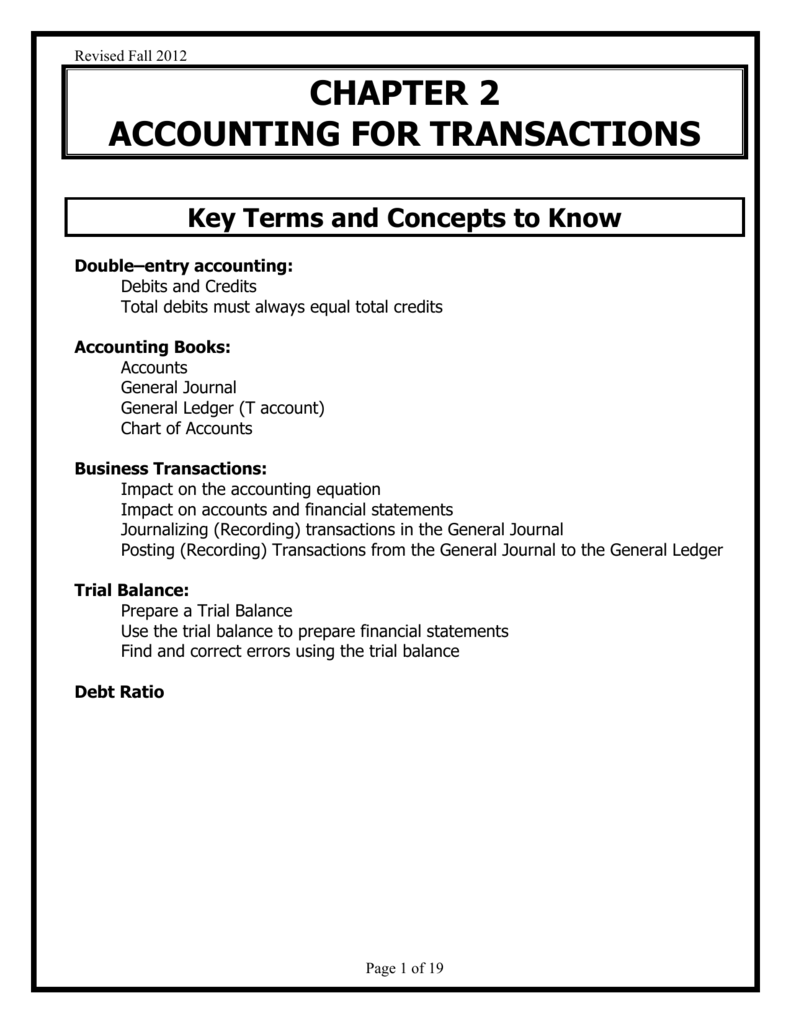

T Chart Accounting

Accounting T Chart Camba

Accounting Terms Flashcards Quizlet

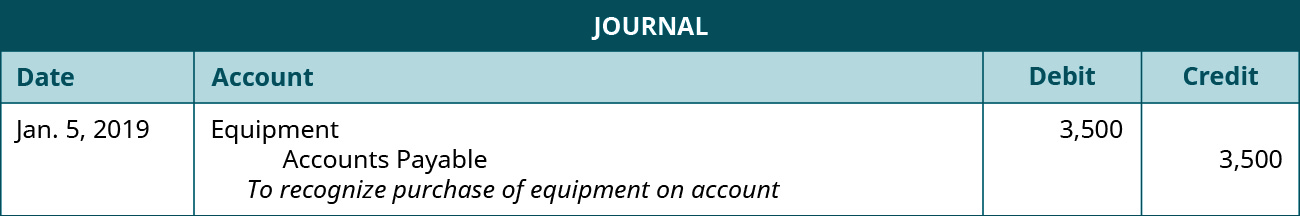

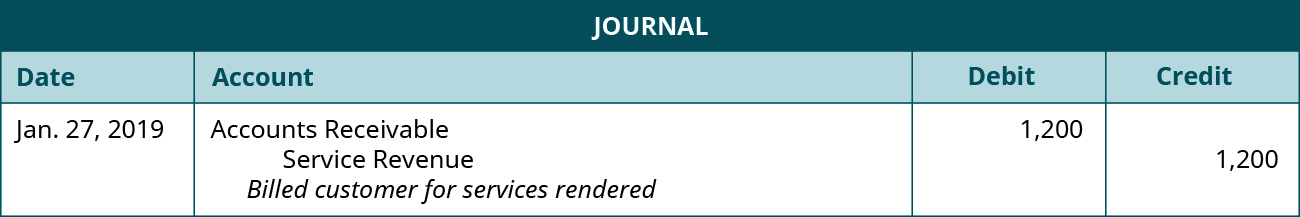

3 5 Use Journal Entries To Record Transactions And Post To T Accounts Business Libretexts

Ledger General Ledger Role In Accounting Defined And Explained

Services On Account Double Entry Bookkeeping

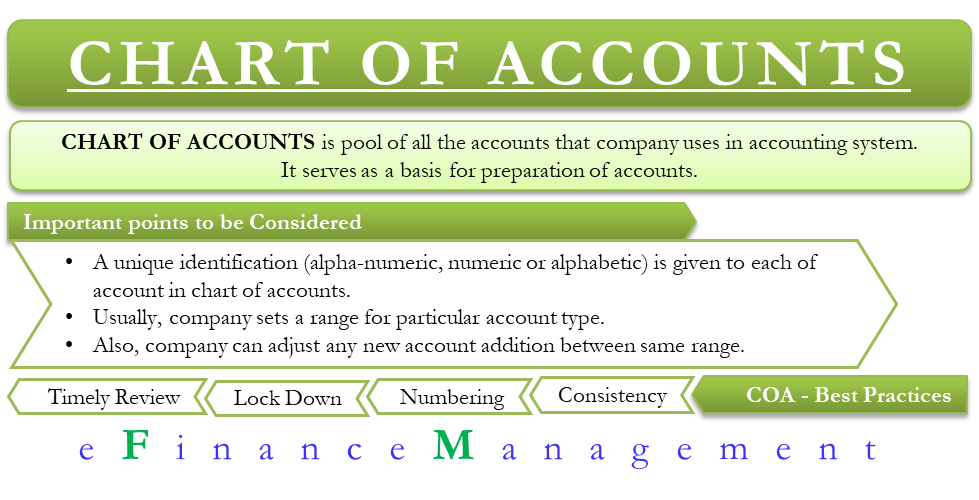

Chart Of Accounts Overview

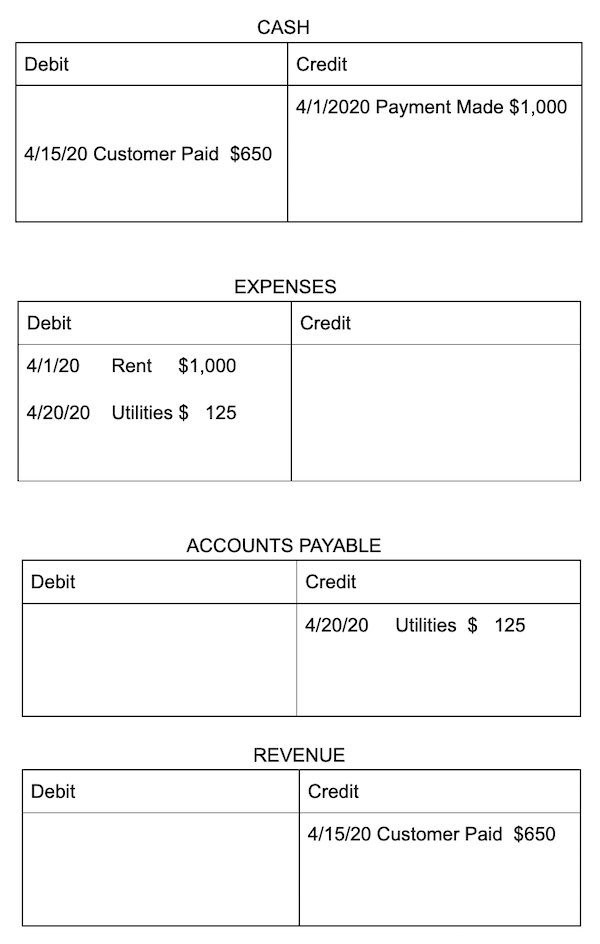

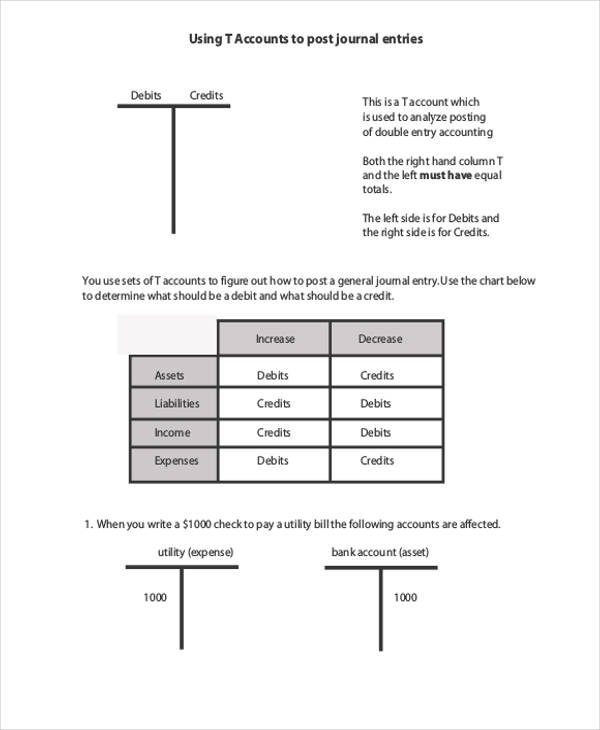

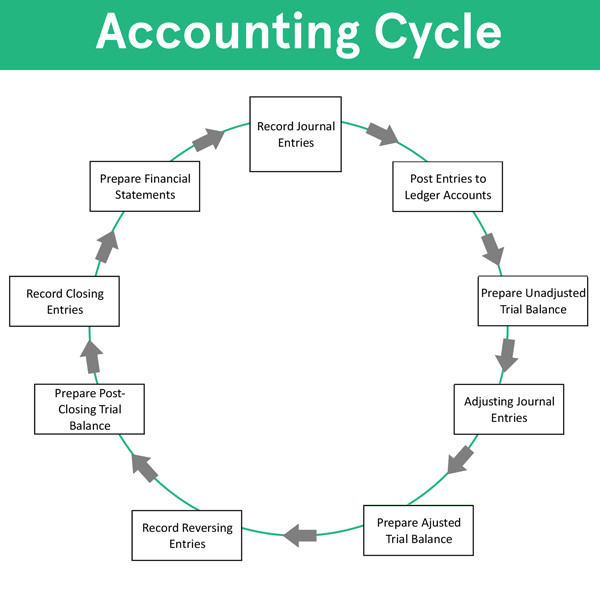

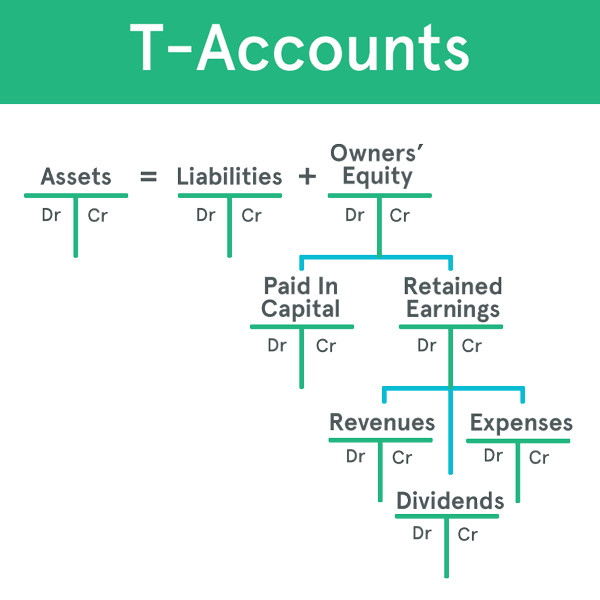

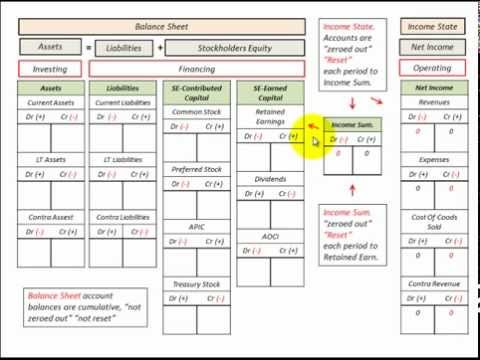

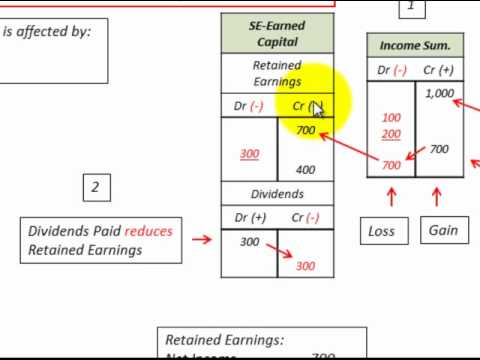

You use closing entries at the end of your accounting period to zero the balances of all revenue, expense, and draw or dividend accounts Your closing entries transfer the balances of those accounts to retained earnings or capital Using Taccounts can help you see a visual picture of your closing journal entries, which may help you avoid errors.

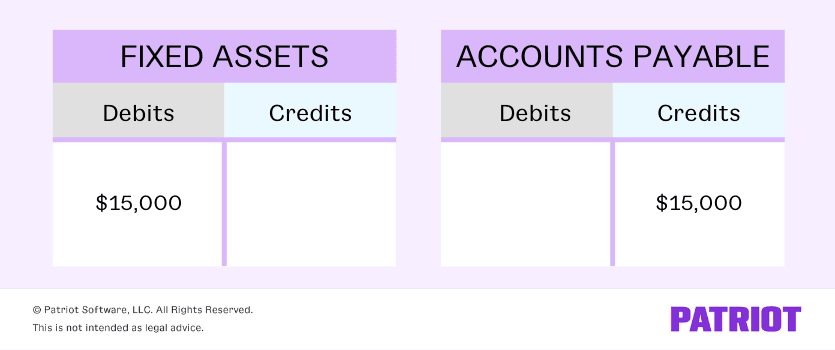

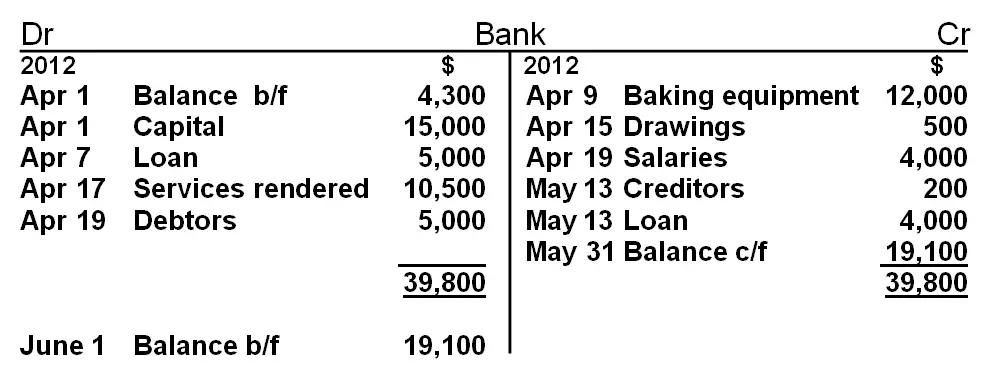

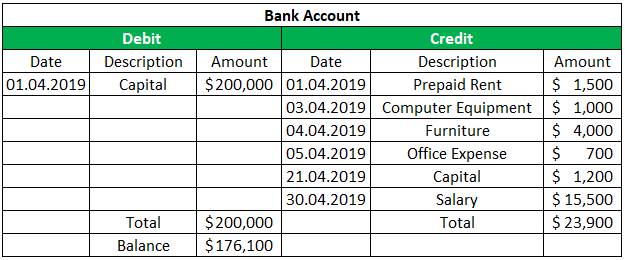

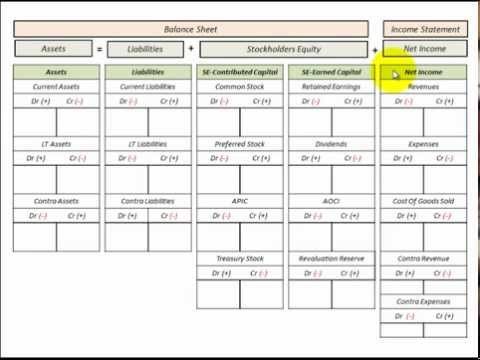

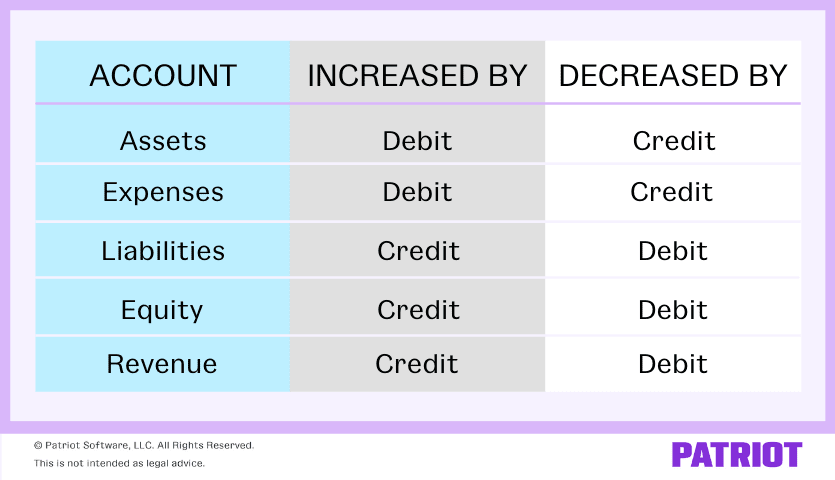

T chart accounting. Accounting TChart Accounting is a professional practice responsible for the financial oversight of account management, bookkeeping, budgeting, financial analysis, and tax reporting A student studying toward a degree in accounting, is later eligible to pursue a professional accreditation as a CPA (certified public accountant) after graduation. "Sal1" is the individual code for the account "salaries" and would also be referred to in the journal entries relating to salaries "J1" is the code for "journal page 1" The folio number or code thus helps with tracing information from the journal entry to the individual Taccounts, or from the ledger (Taccounts) back to the journal entries. Understanding debits and credits in accounting Business transactions take place regularly You must record business transactions in your small business accounting books You will record these transactions in two accounts a debit and credit account Debit vs credit Debits and credits are equal but opposite entries in your books.

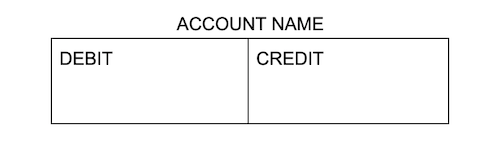

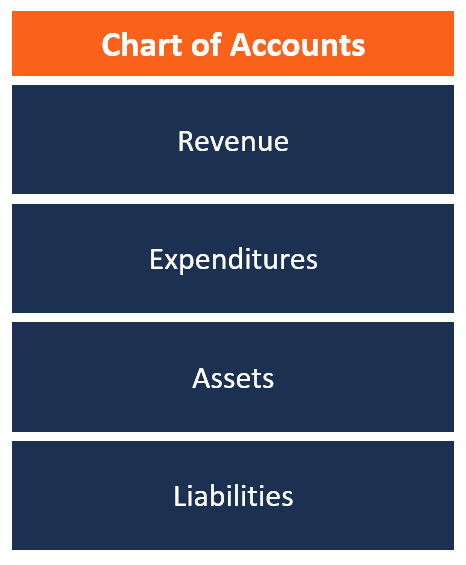

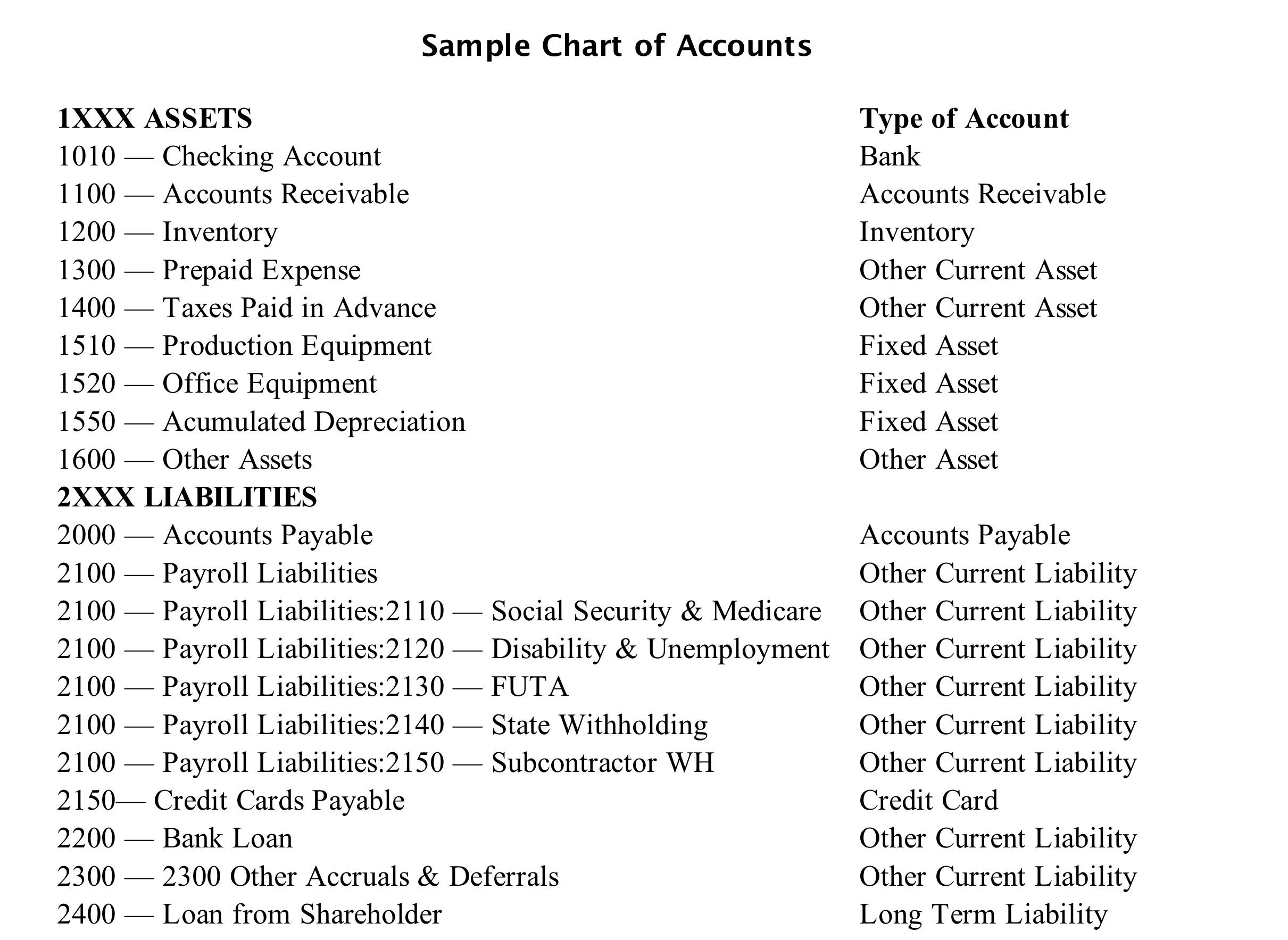

Thus, consuming supplies converts the supplies asset into an expense Despite the temptation to record supplies as an asset, it is generally much easier to record supplies as an expense as soon as they are purchased, in order to avoid tracking the amount and cost of supplies on handAlso, charging supplies to expense allows for the avoidance of the fees charged by external auditors who would. The chart of accounts is a list of all of your accounts in QuickBooks When you create your company file, QuickBooks automatically customizes your chart of accounts based on your industry You can add more accounts any time you need to track other types of transactions. It is called a Taccount because the bookkeeping entries are laid out in a way that resembles a T.

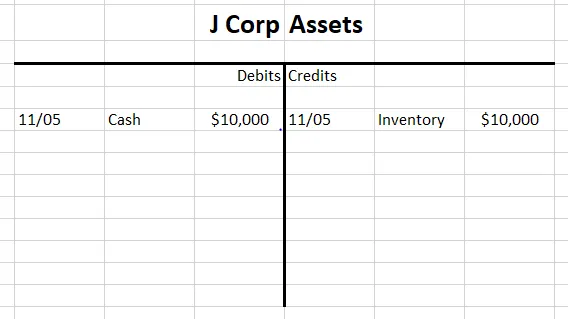

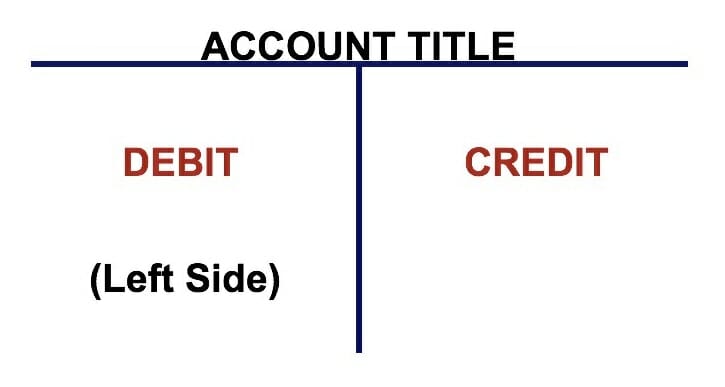

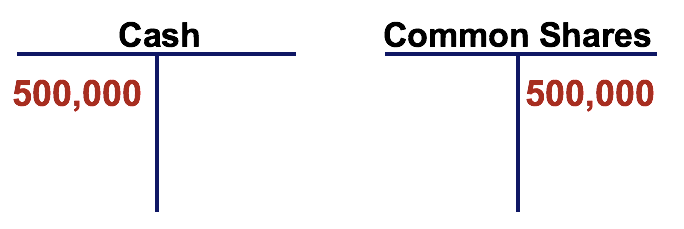

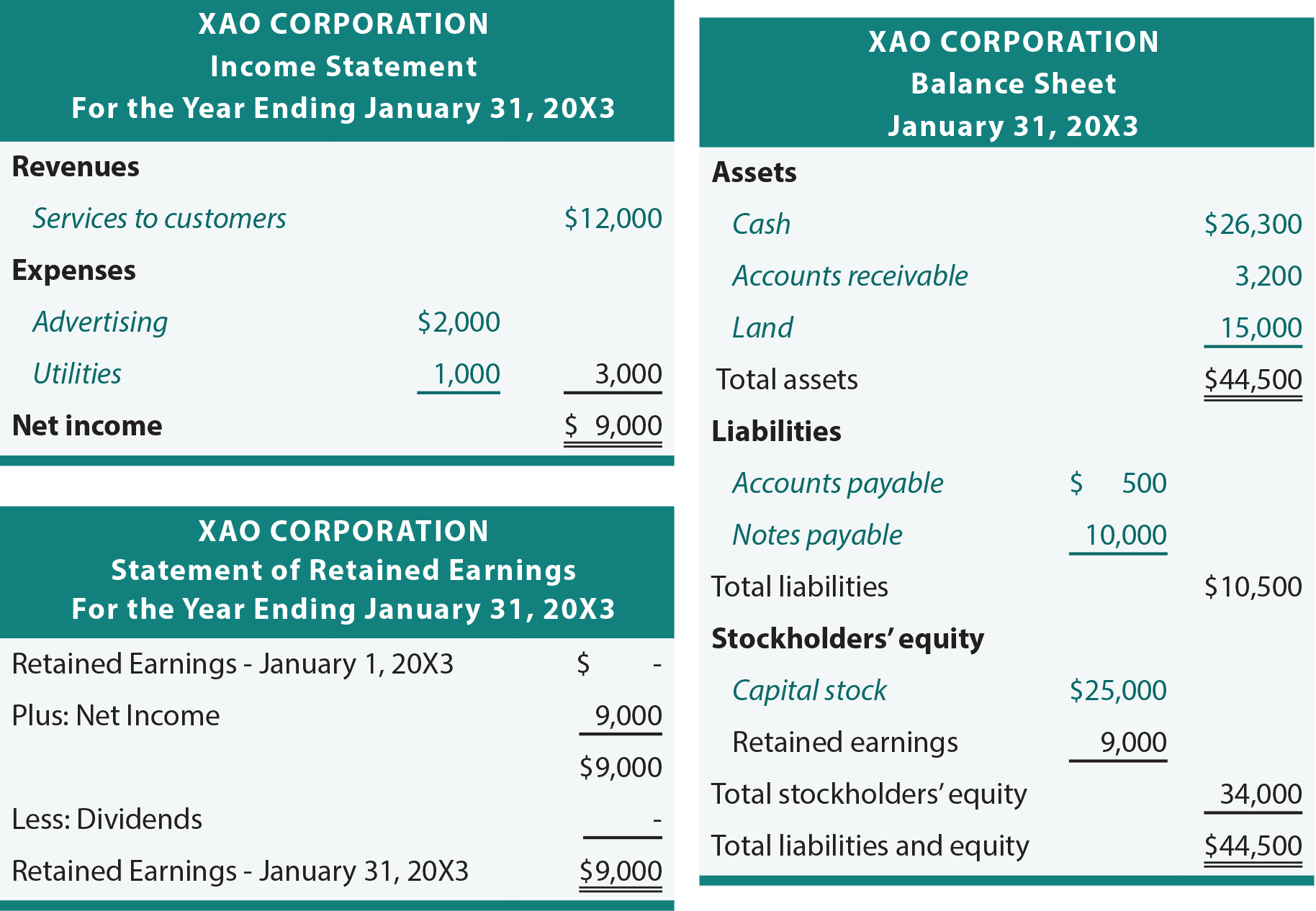

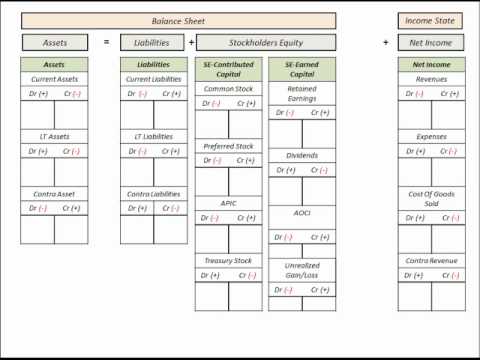

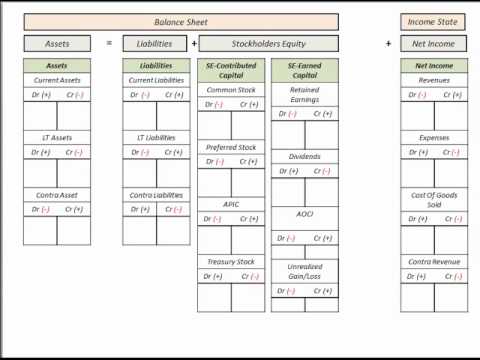

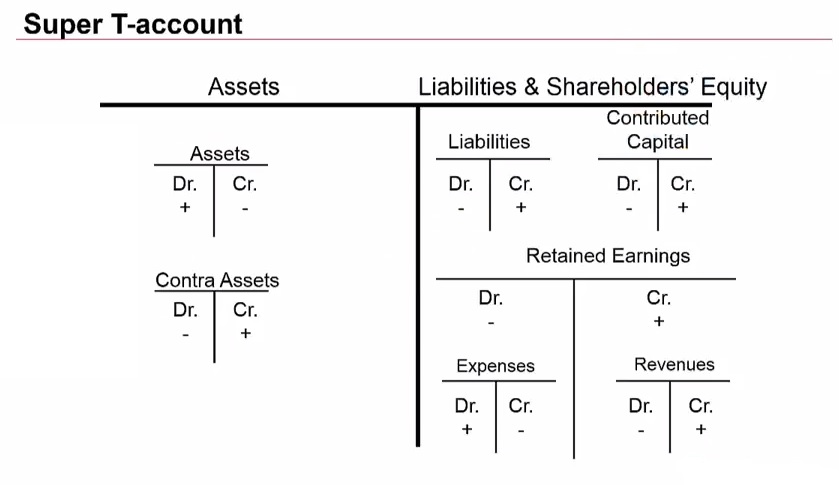

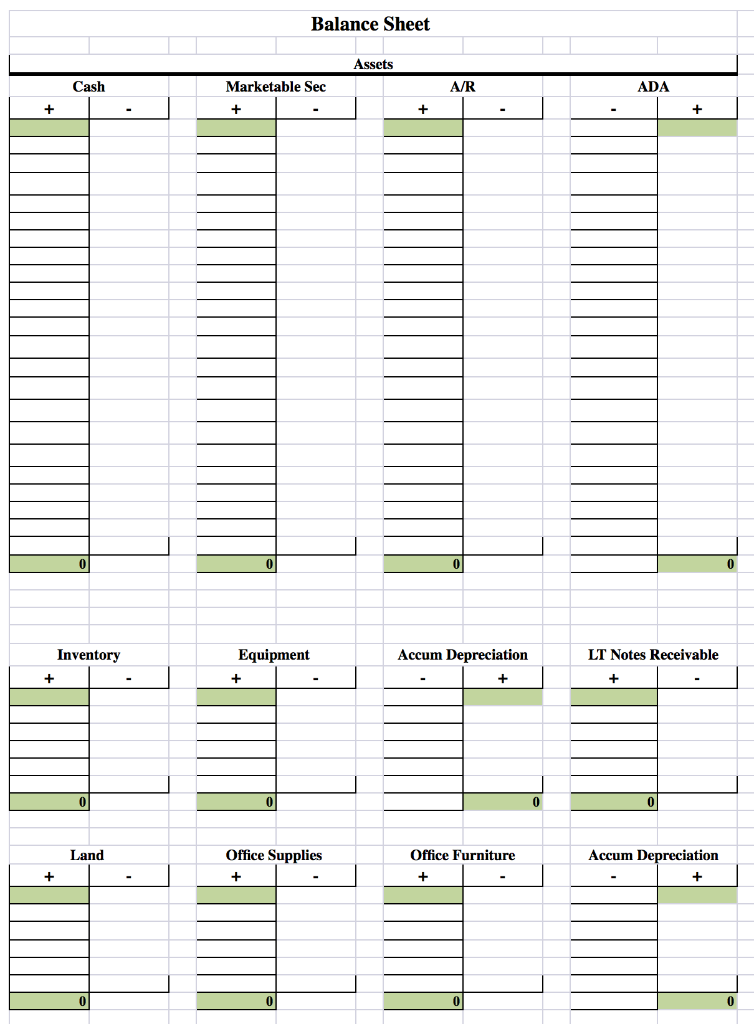

This free accounting course is an essential building block required for performing financial modeling and other types of wall street financial analysis Constructing an income statement and balance sheet In the first module of this free accounting course, we explore the layout of the balance sheet and income statement, how transactions are. A T Account is the visual structure used in double entry bookkeeping to keep debits and credits separated For example, on a Tchart, debits are listed to the left of the vertical line while credits are listed on the right side of the vertical line making the company’s general ledger easier to read Here’s What We’ll Cover. Dec , T Account — Accountingtools in T Chart Accounting Example T Chart Accounting Example World Of Printable And Chart with regard to T Chart Accounting Example Debtors And Creditors Control Accounts in T Chart Accounting Example T Chart Accounting Example Printables And Charts throughout T Chart Accounting Example T Chart Accounting Example Printables.

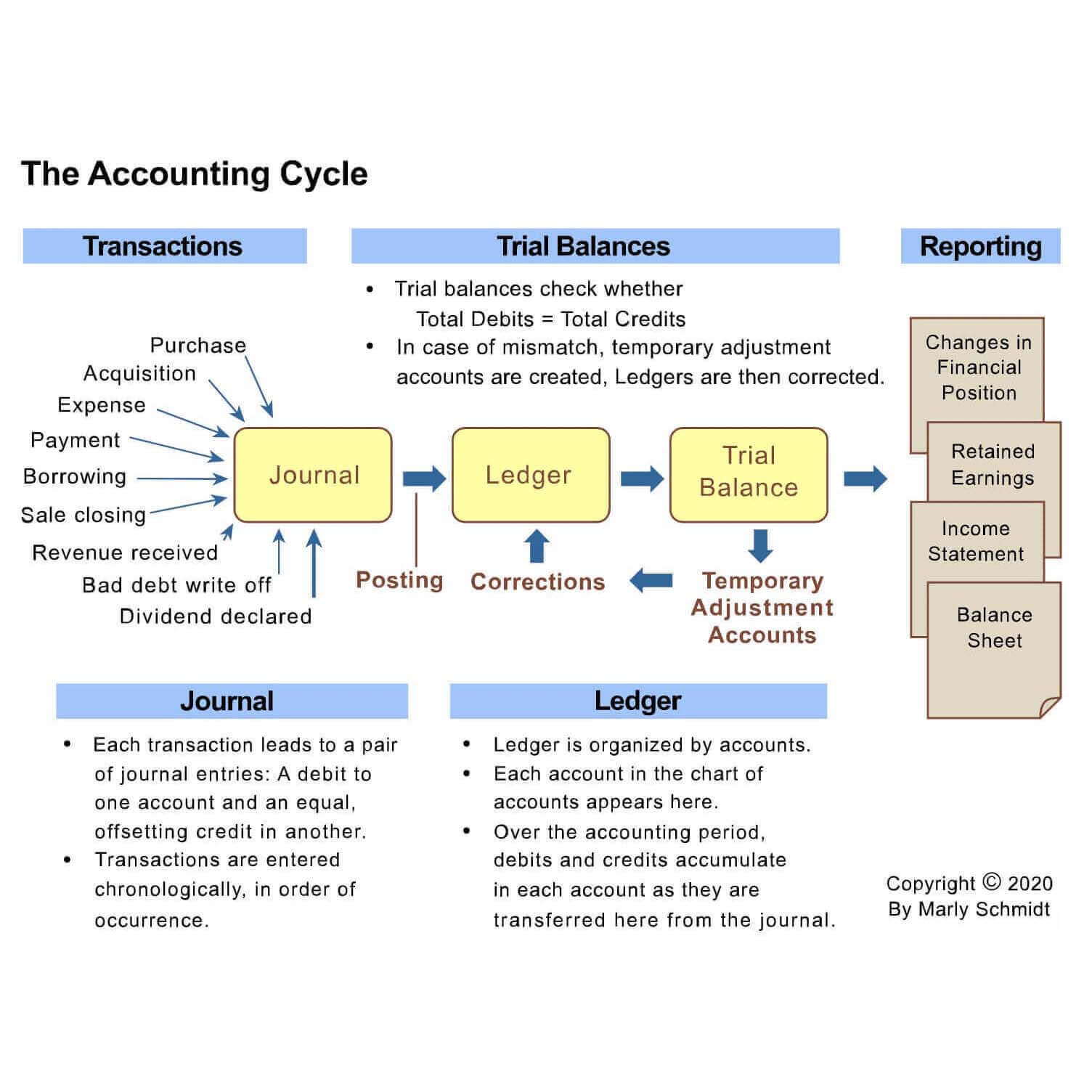

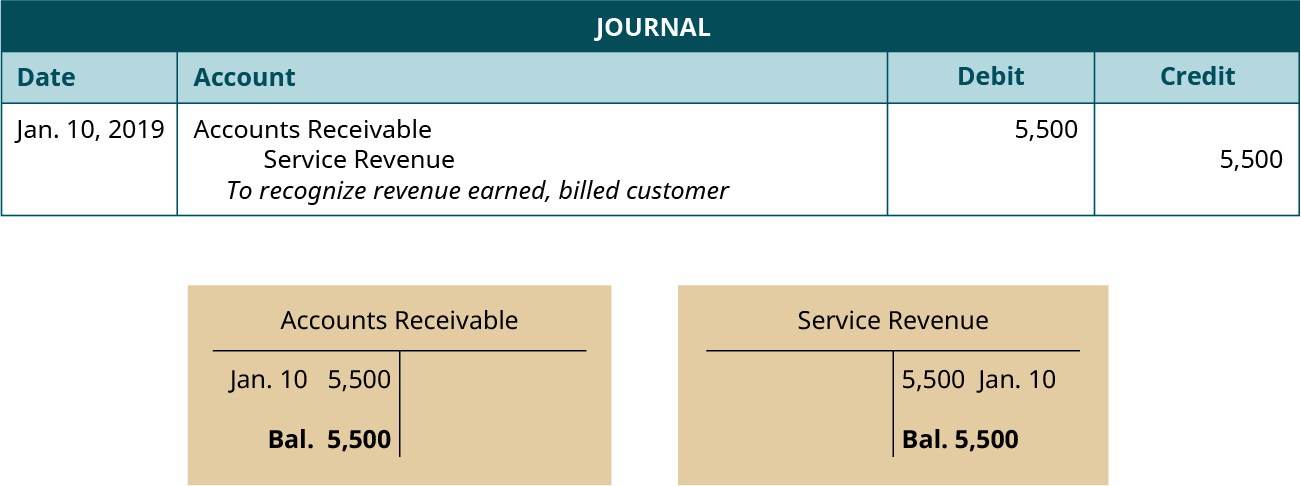

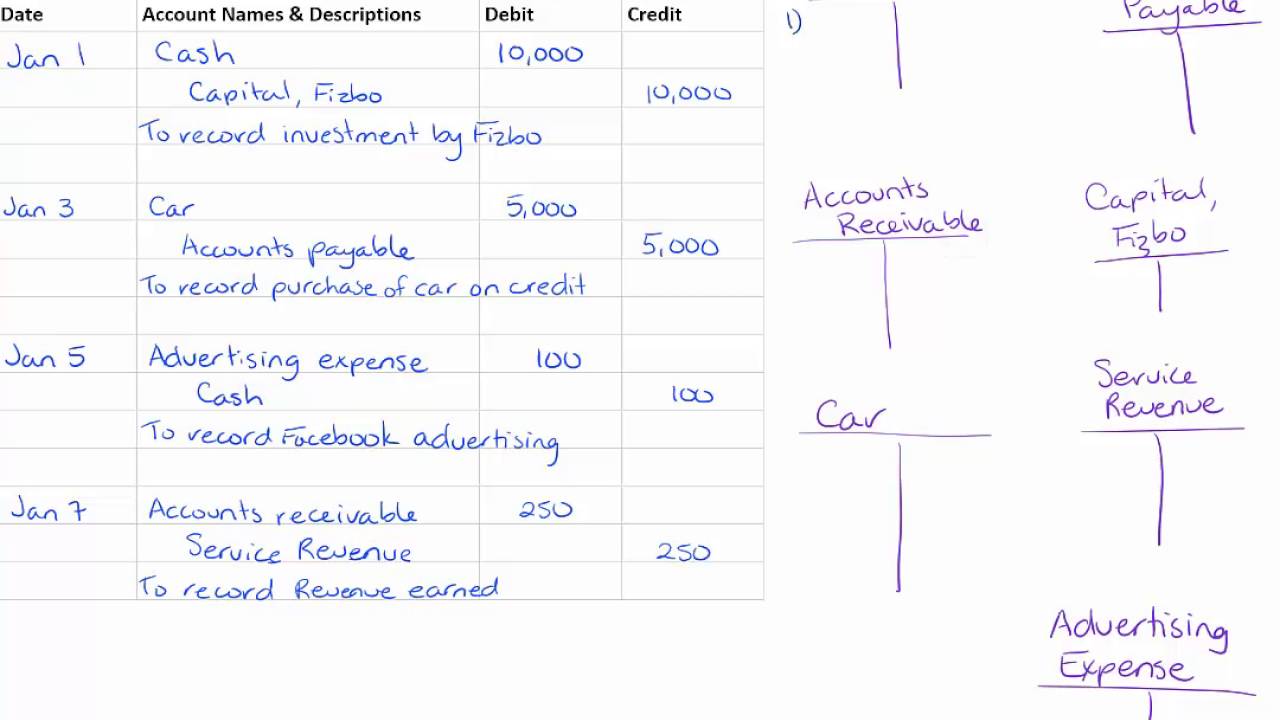

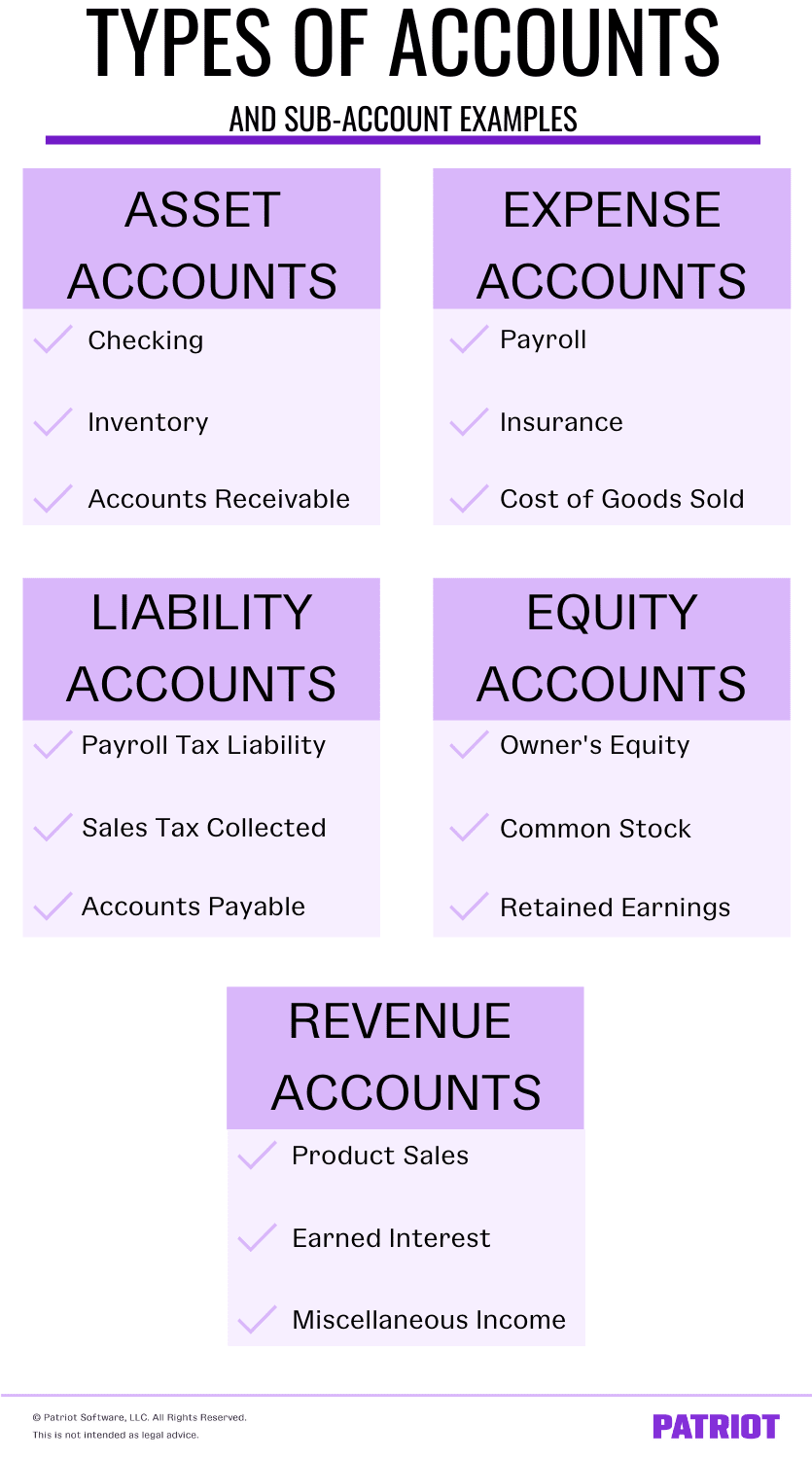

Journals Accountants use special forms called journals to keep track of their business transactions A journal is the first place information is entered into the accounting system A journal is often referred to as the book of original entry because it is the place the information originally enters into the system A journal keeps a historical account of all recordable transactions with which. A number of T accounts are typically clustered together to show all of the accounts affected by an accounting transaction The T account is a fundamental training tool in double entry accounting, showing how one side of an accounting transaction is reflected in another account It is also quite useful for clarifying the more complex transactions. Expense accounts The expense account is the last category in the chart of accounts It includes a list of all the accounts used to capture the money spent in generating revenues for the business The expenses can be tied back to specific products or revenuegenerating activities of the business.

Using TChart in accounting is preferring a lot because it is easy to track and represent visually – Cause & Effect and Compare & Contrast TChart These two types of TChart templates are too similar to each other The only difference is the examination of the title according to Compare and Contrast or Cause and Effect frame. A TAccount is a visual presentation of the journal entries recorded in a general ledger account This T format graphically depicts the debits on the left side of the T and the credits on the right side This system allows accountants and bookkeepers to easily track account balances and spot errors in journal entries. A number of T accounts are typically clustered together to show all of the accounts affected by an accounting transaction The T account is a fundamental training tool in double entry accounting, showing how one side of an accounting transaction is reflected in another account It is also quite useful for clarifying the more complex transactions.

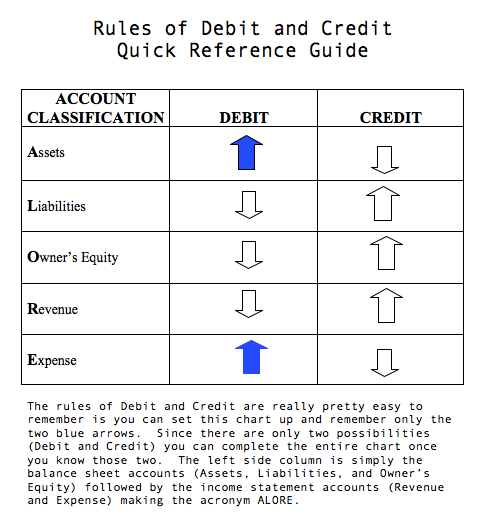

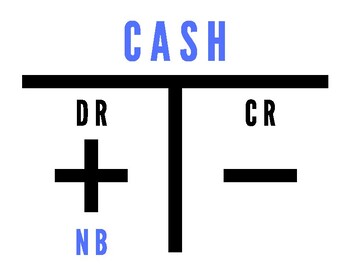

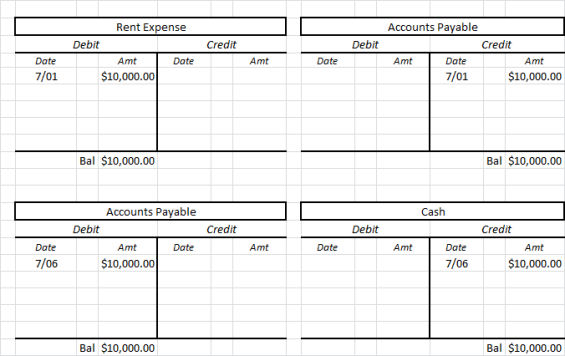

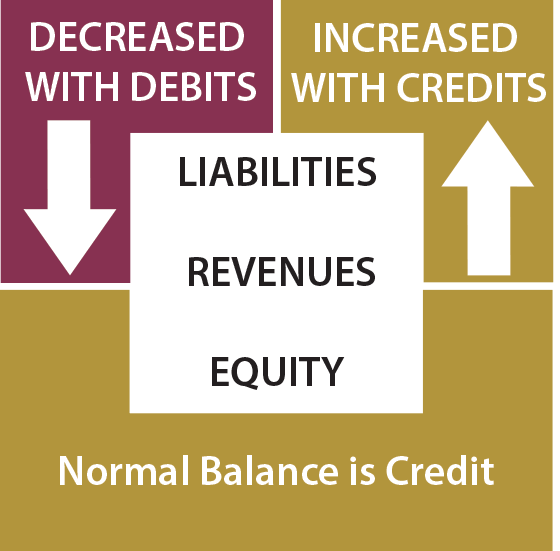

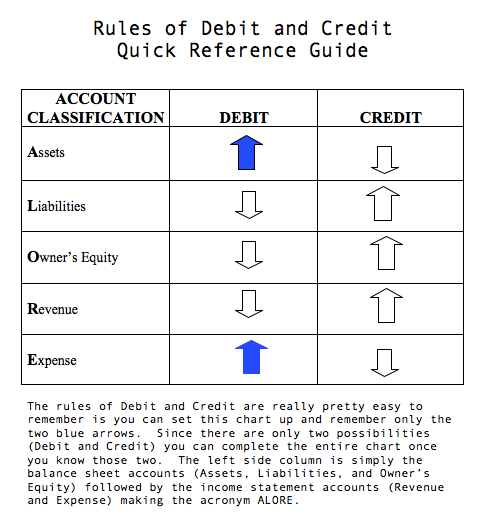

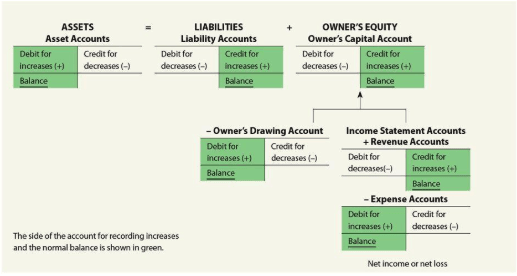

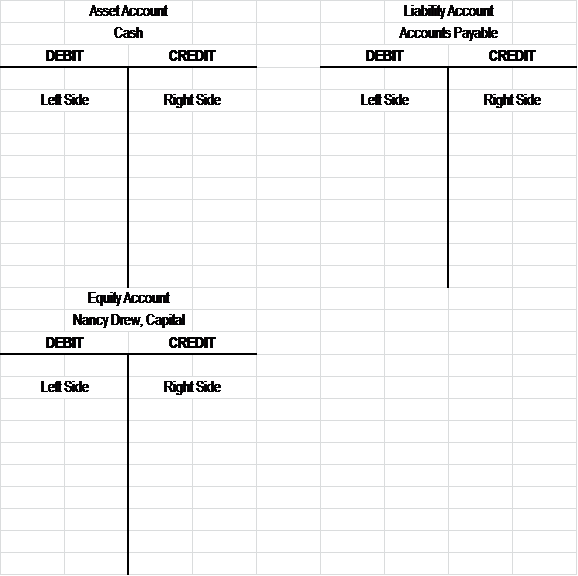

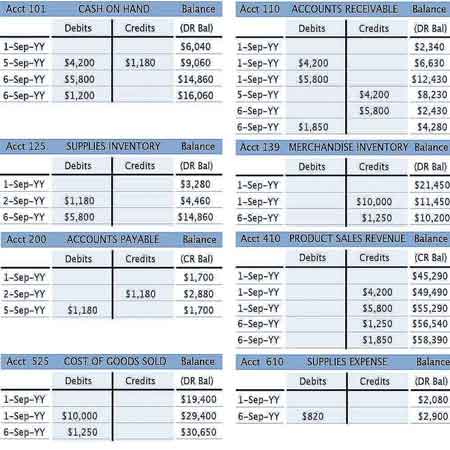

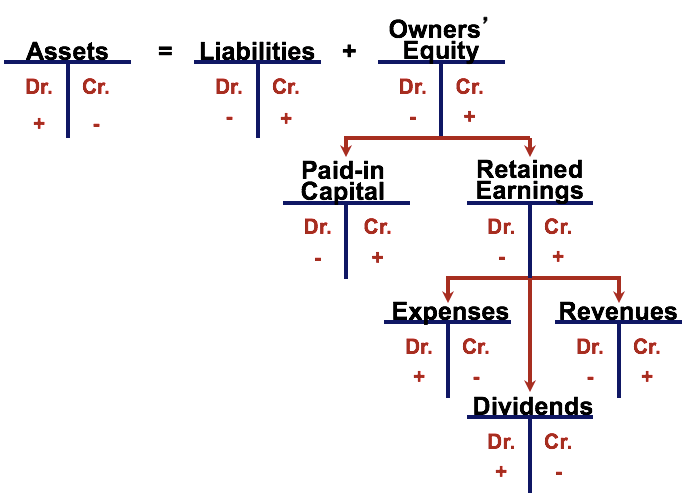

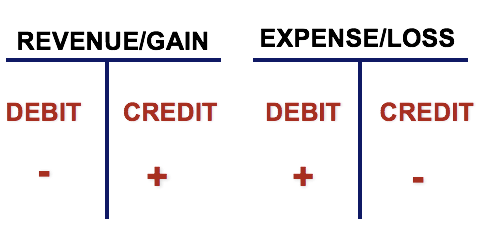

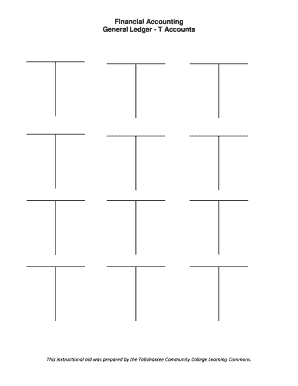

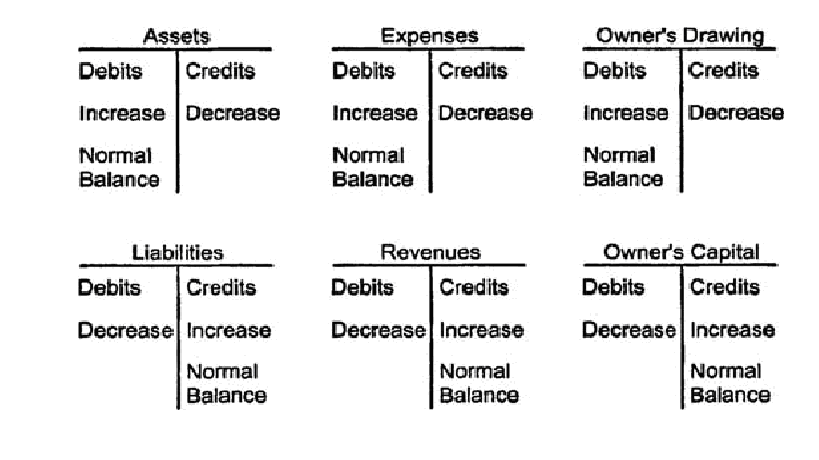

T Accounts The simplest account structure is shaped like the letter T The account title and account number appear above the T Debits (abbreviated Dr) always go on the left side of the T, and credits (abbreviated Cr) always go on the right Accountants record increases in asset, expense, and owner's drawing accounts on the debit side, and they record increases in liability, revenue, and owner's capital accounts on the credit side. A number of T accounts are typically clustered together to show all of the accounts affected by an accounting transaction The T account is a fundamental training tool in double entry accounting, showing how one side of an accounting transaction is reflected in another account It is also quite useful for clarifying the more complex transactions. Counts as either debit or credit in the fundamental accounting equation Record the account balances as of September 1 2 Record the September transactions in the T accounts Key each transaction to the letter that identifies the transaction 3 Foot the columns 4 Prepare a trial balance dated September 30 5.

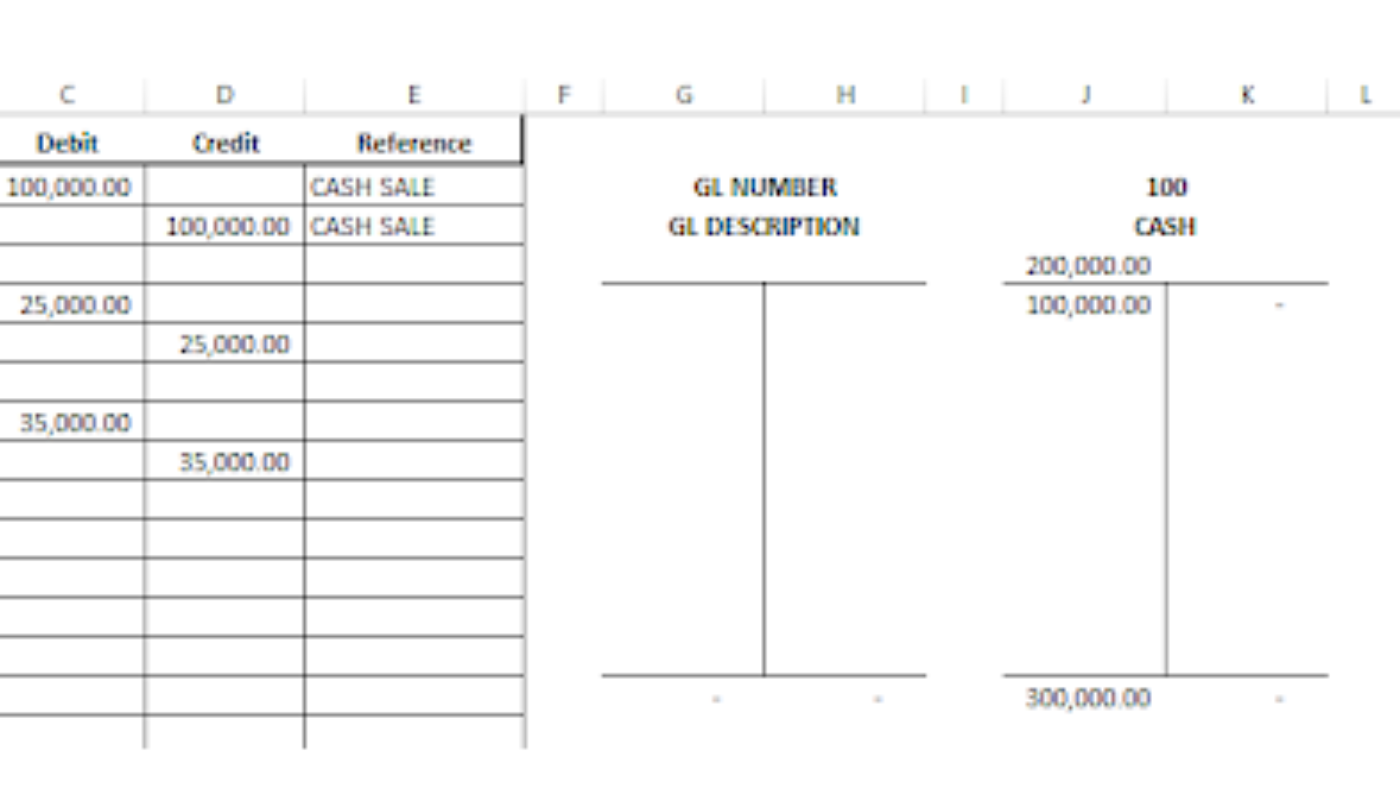

The TAccount Ledger Template for Excel helps you create an organized and professional looking taccount ledger whether for your business, organization, or personal use This template allows you to take on the second step of the accounting cycle without a lot of hassle or difficulty, after making your journal entries in the general journal This TAccount Ledger Template for Excel features. A Taccount is an informal term for a set of financial records that use doubleentry bookkeeping;. Step 2 – Closing of Expense Accounts Expenses account always have debit balances;.

Accounting software can help manage your chart of accounts As your business grows, so too will your need for accurate, fast, and legible reporting Your chart of accounts helps you understand the past and look toward the future A chart of accounts should keep your business accounting errorfree and straightforward. Taccounts would quickly become unwieldy in an enlarged business setting In essence, Taccounts are just a “scratch pad” for account analysis They are useful communication devices to discuss, illustrate, and think about the impact of transactions The physical shape of a Taccount is a “T,” and debits are on the left and credits on. Research Journal of Finance and Accounting "Luca Pacioli's DoubleEntry System of Accounting A Critique," Pages 132–133 Accessed March 23, MerriamWebster "Credit" Accessed March 23.

Chart of accounts sample Here’s a sample chart of accounts list This one is for a fictional business Doris Orthodontics As you can see on the right, there are different financial statements that each account corresponds to the balance sheet and the income statementHere’s what that means. TAccounts are a very simple way of recording and accumulating the effect of transactions in each one of the accounts So, we just take all the accounts that we have on the balance sheet and we present them in the sort of Tshape On one side of the vertical line, we are going to record increases in the account and on the other side, the. The chart of accounts tutorial and course defines, explains, and discusses what the chart of accounts is, how it's organized by major account types, balance sheet and income statement accounts, and its purpose In addition, codes are introduced and defined.

A Taccount is an informal term for a set of financial records that use doubleentry bookkeeping It is called a Taccount because the bookkeeping entries are laid out in a way that resembles a. Journals Accountants use special forms called journals to keep track of their business transactions A journal is the first place information is entered into the accounting system A journal is often referred to as the book of original entry because it is the place the information originally enters into the system A journal keeps a historical account of all recordable transactions with which. What is a TAccount?.

Journals Accountants use special forms called journals to keep track of their business transactions A journal is the first place information is entered into the accounting system A journal is often referred to as the book of original entry because it is the place the information originally enters into the system A journal keeps a historical account of all recordable transactions with which. All the main Taccounts in a business fall under the general ledger For example, land and buildings, equipment, machinery, vehicles, financial investments, bank accounts, inventory, owner's equity (capital), liabilities the Taccounts for all of these can be found in the general ledger Subsidiary Ledgers (or Sub Ledgers). If you want a career in accounting Accounting Public accounting firms consist of accountants whose job is serving business, individuals, governments & nonprofit by preparing financial statements, taxes, T Accounts may be your new best friend The T Account is a visual representation of individual accounts in the form of a “T,” making it so that all additions and subtractions (debits and credits) to the account can be easily tracked and represented visually.

Fast rating need to make a Tchart but I dont how to find the unknowns can you please help me with this?. Remember to put the title of your TChart at the top and, depending what you want to use it for, your name and other details, too Since Tcharts are primarily used to compare two concepts or objects, you should make sure to label the top of each column, too Working with text using Canva is super easy. Counts as either debit or credit in the fundamental accounting equation Record the account balances as of September 1 2 Record the September transactions in the T accounts Key each transaction to the letter that identifies the transaction 3 Foot the columns 4 Prepare a trial balance dated September 30 5.

A Tchart can be used for the following purposes It can create a record breakdown of an individual or a company’s expenses and assets It can be used to discuss to characteristics of a specific topic so that these characteristics can be provided with the It can create a list of a set of problems. The chart of accounts tutorial and course defines, explains, and discusses what the chart of accounts is, how it's organized by major account types, balance sheet and income statement accounts, and its purpose In addition, codes are introduced and defined. A T Chart can be easily designed using MS Word Here is how this can be done 1 Open a Word document 2 Select Insert and Click on the option Table 3 You will be presented with a drop down menu with options to choose a table size For T chart you usually need just 2 columns and a few rows So, select this accordingly and click 4.

As a business manager, taking care of your company’s accounting needs is top priority Correctly preparing a financial statement involves knowing all the information that needs to appear on the statement Making a profit keeps you in business, so follow the financial statements closely, make adjustments if needed, and follow some basic rules for presenting. Taccounts are a useful aid for processing doubleentry accounting transactions The Blueprint goes through what Taccounts are and how Taccounts are used. The TAccount Ledger Template for Excel helps you create an organized and professional looking taccount ledger whether for your business, organization, or personal use This template allows you to take on the second step of the accounting cycle without a lot of hassle or difficulty, after making your journal entries in the general journal This TAccount Ledger Template for Excel features.

At the end of the accounting period, all the expenses accounts will be closed by transferring the debit to income summary, and this will be done by crediting the expenses account and debiting the income summary account After passing this entry, all expense accounts balance will become zero. Chart of accounts sample Here’s a sample chart of accounts list This one is for a fictional business Doris Orthodontics As you can see on the right, there are different financial statements that each account corresponds to the balance sheet and the income statementHere’s what that means. Start studying Accounting "T" Chart Rules Learn vocabulary, terms, and more with flashcards, games, and other study tools.

Taccounts Accountants and bookkeepers often use Taccounts as a visual aid to see the effect of a transaction or journal entry on the two (or more) accounts involved (Learn more about accountants and bookkeepers in our Accounting Career Center) We will begin with two Taccounts Cash and Notes Payable. 6 Your T chart is ready If you use such charts on a daily basis, saving this as a Chart Templates will surely help you to save a lot of time What is Purpose of T Chart?. Thus, consuming supplies converts the supplies asset into an expense Despite the temptation to record supplies as an asset, it is generally much easier to record supplies as an expense as soon as they are purchased, in order to avoid tracking the amount and cost of supplies on handAlso, charging supplies to expense allows for the avoidance of the fees charged by external auditors who would.

T charts are comparison tables or graphical organizers that are used to compare and assess the two facets of any given topic Here are some of the main uses of a T chart 1. Accounts Payable is a liability account Liability accounts have credit balances and to decrease the balance you need to DEBIT the account (If you were to pay off a liability, you would have to credit Cash, so the entry to the liability account would have to be a debit). Remember to put the title of your TChart at the top and, depending what you want to use it for, your name and other details, too Since Tcharts are primarily used to compare two concepts or objects, you should make sure to label the top of each column, too Working with text using Canva is super easy.

Accounting TChart Accounting is a professional practice responsible for the financial oversight of account management, bookkeeping, budgeting, financial analysis, and tax reporting A student studying toward a degree in accounting, is later eligible to pursue a professional accreditation as a CPA (certified public accountant) after graduation. When doing it can you please use the account names that were already provided and not anything else for example beginning balance would be BB, direct materials would be DM, and so on or you can just write then full namesI will post the t account as a template of what it should look like.

Ledger General Ledger Role In Accounting Defined And Explained

T Accounts Comprehensive T Accounting Illustration Chart Of Account Control And Subsidiary Accounts Basics Of Accounting Information Processing

What Are T Accounts Definition And Example

Small Business Accounting Chart Of Accounts The Foundation Of Analytics Plotpath

Debits And Credits T Accounts Journal Entries Accountingcoach

A Guide To T Accounts Small Business Accounting The Blueprint

Solved Prepare An Organization Chart Highlighting The Ac Chegg Com

Normal Balance Of Accounts Double Entry Bookkeeping

In Accounting What Is A T Chart Quora

Adjusting Entries For Asset Accounts Accountingcoach

Odoo 13 Master Doesn T Have Option To Import Upload Chart Of Accounts Issue 513 Odoo Odoo Github

Accounting T Chart Cheat Sheets By Haley Slade S Designs Tpt

Accounting T Chart Template Excel Bamba

Trial Balance Example Format How To Prepare Template Definition

Optimizing Cross Validation Rules In General Ledger Eprentise

T Account Definition Accountingtools

T Accounts

Debits And Credits T Accounts Journal Entries Accountingcoach

Accounting Debit And Credit Rules Chart Accounting Accounting Classes Accounting Education

T Accounts Daily Dose Of Excel

Accounts Debits And Credits Principlesofaccounting Com

T Accounts A Guide To Understanding T Accounts With Examples

/Accounting-journal-entry-guide-392995--color-V3-89d63d65bfc9422a8b587002d412d4a2.png)

How To Create An Accounting Journal Entry

Oracle Subledger Accounting Implementation Guide

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

General Rules For Debits And Credits Financial Accounting

T Chart Templates 6 Free Word Excel Pdf Format Download Free Premium Templates

Normal Balance Of Accounts Bookstime

T Accounts Youtube

T Accounts An Efficient Tool For Using Double Entry Accounting Is A T Account Course Hero

T Accounts

Accounting Cycle Steps Flow Chart Example How To Use Explanation

Debits And Credits Accounting Libguides At Kendall College

A Guide To T Accounts Small Business Accounting The Blueprint

Types Of Accounts In Accounting Assets Expenses Liabilities More

Lesson 2 The Keep It Simple Bookkeeping Crash Course Debits And Credits Thebookkeepersclub

Blank T Accounts Template Cprc

T Accounts A Guide To Understanding T Accounts With Examples

Ledger General Ledger Role In Accounting Defined And Explained

T Accounts Template Double Entry Bookkeeping

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)

T Account Definition

3 The Account Learning Objectives Ppt Download

T Accounts A Guide To Understanding T Accounts With Examples

T Accounts With T Chart Accounting Example Accounting Basics Accounting Accounting Cycle

Debits And Credits Normal Balances Permanent Temporary Accounts Accountingcoach

The Trial Balance Principlesofaccounting Com

Accounting Basics Debits And Credits

Pin By Jolynda Schultz On Studying Accounting Accounting Career Accounting And Finance

T Accounts Debits And Credits On Balance Sheet And Income Statement Youtube

Balancing T Accounts

Chart Of Accounts Definition How To Set Up Categories

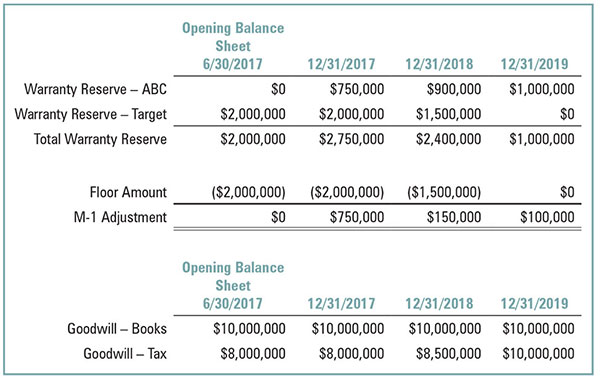

Don T Be Floored By Purchase Accounting Struggles

Chart Of Accounts Example

Income Statement Balance Sheet Template T Accounts Accounting List For I S Youtube

T Account Examples Step By Step Guide To T Accounts With Examples

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

T Chart Excel Template Creating Printable T Chart In Excel

General Ledger Accounting Software Hotels And Resorts Resort Data Processing

T Chart Accounting Example Printables And Charts Within T Chart Accounting Example Accounting And Finance Accounting Online Accounting

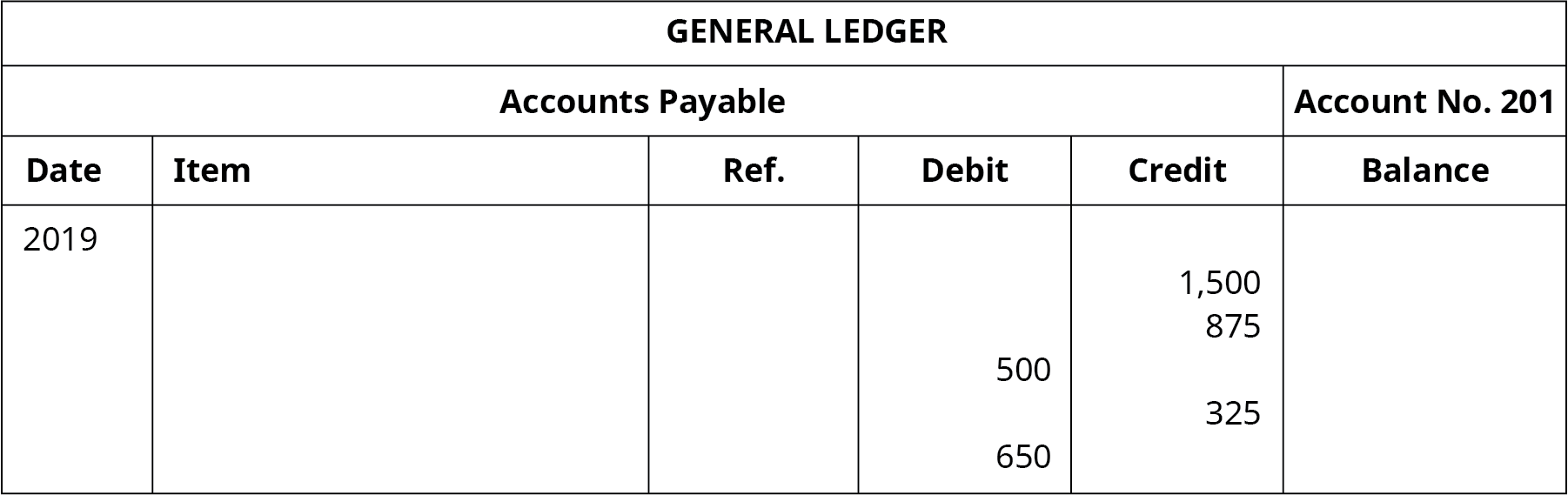

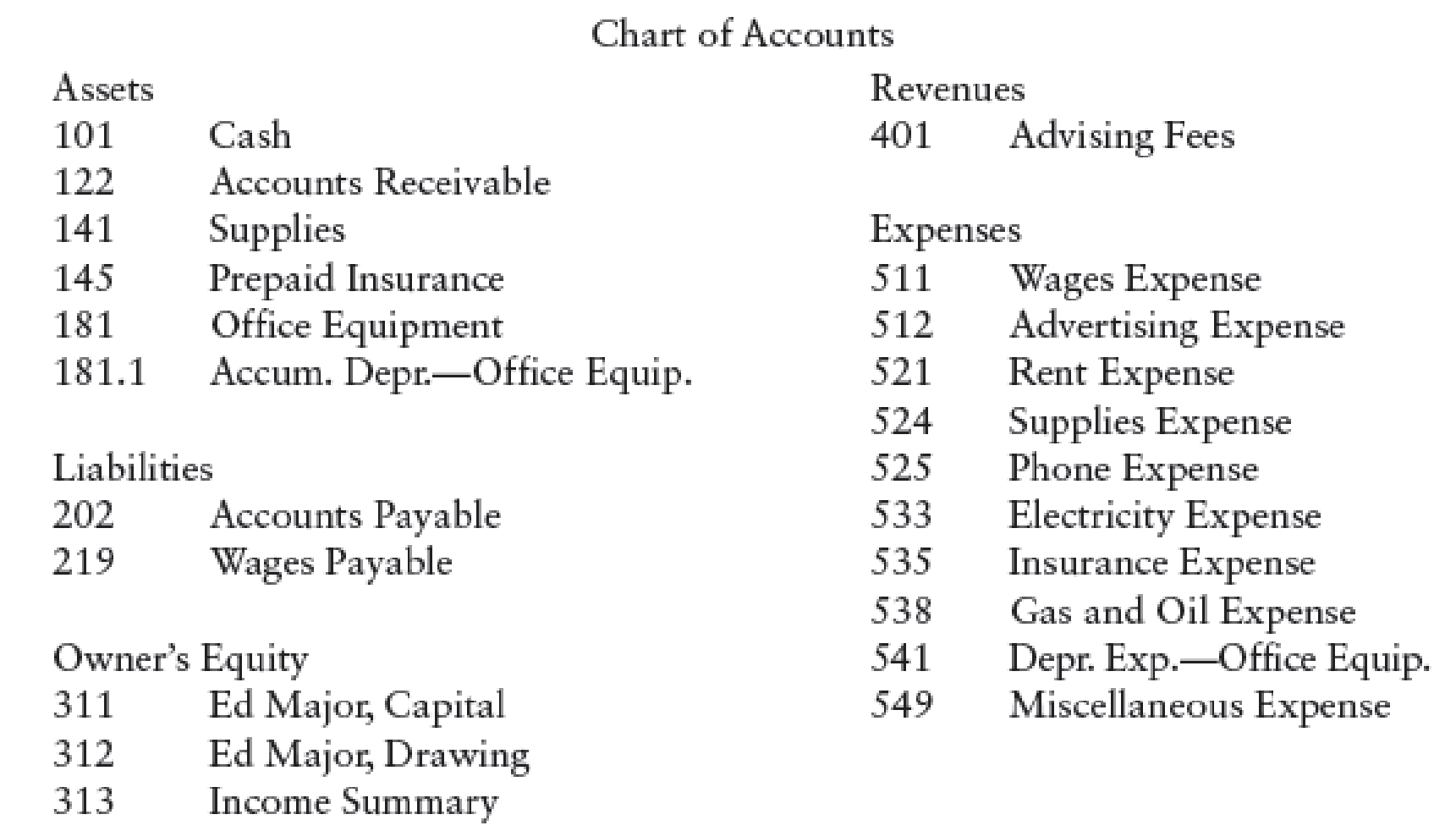

Closing Entries Net Income Set Up T Accounts For Major Advising Based On The Work Sheet In Exercise 6 1a And The Chart Of Accounts Provided Below Enter The Existing Balance For Each

T Accounts A Guide To Understanding T Accounts With Examples

Accounting T Chart Template Bamba

T Accounts A Guide To Understanding T Accounts With Examples

T Charts Accounting Worksheet Printable Worksheets And Activities For Teachers Parents Tutors And Homeschool Families

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

T Accounts A Guide To Understanding T Accounts With Examples

T Account Generator Fill Online Printable Fillable Blank Pdffiller

Why Financial Statements Don T Work For Highly Innovative Companies Knowledge Leaders Capital

Journal Entries Examples Format How To Use Explanation

Balance Sheet Income Statement Template T Accounts Accounting Explained Youtube

Credit Debits And Credits Explanation Accounting Education Accounting Classes Accounting Basics

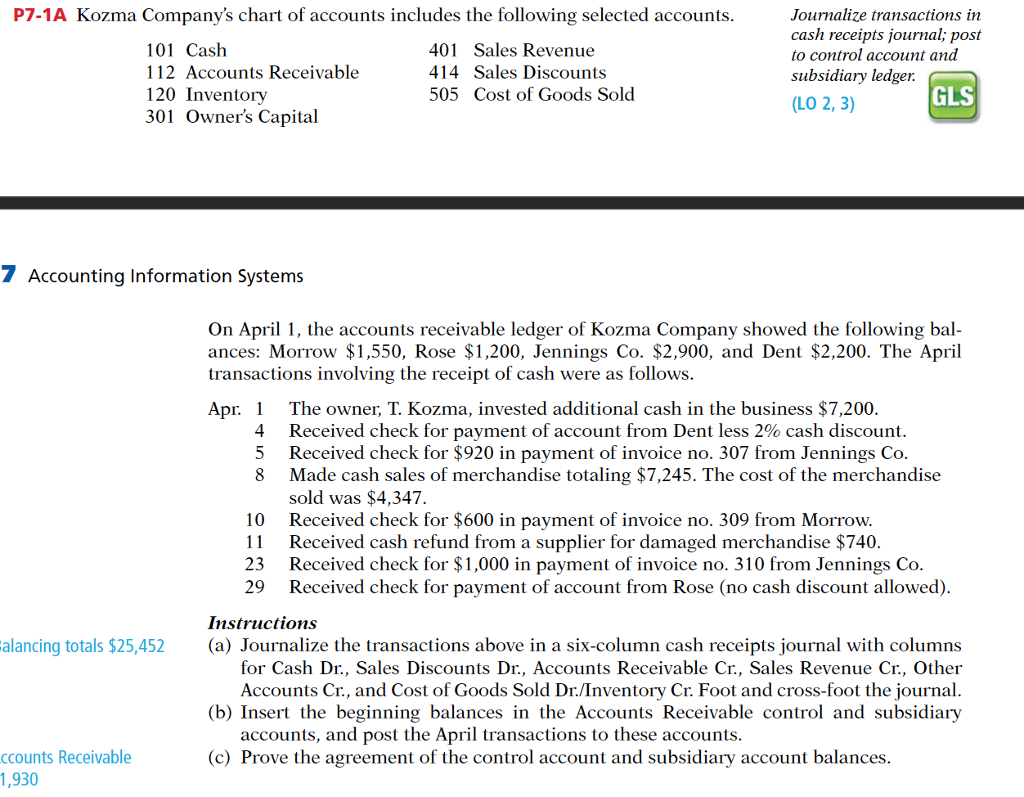

Solved P7 1a Kozma Company S Chart Of Accounts Includes T Chegg Com

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Basics Of Accounting Chart Of Accounts General Journal General Led Chart Of Accounts Accounting General Ledger

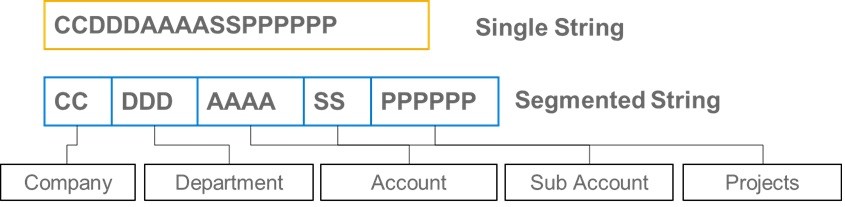

The Accounting Code Block In Sap Business Bydesign Erp Logic Your Global Partner For Sap Cloud Solutions

T Chart Accounting Example Camba

Accounting Manual T Count And Double Entry Accounting

Balance Sheet Template T Accounts With Chart Of Accounts Listing For Accounting Youtube

Purchase Office Supplies On Account Double Entry Bookkeeping

Chart Of Accounts Explanation Accountingcoach

Accounting Basics Debits And Credits

/chartofaccountswebbased-56a03ef33df78cafdaa0a80a.jpg)

Sample Chart Of Accounts For A Web Based Craft Business

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)

T Account Definition

Super T Account Basics Of Accounting

Ledger General Ledger Role In Accounting Defined And Explained Throughout T Chart Accounting Example Accounting General Ledger Budgeting

Retained Earnings Accounting Affected By Net Income Dividends Paid B S I S Accounts Youtube

T Accounts And Ledgers

:max_bytes(150000):strip_icc()/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)

T Account Definition

How The Chart Of Accounts Can Help You And Why You Should Care By Lianabel Oliver Medium

Overview To Manufacturing Accounting

Solved Create A Chart Of T Accounts And Post Each Journal Chegg Com

T Chart Accounting Example Printables And Charts Throughout T Chart Accounting Example Accounting Basics Accounting Accounting Career

Solved Make A T Chart T Account With The Information Bel Chegg Com

Bladerunners T Accounts Template Gb 112 Balderunners Using T Accounts Assets Cash Office Supplies Liabilities Accounts Payable Stockholders Equity Course Hero