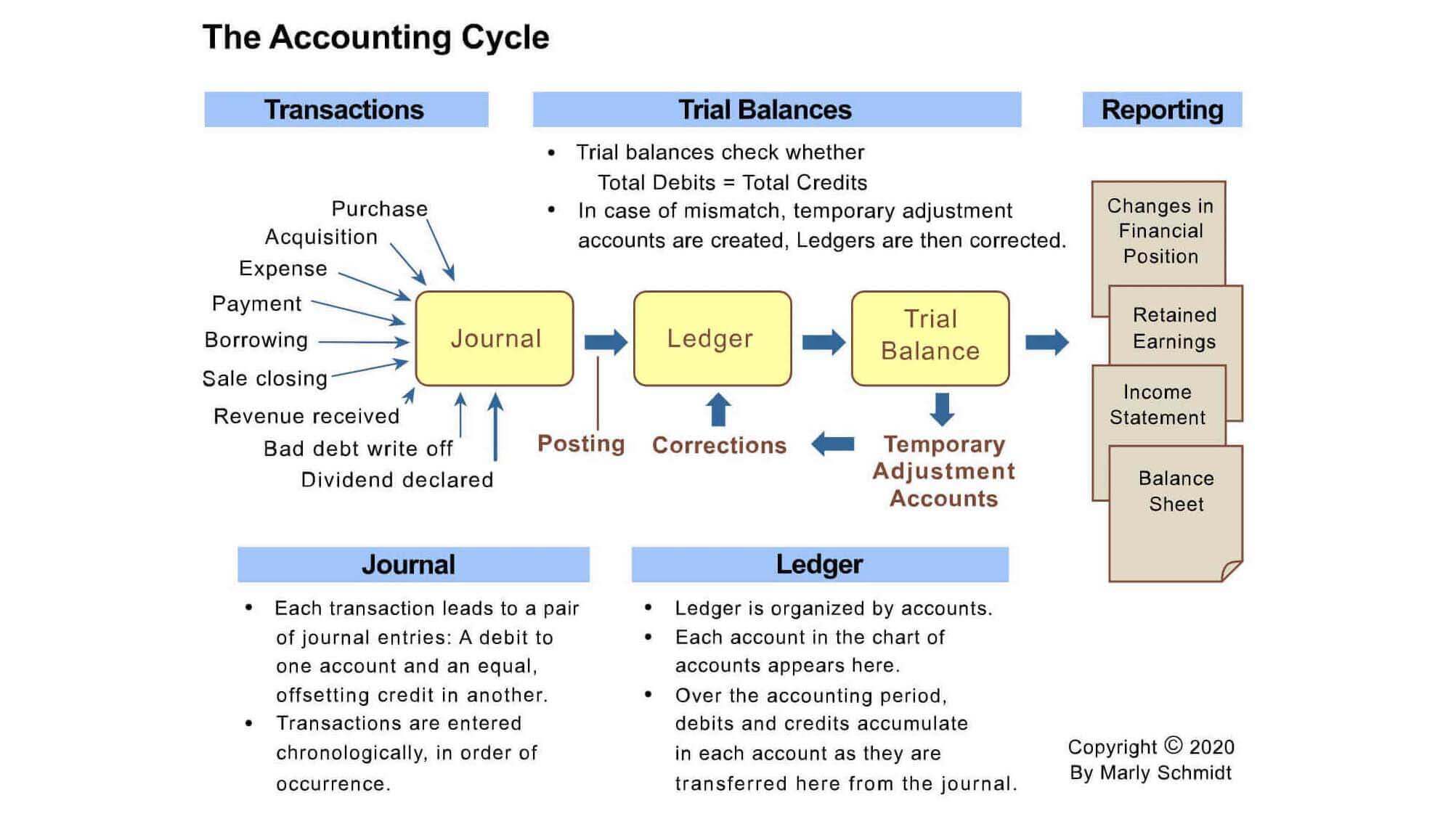

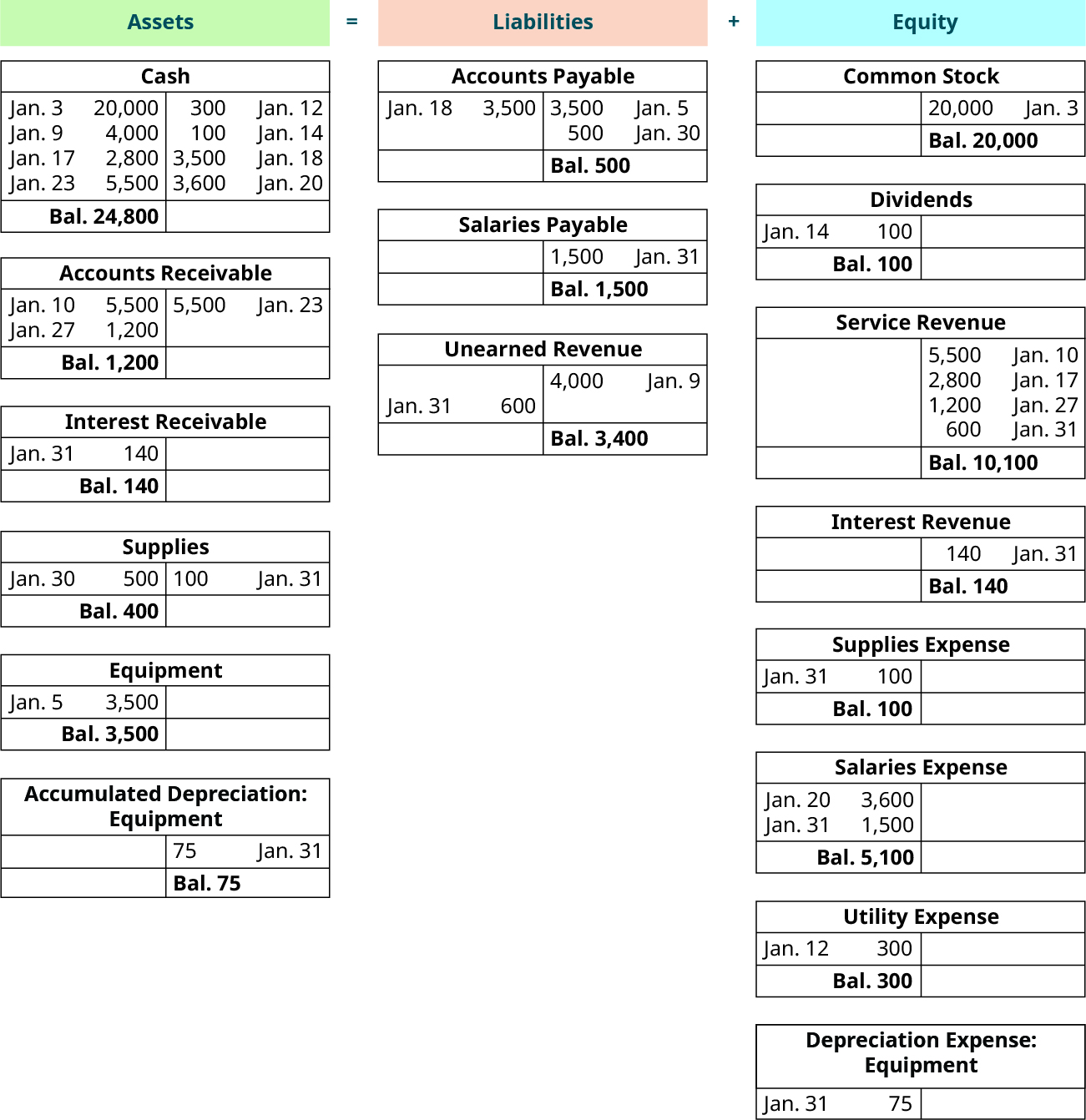

The Accounting Cycle Boundless Accounting

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)

T Account Definition

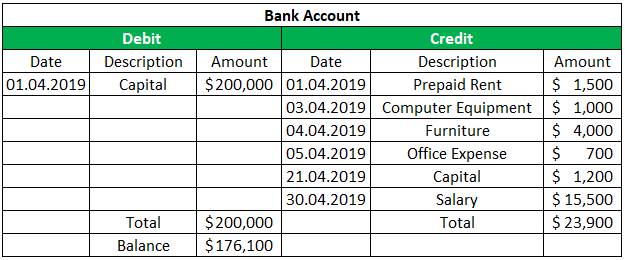

Accounting Debit Credit Software Polarmar Over Blog Com

/Accounting-journal-entry-guide-392995--color-V3-89d63d65bfc9422a8b587002d412d4a2.png)

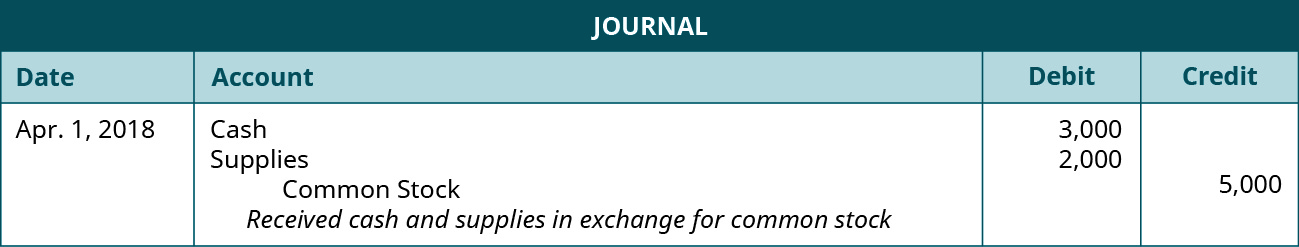

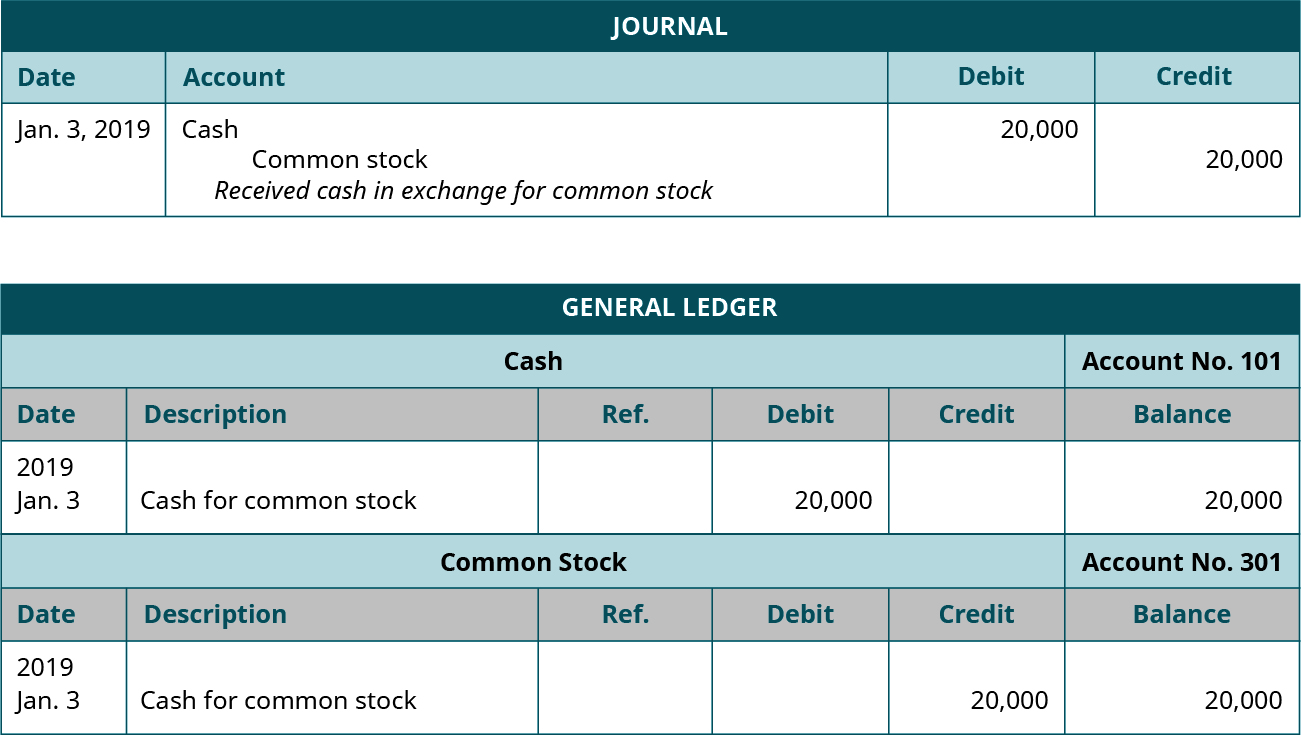

How To Create An Accounting Journal Entry

Paid Cash On Account Journal Entry Double Entry Bookkeeping

In the Accountant Role Center, under the Cash Flow Forecast chart, choose the Open Assisted Setup action Fill in the fields in each step of the guide Choose the icon, enter Cash Flow Forecast, and then choose the related link On the Cash Flow Forecast page, choose the Recalculate Forecast action To use a manual process.

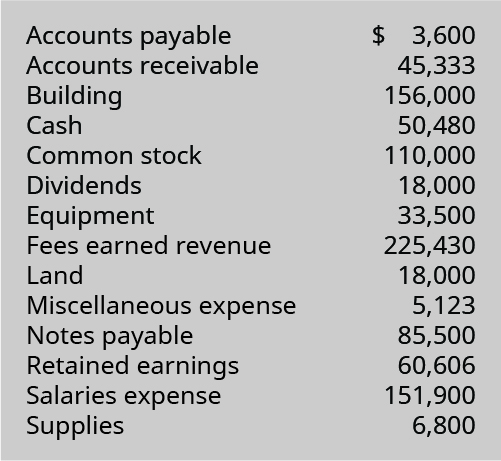

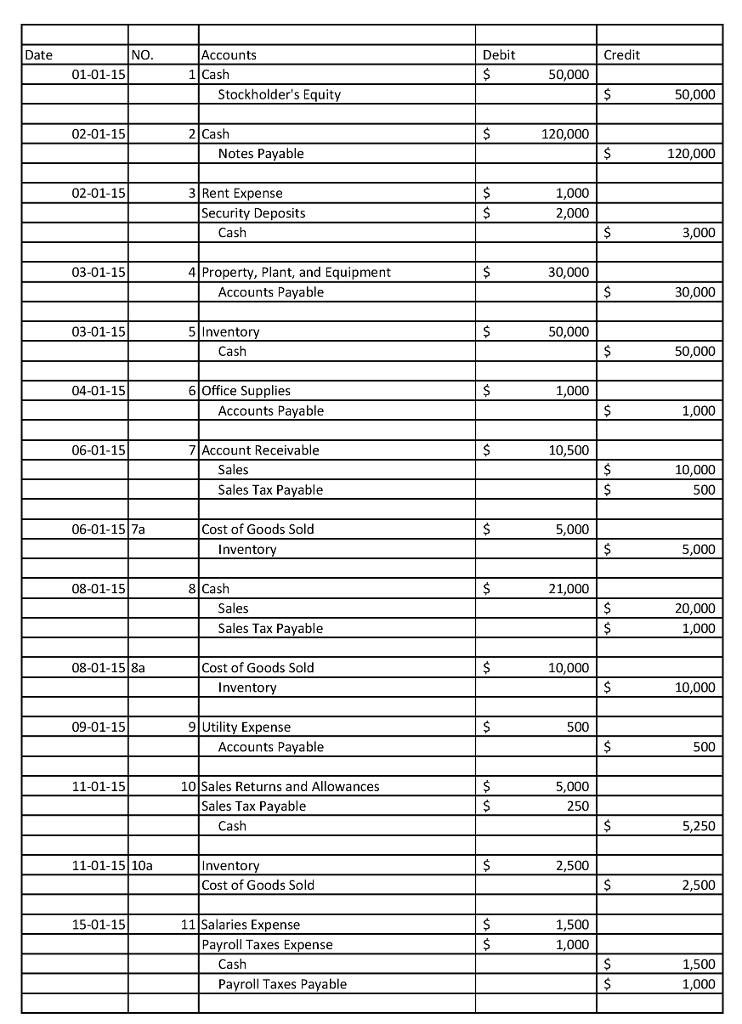

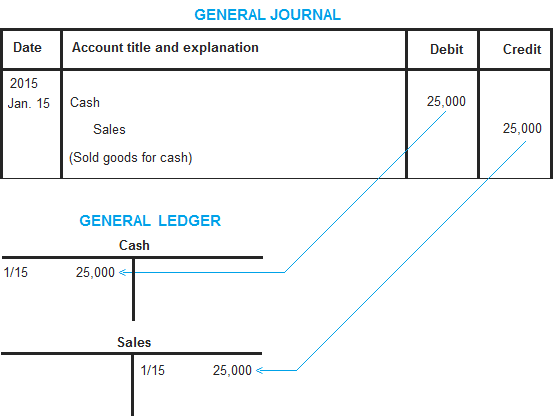

Cash t chart accounting. The Chart of Accounts established by the business helps the business owner determine what is a debit and what is a credit The best way to learn how to record debits and credits is to use Taccounts then turning them into accounting journal entries The information from the Taccounts is then transferred to make the accounting journal entry. Send an invoice to a customer – you don't record the sale in your books until you get their payment. Chart of Accounts Current Assets Liabilities Cash Accounts receivable Inventory Creditors Accounts Payable Loan ShortTerm Loan LongTerm Fixed Assets Owner's Equity Land Building Office Equipment Furniture Capital Retained Earnings Reserves Expenses Revenues Salaries Electricity Supplies Sales Fees Earned Interest Received.

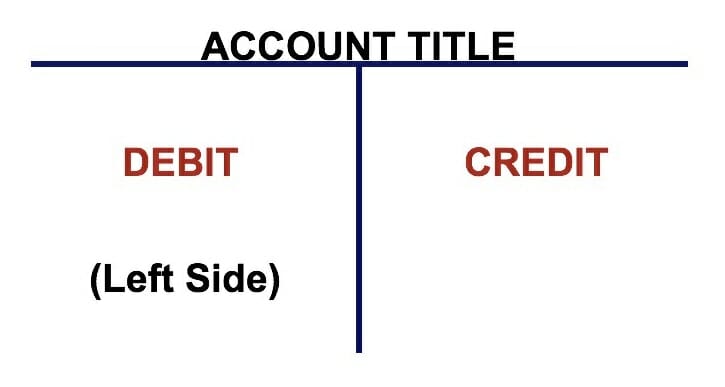

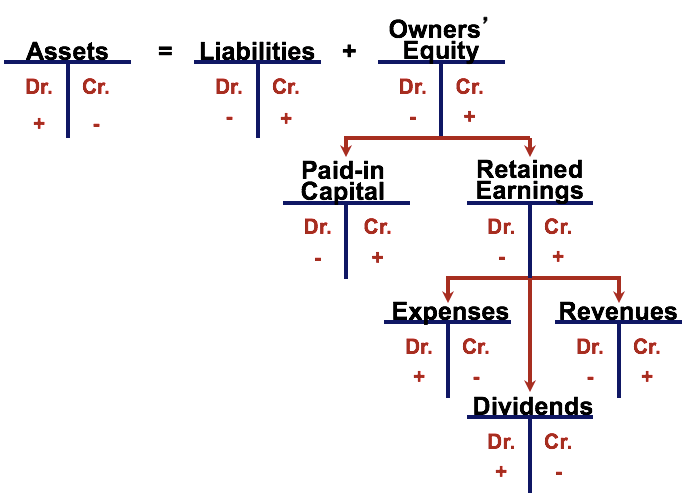

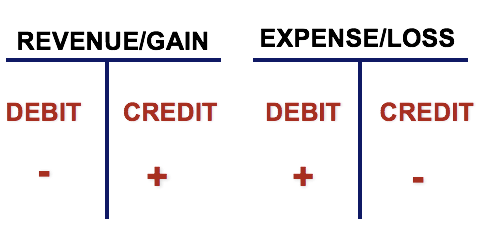

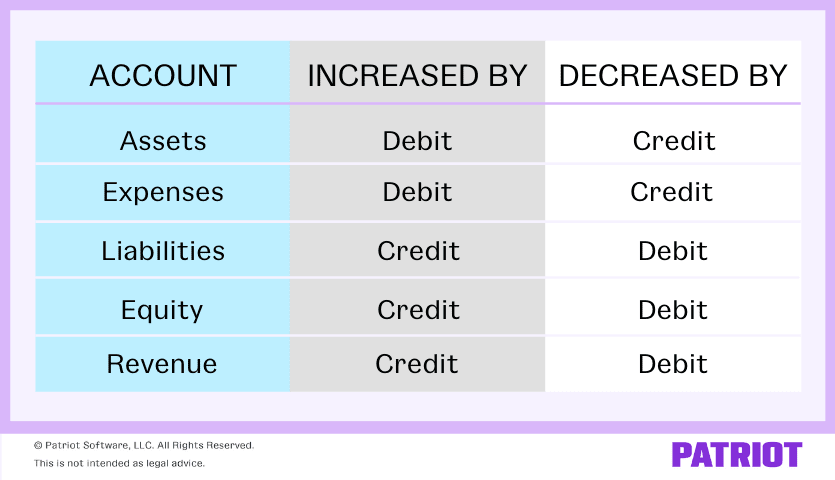

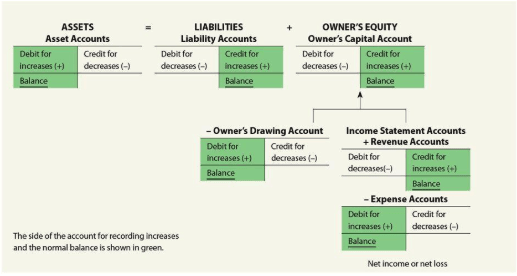

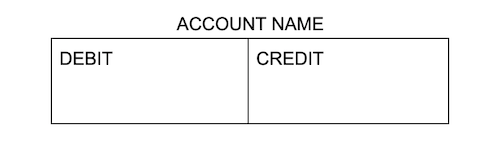

The left side of the Account is always the debit side and the right side is always the credit side, no matter what the account is For different accounts, debits and credits can mean either an increase or a decrease, but in a T Account, the debit is always on the left side and credit on the right side, by convention. Cash basis accounting allows recognition/recording of the transaction when cash is physically received and/or released For instance;. Chart of Accounts Current Assets Liabilities Cash Accounts receivable Inventory Creditors Accounts Payable Loan ShortTerm Loan LongTerm Fixed Assets Owner's Equity Land Building Office Equipment Furniture Capital Retained Earnings Reserves Expenses Revenues Salaries Electricity Supplies Sales Fees Earned Interest Received.

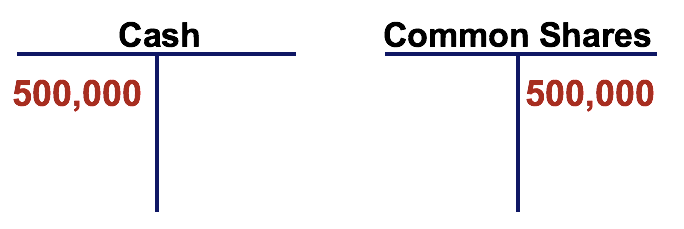

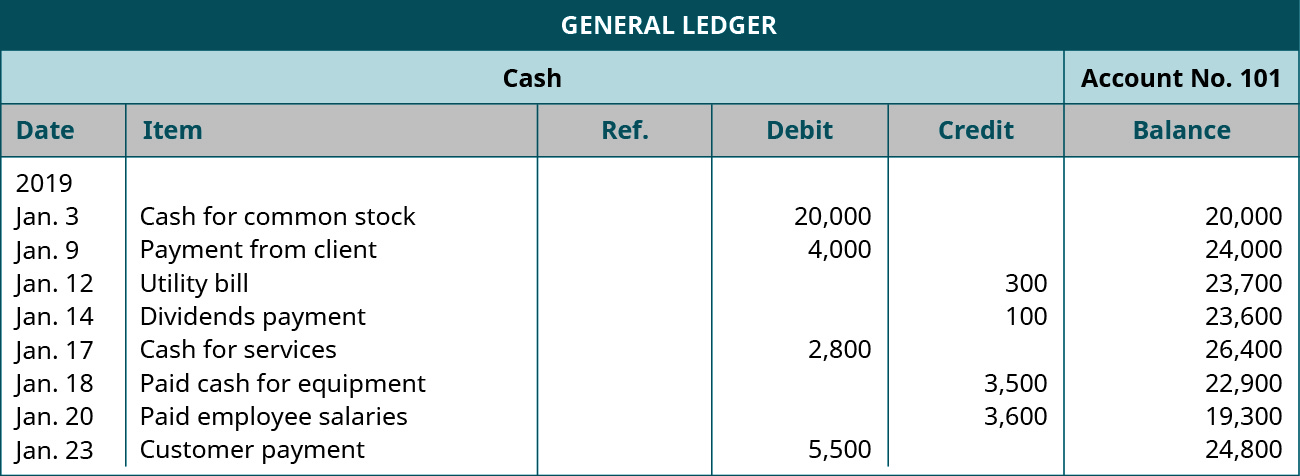

Refer to the chart of accounts illustrated in the previous section 1 Owners invested cash Metro Courier, Inc, was organized as a corporation on January 1, the company issued shares (10,000 shares at $3 each) of common stock for $30,000 cash to Ron Chaney, his wife, and their son The $30,000 cash was deposited in the new business account. A Cash and Accounts Receivable B Cash and Notes Payable C Cash and an expense account Footings in T accounts A appear to the left of the amount columns A chart of accounts does NOT include A assets B liabilities C owner's equity D names of customers. Taccounts represent the changes made to the general ledger They are used as an illustrative tool when planning or discussing the effects a particular transaction will have on the accounting records Taccounts are used in academic and business situations, as they are easier to sketch out than general journals.

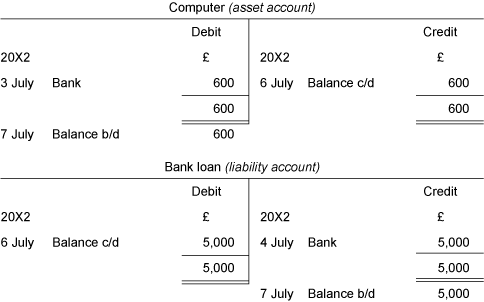

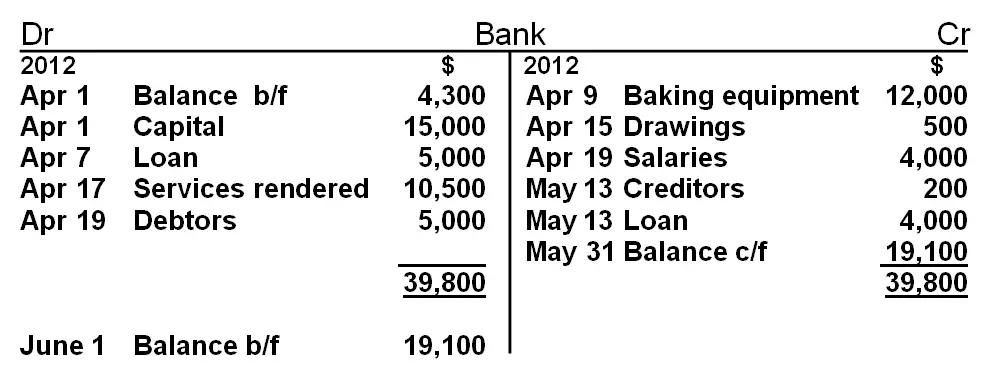

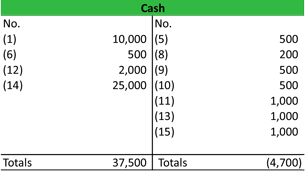

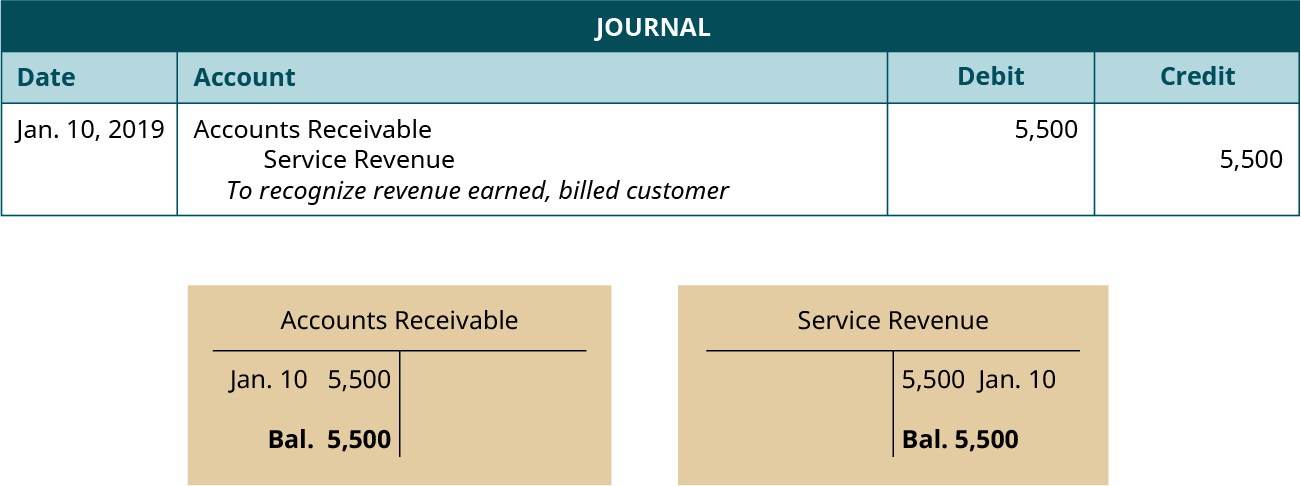

Welcome to the second lesson on Taccounts Balancing Taccounts is one of the more complicated and frustrating things for many accounting students Well, in this lesson we're going to learn the exact steps to do so and even go through a quick practice example TAccount Opening and Closing Balances The last element of the Taccount that we. Cash basis accounting is a good option for sole proprietors and very small businesses without employees First, cash basis accounting is much easier than its accrual basis counterpart, partially. After entering the debits and credits the Taccounts look like this On June 2, 19 the company repays $2,000 of the bank loan As a result, the company's asset Cash must be decreased by $2,000 and its liability Notes Payable must be decreased by $2,000 To reduce the asset Cash the account will need to be credited for $2,000.

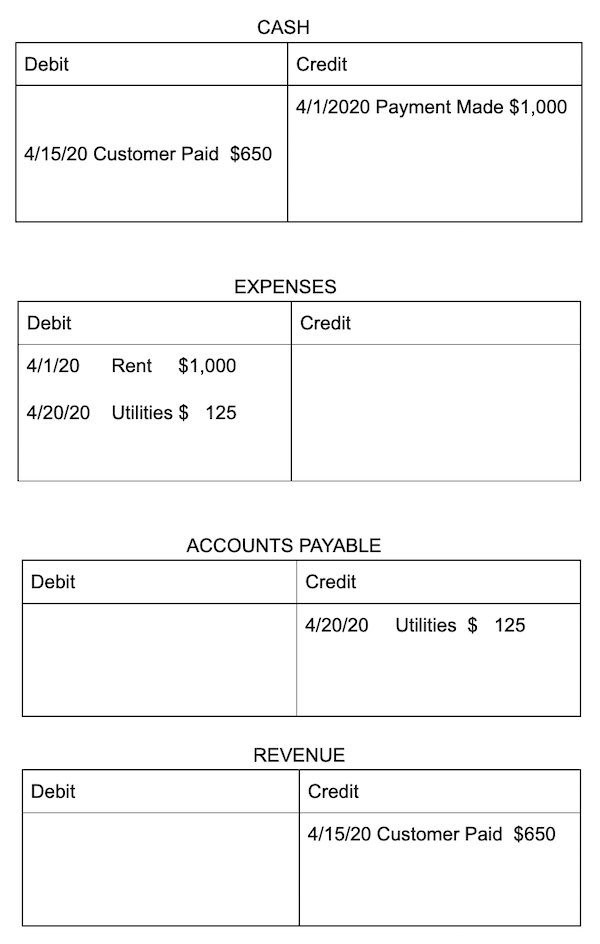

In this journal entry, cash is increased (debited) and accounts receivable credited (decreased) Working from the rules established in the debits and credits chart below, we used a debit to record. Under the appropriate groupings in the HUD Chart of Accounts C An explanation of the Chart of Accounts appears in paragraph 64 _____ 61 6/92 _____ _____ 63 CHART OF ACCOUNTS A 1000 ASSET ACCOUNTS 1100 CURRENT ASSETS 1110 Petty Cash 11 Cash in Bank 1130 Tenant/Member Accounts Receivable. Free cash flow represents the cash a company can generate after accounting for capital expenditures needed to maintain or maximize its asset base more TAccount Definition.

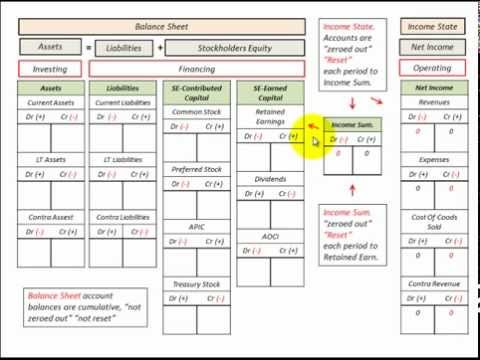

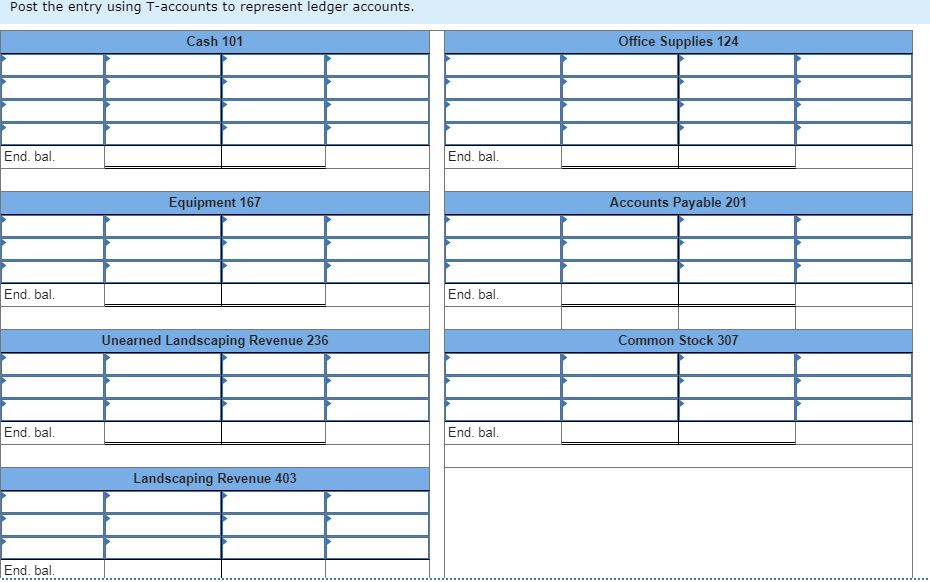

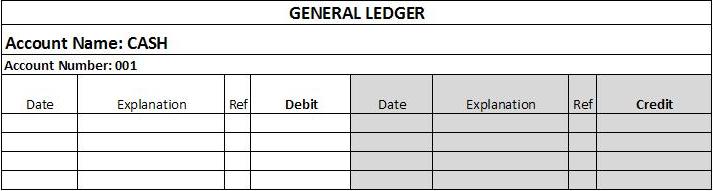

The Chart of Accounts established by the business helps the business owner determine what is a debit and what is a credit The best way to learn how to record debits and credits is to use Taccounts then turning them into accounting journal entries The information from the Taccounts is then transferred to make the accounting journal entry. Learn how to post to the Taccount!. The visual presentation of journal entries, which are recorded in the general ledger account is known as the TAccount It is called the Taccount because entries of bookkeeping are shown in a way that resembles the shape of alphabet T It depicts credits graphically on the right side and debits on the left side.

💥TAccounts Cheat Sheet → https//accountingstuffco/shopAccounting Basics Lesson 3 T Accounts Explained This episode of Accounting Basics for Beginners. A TAccount is a visual presentation of the journal entries recorded in a general ledger account This T format graphically depicts the debits on the left side of the T and the credits on the right side This system allows accountants and bookkeepers to easily track account balances and spot errors in journal entries TAccount Debits and Credits. Since the income statement is usually prepared under the accrual method of accounting, the statement of cash flows provides information on the amounts of cash flowing in and out of the business Some investors will compare the cash from operating activities to the amount of net income in order to assess the “quality” of a company’s earnings.

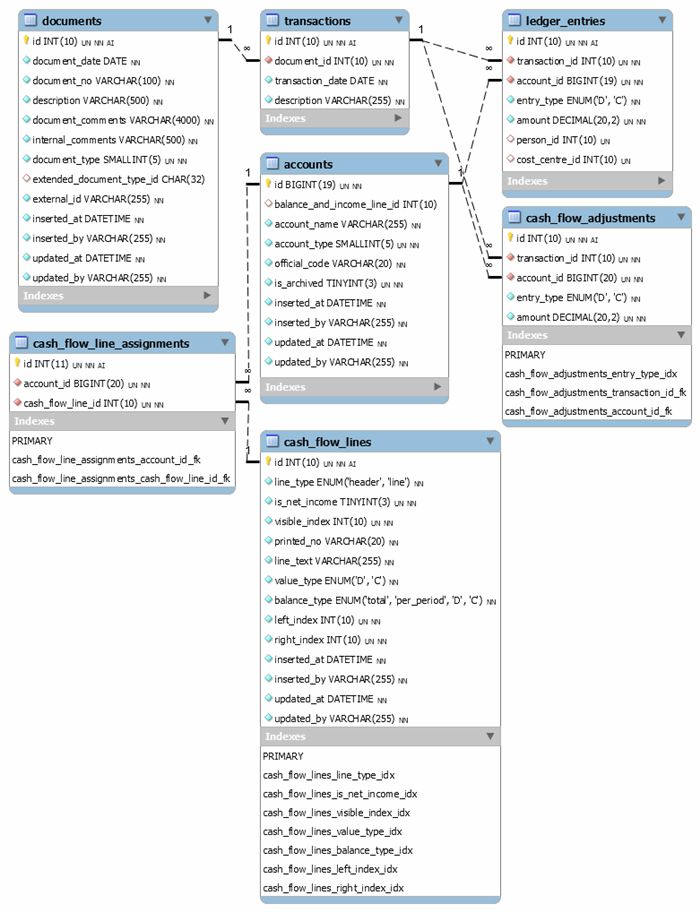

For example, assume your cash account is 1001 and your accounts receivable account is 1002, now you want to add a petty cash account Well, this should be listed between the cash and accounts receivable in the chart, but there isn’t a number in between them Look at the number pattern in our example above. Taccounts represent the changes made to the general ledger They are used as an illustrative tool when planning or discussing the effects a particular transaction will have on the accounting records Taccounts are used in academic and business situations, as they are easier to sketch out than general journals. A chart of accounts (COA) is a list of the categories used by an organization to classify and distinguish financial assets, liabilities, and transactionsIt is used to organize the entity’s finances and segregate expenditures, revenue, assets and liabilities in order to give interested parties a better understanding of the entity’s financial health.

Chart of Accounts Current Assets Liabilities Cash Accounts receivable Inventory Creditors Accounts Payable Loan ShortTerm Loan LongTerm Fixed Assets Owner's Equity Land Building Office Equipment Furniture Capital Retained Earnings Reserves Expenses Revenues Salaries Electricity Supplies Sales Fees Earned Interest Received. Cash flow and operating cash flow are two of the accounting terms that all business owners should be familiar with Cash flow includes total revenues that flow into your business while operating. Revenue is recorded when received and expenses are recorded when payment is made either by cash, check or credit card.

A Taccount is an informal term for a set of financial records that use doubleentry bookkeeping It is called a Taccount because the bookkeeping entries are laid out in a way that resembles a. The chart of accounts is a tool that lists all the financial accounts included in the financial statements Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows These three core statements are. The Chart of Accounts established by the business helps the business owner determine what is a debit and what is a credit The best way to learn how to record debits and credits is to use Taccounts then turning them into accounting journal entries The information from the Taccounts is then transferred to make the accounting journal entry.

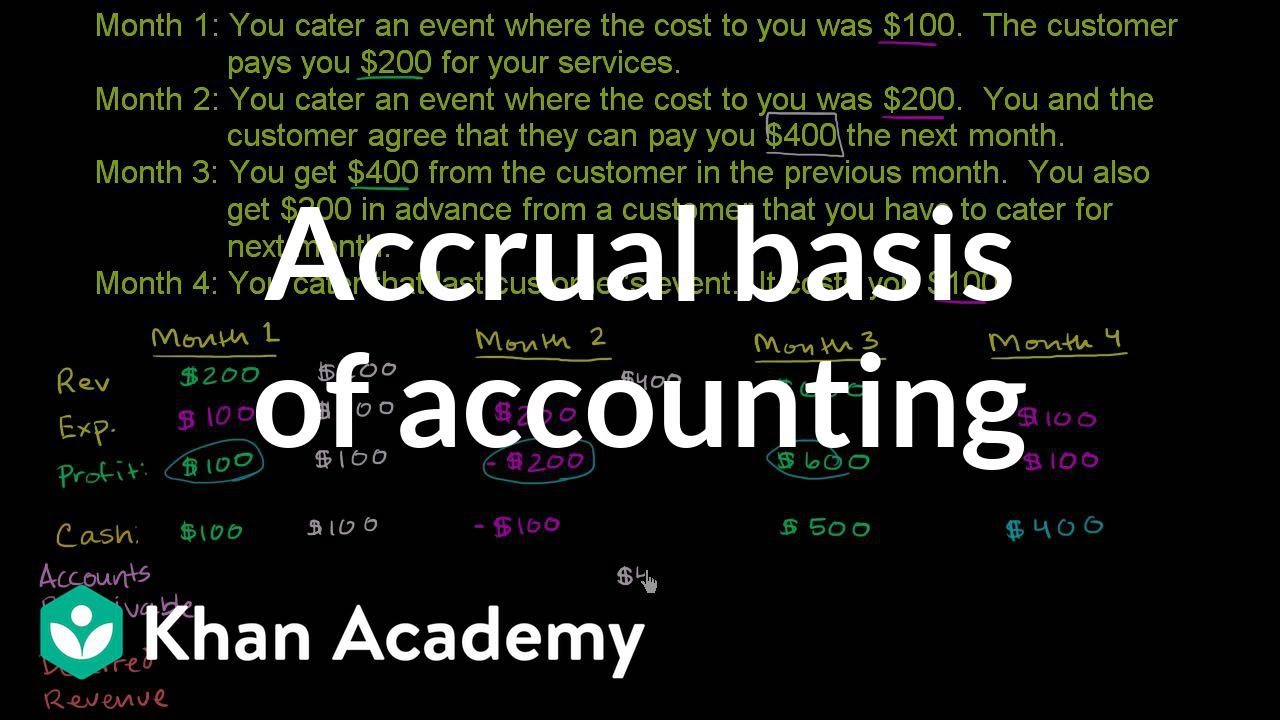

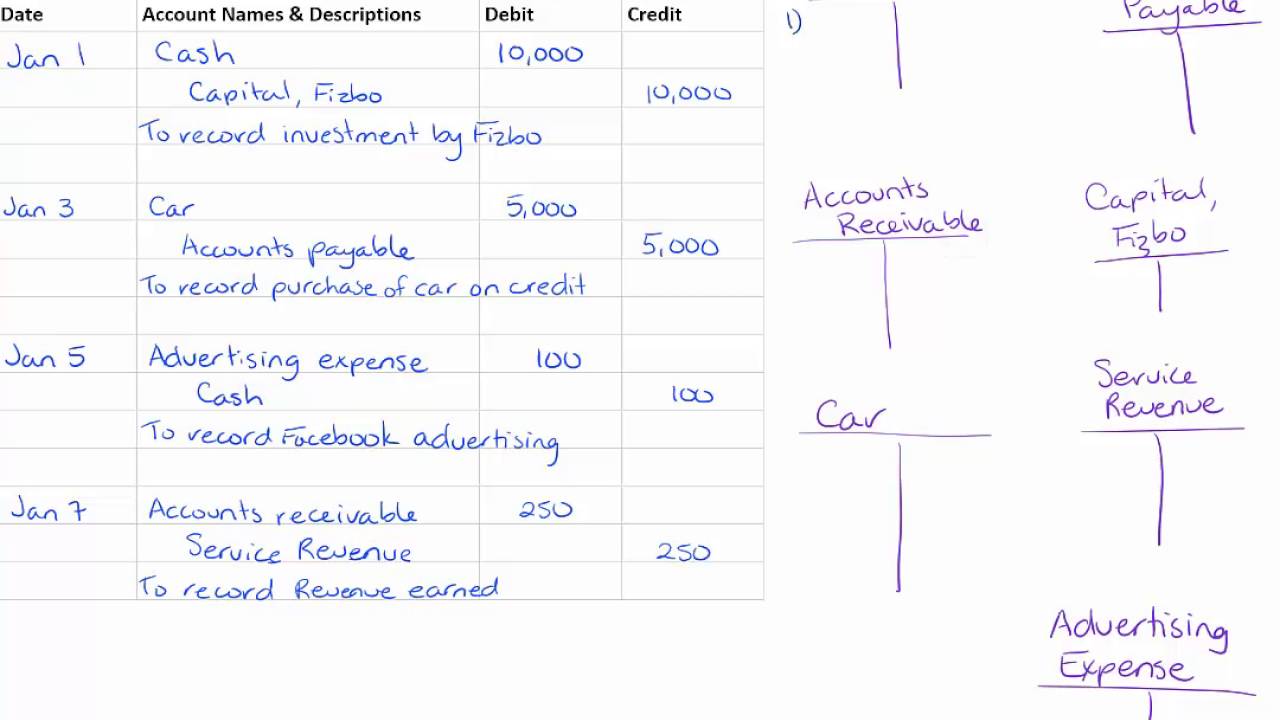

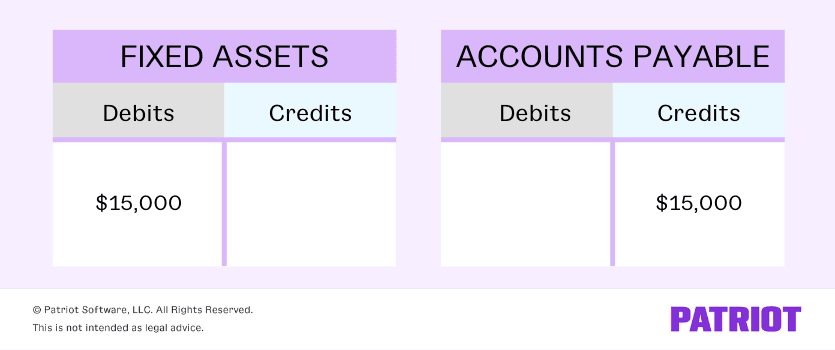

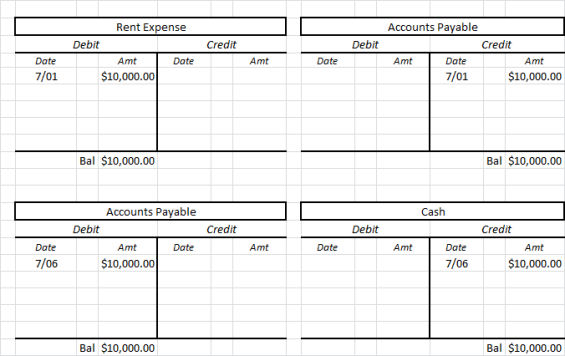

The Taccount is used instead of the general ledger This video uses our Fizbo examples that we used to set up journal en. The bottom set of T accounts in the example show that, a few days later, the company pays the rent invoice This results in the elimination of the accounts payable liability with a debit to that account, as well as a credit to the cash (asset) account, which decreases the balance in that account. Also, since transactions aren’t recorded until the cash is received or paid, the business’s income isn’t taxed until it’s in the bank Accrual basis accounting Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned, regardless of when the money is actually received or paid.

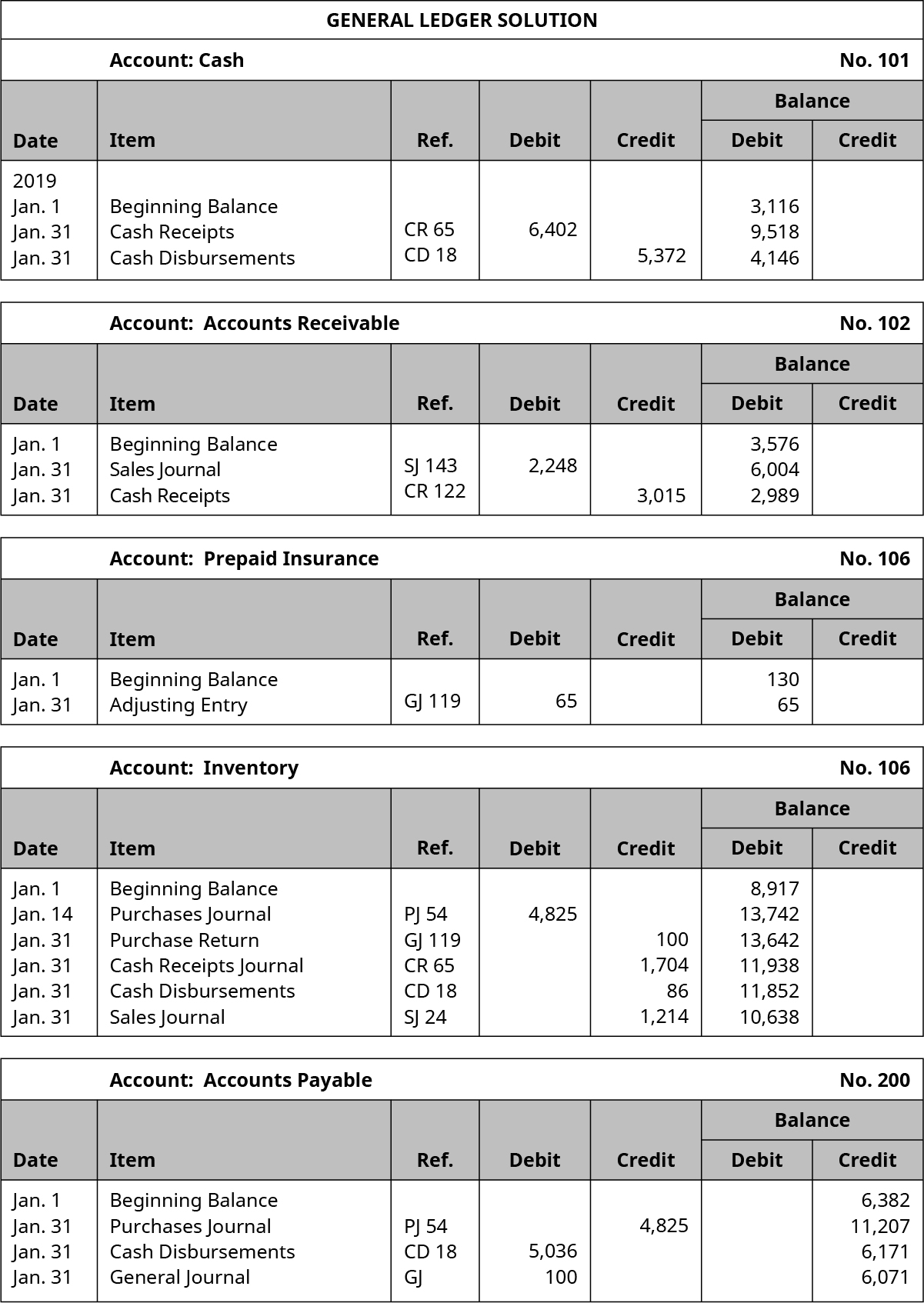

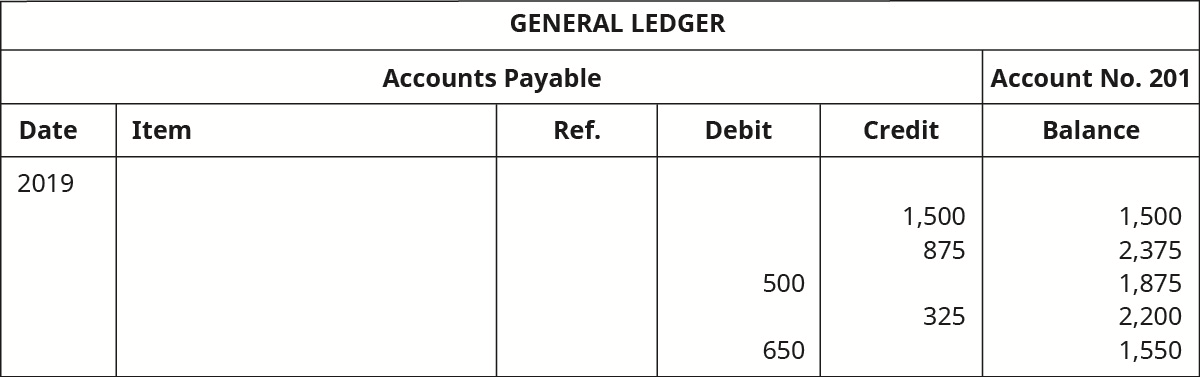

The accounts payable ledger is a record of what you owe each vendor Ensure your accounting software automatically keeps separate ledgers as well as the general ledger The general ledger contains an accounts payable account, which is your accounts payable control account The cash disbursements journal has accounts payable credit and debit. The chart of accounts refers to the directory of every account made in the general ledger in an accounting system It’s a simple list of accounts with titles of accounts and numbers Unlike a trial balance, the chart does not incorporate any other information like debit and credit balances. A cash flow forecast is the most important business tool for every business The forecast will tell you if your business will have enough cash to run the business or pay to expand it It will also show you when more cash is going out of the business than in Use the Cash flow forecasting template below to forecast and record cash flow.

Chart of Accounts Current Assets Liabilities Cash Accounts receivable Inventory Creditors Accounts Payable Loan ShortTerm Loan LongTerm Fixed Assets Owner's Equity Land Building Office Equipment Furniture Capital Retained Earnings Reserves Expenses Revenues Salaries Electricity Supplies Sales Fees Earned Interest Received. The accounts payable ledger is a record of what you owe each vendor Ensure your accounting software automatically keeps separate ledgers as well as the general ledger The general ledger contains an accounts payable account, which is your accounts payable control account The cash disbursements journal has accounts payable credit and debit. All the main Taccounts in a business fall under the general ledger For example, land and buildings, equipment, machinery, vehicles, financial investments, bank accounts, inventory, owner's equity (capital), liabilities the Taccounts for all of these can be found in the general ledger Subsidiary Ledgers (or Sub Ledgers).

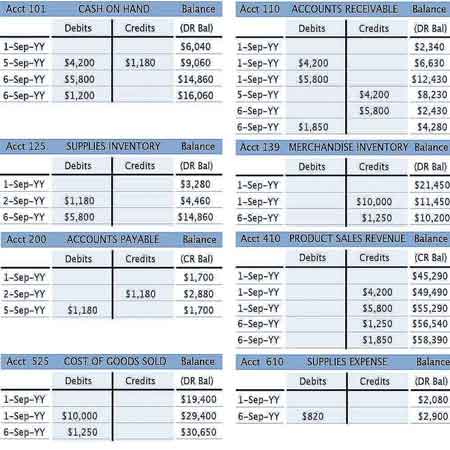

Chart of Accounts, Page 4 of 4 Example Chart of Accounts 100 Assets 101 Cash 102 Accounts receivable 103 Automobile 104 Equipment 105 Building 106 Land 107 Supplies 108 Accumulated Depreciation 0 Liabilities 1 Accounts payable 2 Note payable 3 Mortgage payable 4 Salaries payable 300 Net worth. For small business owners, managing cash flow can be the difference between a thriving, successful company and filing for chapter 11 In fact, one study showed that 30% of businesses fail because the owner runs out of money and 60% of small business owners don’t feel knowledgeable about accounting or finance. Instructions 1 Correctly place plus and minus signs under each T account and label the sides of the T ac counts as either debit or credit in the fundamental accounting equation Record the account balances as of September 1.

The cash conversion cycle (CCC) is a financial metric that helps companies in tracking how much time a company needs to convert its resources into cash from sales In our example, the formula is also simply depicted so that it can easily be followed you need to add the days sales outstanding to the days of inventory outstanding and deduct the days payable outstanding to calculate the cash conversion cycle. T Accounts The simplest account structure is shaped like the letter T The account title and account number appear above the T Debits (abbreviated Dr) always go on the left side of the T, and credits (abbreviated Cr) always go on the right Accountants record increases in asset, expense, and owner's drawing accounts on the debit side, and they record increases in liability, revenue, and owner's capital accounts on the credit side. In exercise6 we used formula approach to calculate cash received from customer We can also compute this figure by making an accounts receivable taccount In this exercise, we shall use the data from exercise6 and calculate cash received from customers during a period using taccounts approach The following information belongs to Alpha company Accounts receivable on.

Create a journal entry and a TAccount for each of the following transactions $5,000 of accounts payable is paid in cash $30,000 of cash is received from taking out a note with the local bank. 💥TAccounts Cheat Sheet → https//accountingstuffco/shopAccounting Basics Lesson 3 T Accounts Explained This episode of Accounting Basics for Beginners. The exact configuration of the chart of accounts will be based on the needs of the individual business Sample Chart of Accounts Typical accounts found in the chart of accounts are Assets Cash (main checking account) Cash (payroll account) Petty Cash Marketable Securities Accounts Receivable Allowance for Doubtful Accounts (contra account) Prepaid Expenses.

Cash accounting tracks the actual money coming in and out of your business In cash accounting, when you get an invoice for something – you don't record the cost in your books until you've paid the invoice;. Accrual basis of accounting always tries to match revenue with expenses Purchasing $0 in inventory that you will sell next month will result in a $0 increase in inventory and a $0 decrease in cash on the balance sheet When you sell the inventory, revenue and cost of goods sold (the expense) will be recognized on the income statement.

T Accounts And Ledgers

:max_bytes(150000):strip_icc()/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)

T Account Definition

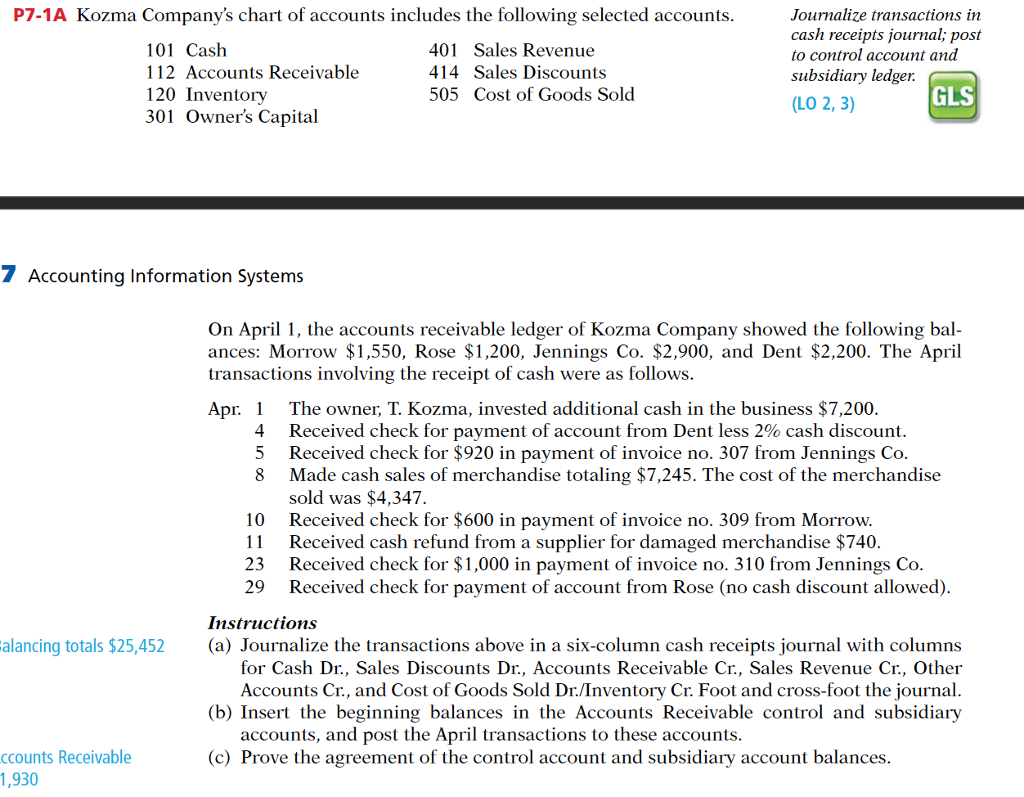

Prepare A Subsidiary Ledger Principles Of Accounting Volume 1 Financial Accounting

T Accounts Journal Entry And Trial Balance Question

Services On Account Double Entry Bookkeeping

T Accounts A Guide To Understanding T Accounts With Examples

Bookkeeping Double Entry Debits And Credits Accountingcoach

Accrual Basis Of Accounting Video Khan Academy

Debits And Credits T Accounts Journal Entries Accountingcoach

/how-to-prepare-a-trial-balance-393000-Final-e7e6e3ee832c4a3593cc611d0a73edf8.png)

How To Prepare A Trial Balance For Accounting

/accounts-receivables-on-the-balance-sheet-357263-FINAL3-49402f58e70a42ab9468144f84f366d6.png)

Accounts Receivable On The Balance Sheet

Balance Sheet Income Statement Template T Accounts Accounting Explained Youtube

T Accounts

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

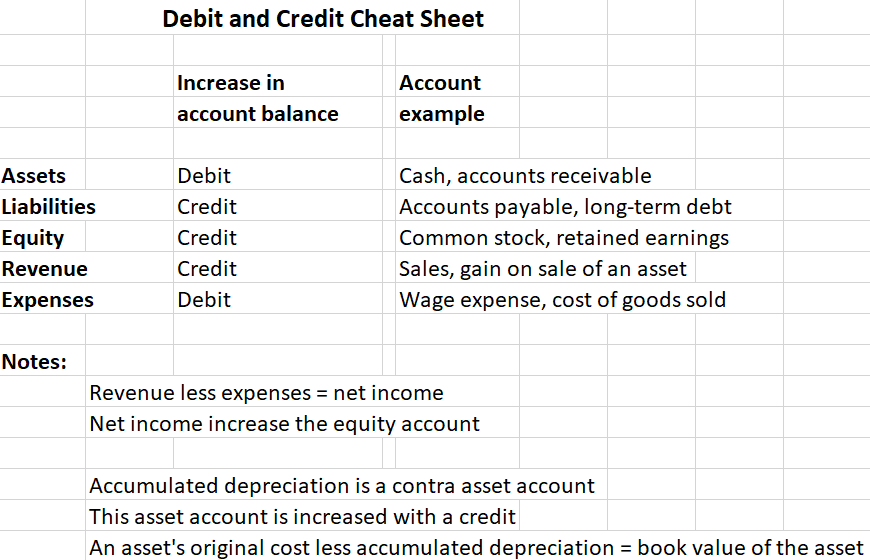

Accounting Debit And Credit Rules Chart Accounting Accounting Classes Accounting Education

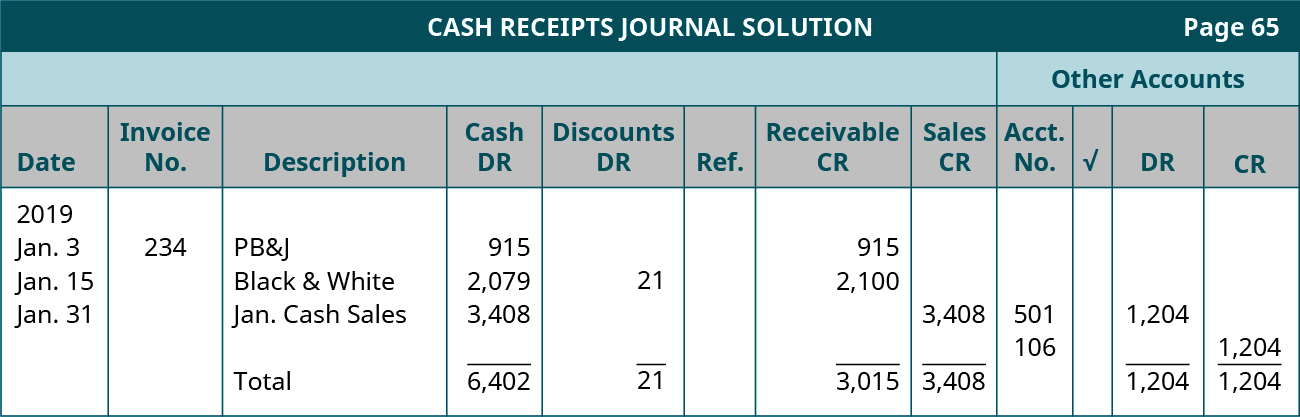

Special Journals

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)

T Account Definition

Accounting Basics Purchase Of Assets Accountingcoach

T Account Meaning Format How Does T Account Work

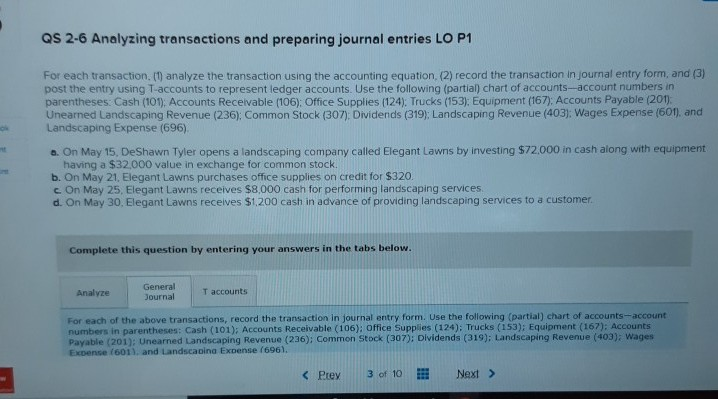

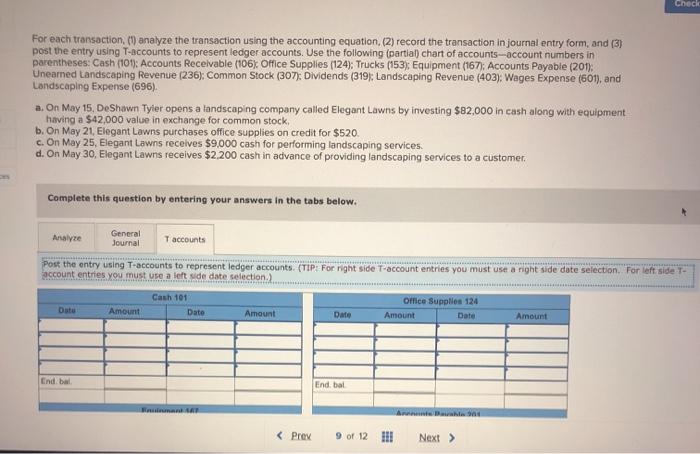

Solved For Each Transaction 1 Analyze The Transaction Chegg Com

Week 4 Preparing The Trial Balance And The Balance Sheet View As Single Page

Review What Is The Left Side Of The Accounting Equation Called Assets What Is The Right Side Of The Accounting Equation Called Equities Liabilities Ppt Download

T Accounts A Guide To Understanding T Accounts With Examples

Accounts Payable Control Account Double Entry Bookkeeping

General Ledger Accounts T Account Examples Format

Accounting Exercise Cash Payments Journal

General Ledger Examples I Format I Accountancy Knowledge

Accounts Debits And Credits Principlesofaccounting Com

What Is The Entry In A Ledger For Commenced Businesses With Cash Quora

Debits And Credits Normal Balances Permanent Temporary Accounts Accountingcoach

T Accounts And Ledgers

Adjusting Entries For Asset Accounts Accountingcoach

Debit Vs Credit

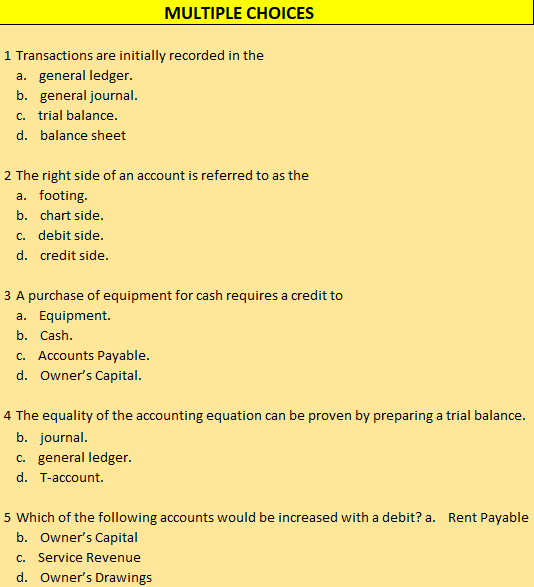

Answered 1 Transactions Are Initially Recorded Bartleby

T Accounts A Guide To Understanding T Accounts With Examples

General Ledger Accounts T Account Examples Format

Solved For Each Transaction 1 Analyze The Transaction Chegg Com

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Debits And Credits T Accounts Journal Entries Accountingcoach

Prepare A Subsidiary Ledger Principles Of Accounting Volume 1 Financial Accounting

Received Cash On Account Journal Entry Double Entry Bookkeeping

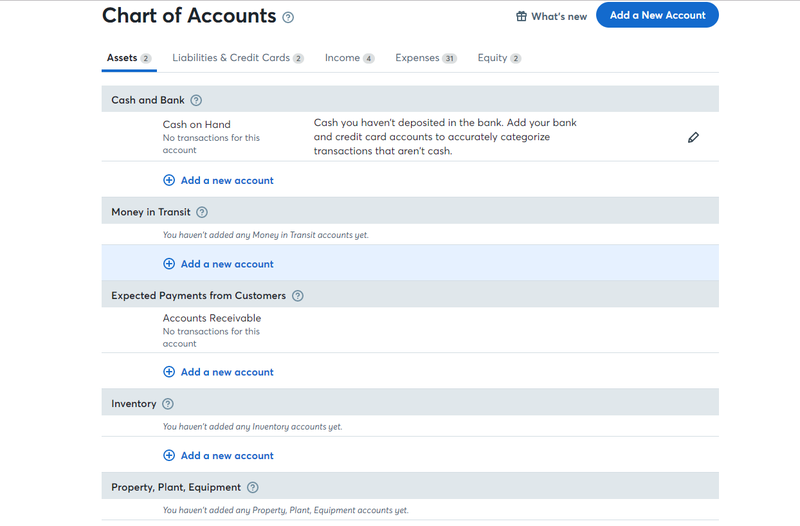

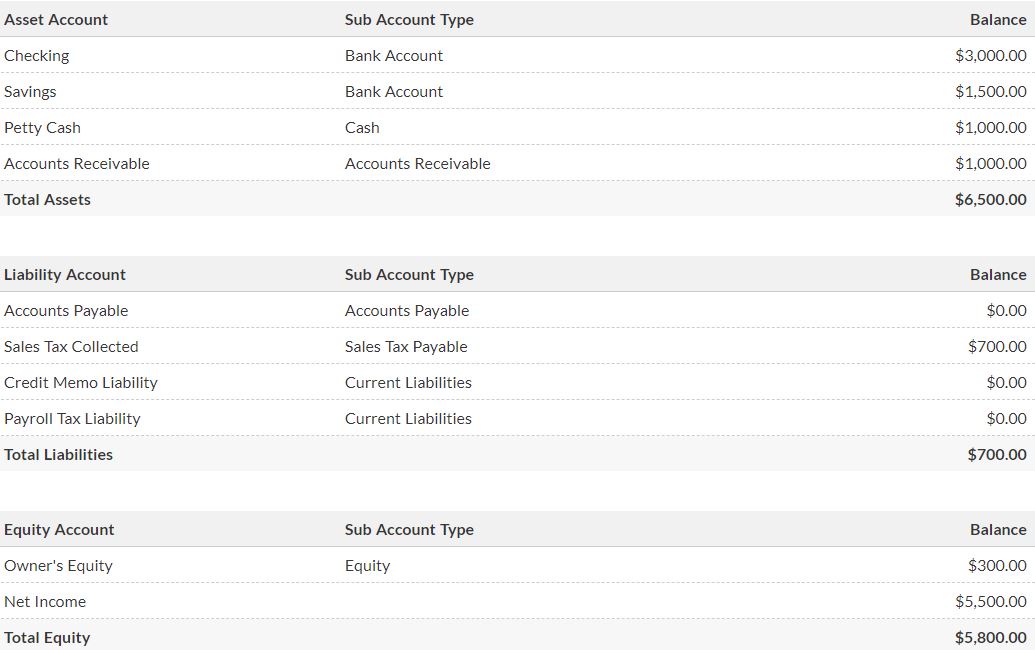

Chart Of Accounts

Balancing T Accounts

A Guide To T Accounts Small Business Accounting The Blueprint

The Balance Sheet Debits And Credits And Double Entry Accounting Practice Problems Universalclass

A Beginner S Guide To Bookkeeping Basics The Blueprint

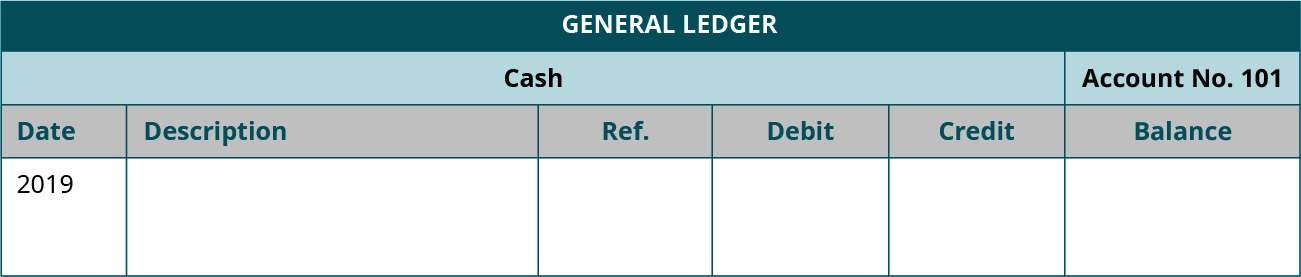

Ledger General Ledger Role In Accounting Defined And Explained

Cash Basis Vs Accrual Comparing Accounting Methods

Insurance Journal Entry For Different Types Of Insurance

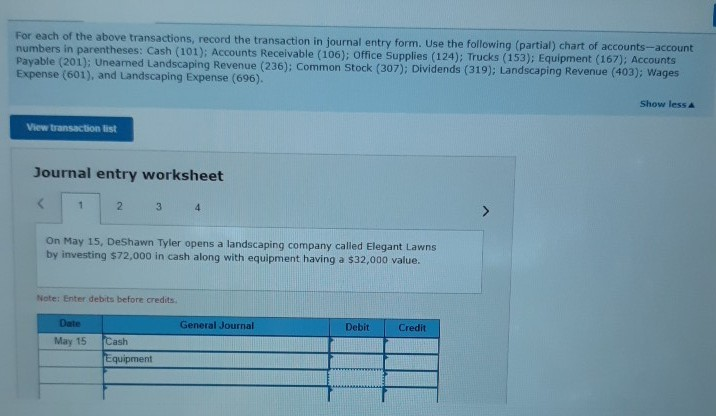

Journal Entries Examples Format How To Use Explanation

T Accounts And Ledgers

Basic Cash Flow Statement Video Khan Academy

T Accounts A Guide To Understanding T Accounts With Examples

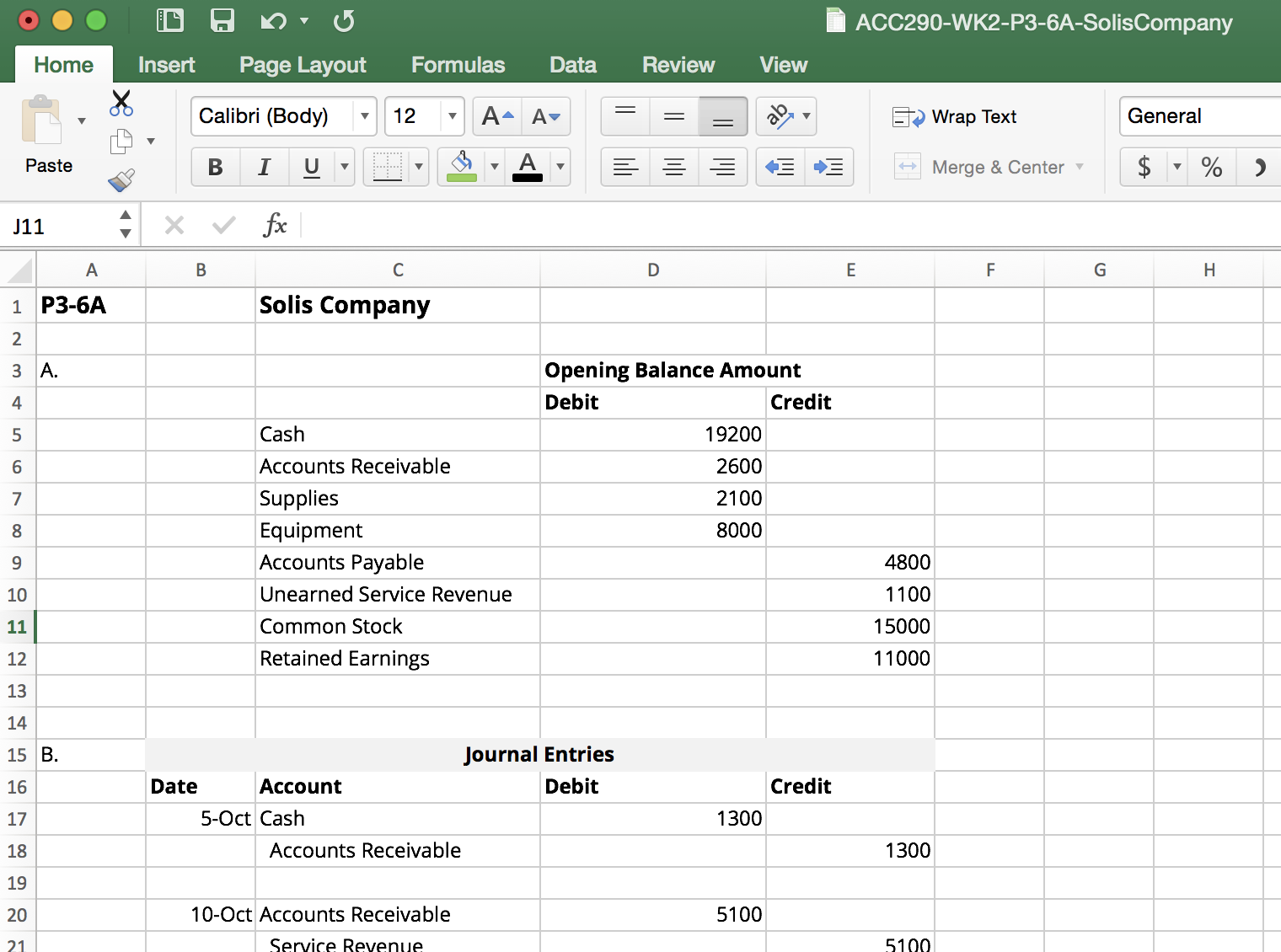

How To Solve P3 6a Solis Company Campushippo

General Ledger Accounts T Account Examples Format

What Is A General Ledger And Why Is It Important Quickbooks

Solved Analyze General Journal Taccounts Post The Entry U Chegg Com

What Are T Accounts Definition And Example

T Account Examples Step By Step Guide To T Accounts With Examples

Database For Financial Accounting Application Ii Infrastructure Codeproject

T Chart Accounting Example Printables And Charts Within T Chart Accounting Example Accounting And Finance Accounting Online Accounting

:max_bytes(150000):strip_icc()/T-Account2_2-88f09021aae149ca8fce870a08ae2752.png)

T Account Definition

The Basics Of Double Entry Accounting Community Tax

T Accounts In Bookkeeping Double Entry Bookkeeping

Posting To The General Ledger Financial Accounting

Record And Post The Common Types Of Adjusting Entries Principles Of Accounting Volume 1 Financial Accounting

T Accounts Journal Entry And Trial Balance Question

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Chart Of Accounts

T Accounts Youtube

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Cash Discount Received Double Entry Bookkeeping

Accounting Basics Debits And Credits

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Solved P7 1a Kozma Company S Chart Of Accounts Includes T Chegg Com

T Accounts A Guide To Understanding T Accounts With Examples

General Ledger Problems And Solutions Accountancy Knowledge

T Accounts

Ledger General Ledger Role In Accounting Defined And Explained

Journal Entries And Ledger Question And Answer

T Accounts Explained With Examples Brixx

3 5 Use Journal Entries To Record Transactions And Post To T Accounts Business Libretexts

T Account Definition Accountingtools

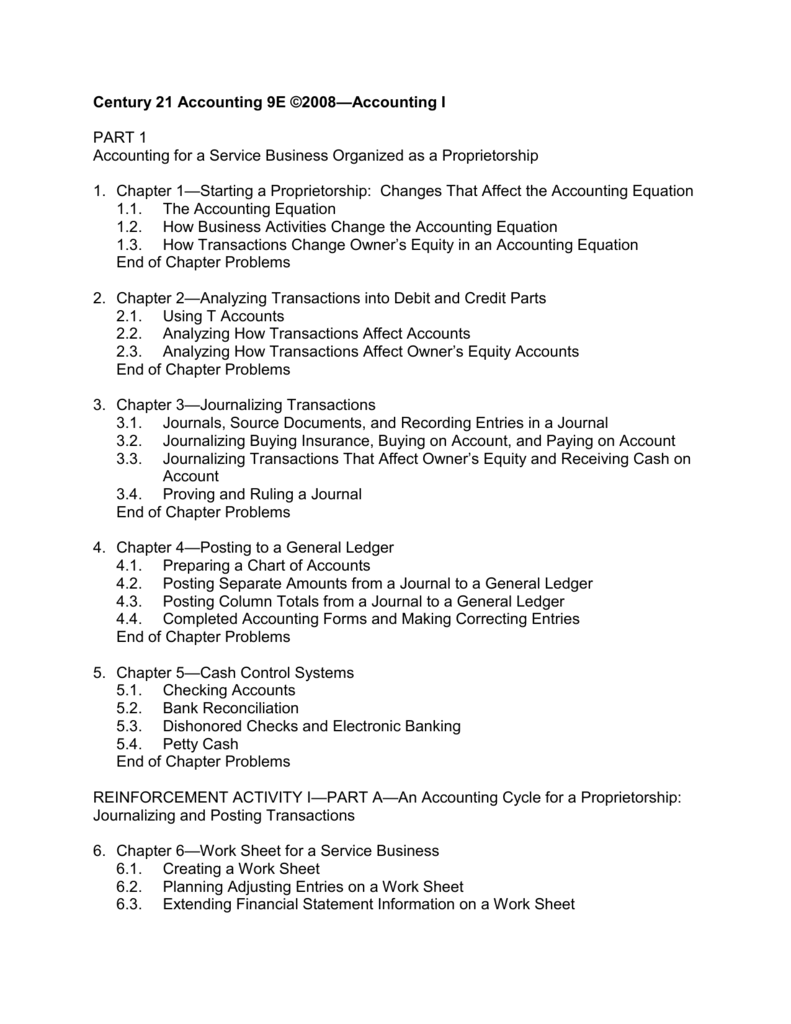

Century 21 Accounting 9e I Nmhs

Accounting Basics Debits And Credits

Solved Make A T Chart T Account With The Information Bel Chegg Com

Solved For Each Transaction 1 Analyze The Transaction U Chegg Com

Normal Balance Of Accounts Bookstime

How To Post Journal Entries To The General Ledger Business Tips Philippines

General Ledger Explanation Process Format Example Accounting For Management

A Guide To T Accounts Small Business Accounting The Blueprint

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Ledger General Ledger Role In Accounting Defined And Explained