Bbt Checking Account For Minors

Insuring Your Improvements Education Center T Bank

T Bank Review Account Pros And Cons

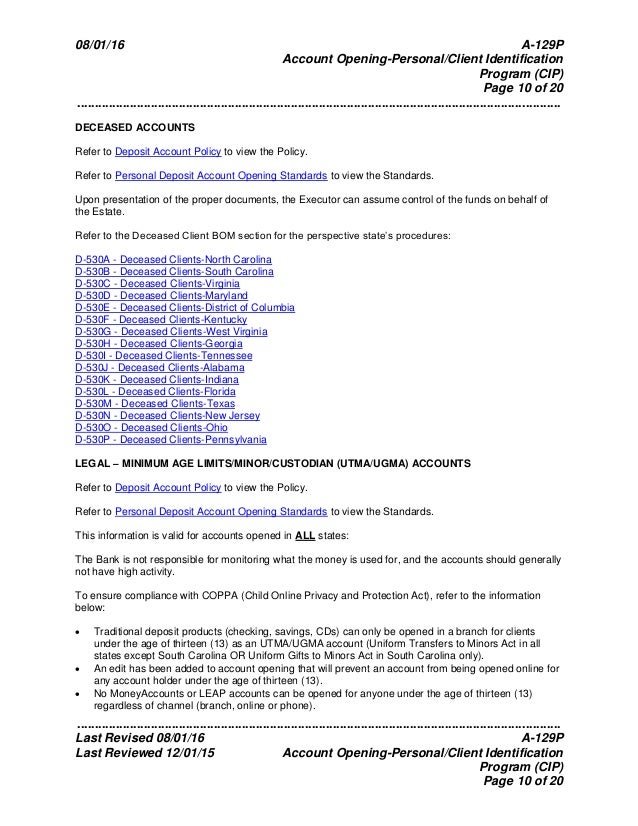

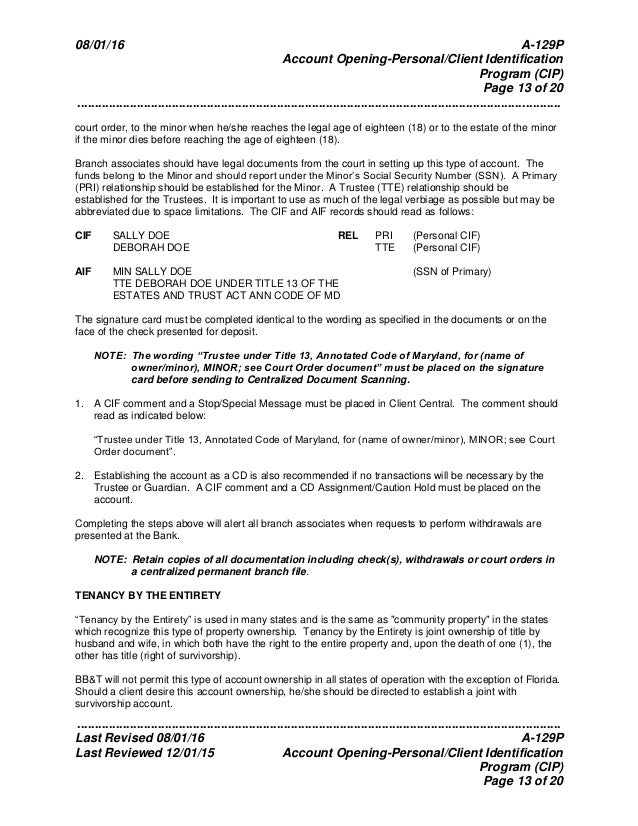

Account Opening Personal Or Client Identification Bom A129p

Prepaid Debit Card For Teens From T Bank S Leap Account Youtube

Where Can I Cash A Third Party Check 18 Options Detailed First Quarter Finance

Account Opening Personal Or Client Identification Bom A129p

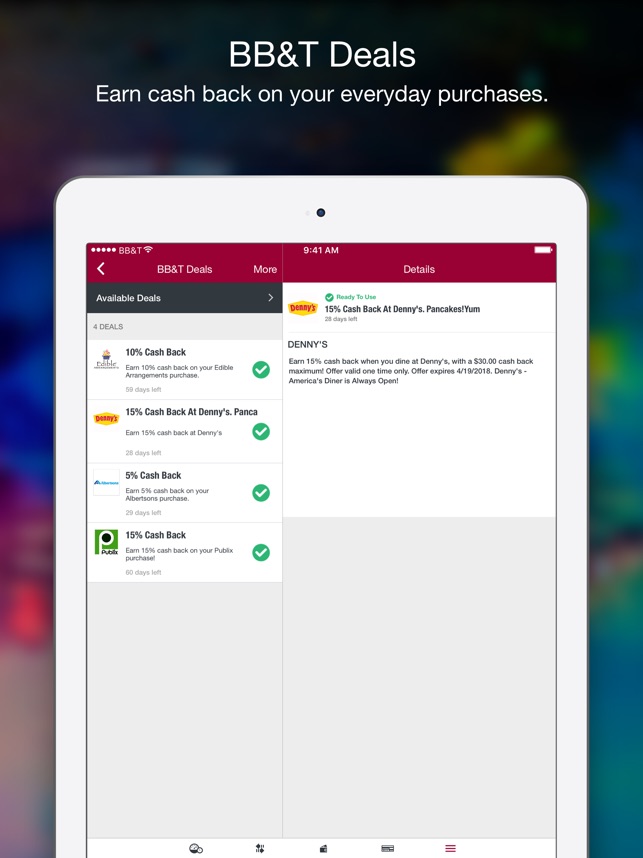

BB&T Personal Credit, Personal and Business Debit, and MoneyAccount cards are eligible for BB&T Deals Credit cards are subject to credit approval There is no monthly fee and no charge for enrolling in BB&T Deals For complete details, refer to BB&T Deals Terms and Conditions 5 Fees from your mobile or data carrier may apply 6.

Bbt checking account for minors. The BB&T Young Savers savings account is available to clients under the age of 18 With no service charges, no annual fees, and no minimum balance requirements, it’s a great opportunity for young people to learn the value of saving early. While a minor can’t open a checking or savings account, they can get an account with a parent or legal guardian as joint owner of the account The account is technically the child’s. Secure Log On Ensuring the security of your personal information online is a top priority for us We encrypt both your User ID and Password using Secure Sockets Layer (SSL) technology the highest level of protection available online.

Truist Checking Account Fees Like most other banks, Truist offers multiple checking account options Other than the Student Checking designed for college students, all of these checking accounts include Truist Checking Account fees of some type The only account that does not allow for fee avoidance is the BB&T Fundamentals Account. Essential Checking MENU Fee Schedule. Valid until December 31, , for new BB&T Bright Banking ® accounts Must open online at BBTcom or in the U by BB&T app Payout limited to one per household Not available if the household closed a BB&T personal checking account in the last 12 months or has an active account.

The account does have a $10 monthly fee, but you can waive it with $500 in deposits (in a BB&T account) or a $1,000 minimum balance in your checking account BB&T Fundamentals If you don't like worrying about minimum balance requirements, the BB&T Fundamentals account may be for you You'll pay a $5 monthly fee and you won't earn interest. Checking, savings, investments, mortgage, loans, insurance BB&T offers banking services to help you reach your financial goals and plan for a sound financial future BB&T All We See Is You. Instead, your child will maintain both accounts All checking account holders also get a free debit card that they can use to access funds in both accounts.

Account alerts by text or email;. Upon 24th birthday or upon reaching the graduation date provided to the Bank, whichever occurs later, the account will be converted to Bright Banking or Fundamentals Checking;. Switching to BB&T may be worth it if you’re interested in a cashback rewards credit card You don’t need BB&T coupons to earn the bonuses, and having the option to redeem rewards for cash puts free money in your pocket However, if you’re looking for a checking or savings account with bonus money, check back for updates and new BB&T offers.

This is BB&T’s checking account specially designed for students aged 23 and younger Upon their 24th birthday or college graduation (whichever occurs later), the account converts to a BB&T Fundamentals account. The BBVA Free Checking account is a great choice for a starter account Checking Requirements Minimum opening deposit of $25;. The eSavings account is BB&T’s most popular, because while it does not earn much interest, it is a safe place to park your money The bank offers a Young Savers account for children under the age of 18 that also has no minimum balance or fees associated with it.

Free linked savings account;. No BB&T fees for 2 nonBB&T ATM transactions per statement cycle;. Truist Checking Account Fees Like most other banks, Truist offers multiple checking account options Other than the Student Checking designed for college students, all of these checking accounts include Truist Checking Account fees of some type The only account that does not allow for fee avoidance is the BB&T Fundamentals Account.

You don’t actually have to live near a bank branch – you can open the account online Teens can’t apply on their own;. You must accept the user agreement to use mobile check deposit Effective August 12, 18 BB&T Mobile Check Deposit User Agreement This Mobile Check Deposit User Agreement ("Agreement") contains the terms and conditions for the use of BB&T Mobile Check Deposit and/or other remote deposit capture services that BB&T or its affiliates ("BB&T", "us," or "we") may provide to you ("you," or "User"). BB&T Checking Account BB&T Student Checking Account Overdraft Protection available;.

Regular savings account with no maintenance fee;. Cashing a check usually is fairly straightforward You take the check to your bank or the bank from which the check was written, show your picture ID and they give you the money For someone under 18, however, it can be a bit trickier Many under 18 don't have their own bank and bank account Others don't have a picture ID Often, it's necessary to get a guardian or parent's help to cash. BB&T Fundamentals With a $5 monthly fee, no minimum balance requirements, and no direct deposit requirements, this BB&T account is perfect for those wanting a simple, affordable checking option BB&T Bright Banking Customers can easily avoid the $12 monthly maintenance fee with direct deposits of at least $500 or a $1,500 average balance.

For people under the age of 18, opening a bank account is hard The problem is that you need to sign a contract to open an account, and contracts signed by minors are complicated State laws and corporate policies vary, but most banks aren’t going to open accounts for anybody under 18 unless there’s also an adult on the account 1 . Account Overview Common fees for checking accounts (PDF) EZChoice Get the essentials for no monthly maintenance fee 3 Open Account > MyWay Banking A checkless account without the worry of overdraft fees 4 Open Account > MyChoice Plus Enjoy ATM surcharge rebates and earn interest Open Account > MyChoice Premium Exclusive rates on deposits, loans, and more. The minimum opening deposit is $50, and you can connect this account to a savings account for overdraft protection Students under age 23 can opt for BB&T’s Student Checking Account, which has no monthly fees, no minimum opening deposit, no minimum account balance or direct deposit requirements.

Teens from the ages of 13–17 can open a teen checking account as long as a parent cosigns the account This account comes with a Visa debit card, and the parent can set daily limits on withdrawals and spending This account comes with online access, free online statements, and no monthly service charge on the account . Secure Log On Ensuring the security of your personal information online is a top priority for us We encrypt both your User ID and Password using Secure Sockets Layer (SSL) technology the highest level of protection available online. In the effort of continuing to educate our youth on financial responsibility, State Employees' Credit Union offers members ages 1319 the opportunity to participate in our Zard program for teens Focused on helping teens develop solid money management skills, the Zard program offers teens a variety of products and services tailored to meet their needs.

HighPerformance Money Market Account Enjoy tiered money market rate savings to complement your BB&T checking account $1,000 minimum balance to avoid the monthly maintenance fee Young Savers Helps children under the age of 18 learn how to save. Checking accounts provide easy access to your money Once you have a checking account, you can pay bills, transfer money, use an ATM and make purchases with a debit card We offer a variety of checking accounts with options such as online and mobile banking to make it easy to bank when and where you want. The adult and child account holders must both be present at account opening.

Young Savers This BB&T account for children under the age of 18 teaches the importance of saving and budgeting and has zero maintenance fees Health Savings Account (HSA) An easy, taxefficient way to pay for qualified medical expenses and includes access to debit cards and checks. Advantage Checking Combo Offer MENU mmaoffer MENU Mortgage Summer Newsletter MENU Open Business Banking Checking Account MENU Open Small Business Checking Account Jan0 MENU combo MENU checking0 MENU promotion MENU opensmallbusinesscheckingaccountfeb0 MENU View Essential Checking Menu;. This savings account is designed to work alongside your BB&T checking account When you keep a minimum of $1,000 in the account, you can avoid the $12 monthly fee Account name.

BB&T Student Checking is a stressfree checking account designed to meet each student’s personal banking needs With a personalized debit card, no monthly maintenance fees and no minimum balance requirements, a Student Checking account is a great way to manage your finances, on or off campus. BB&T Account Name Annual Percentage Yield* Minimums to avoid fee;. With BB&T Senior Checking, account holders must make a minimum deposit of $100 to establish an account There is a $10 monthly maintenance fee charged on the account, but this can be waived if at least $500 in direct deposits are made each month or the average account balance does not fall below $1,000.

Yes, your BB&T checking accounts are insured up to $250,000 per person by the Federal Deposit Insurance Corporation (FDIC) The FDIC is an independent agency of the United States government that protects you against the loss of your insured deposits if an FDICinsured bank or savings association fails FDIC insurance is backed by the full faith. No BB&T fees for 2 nonBB&T ATM transactions per statement cycle Upon 24th birthday or upon reaching the graduation date provided to the Bank, whichever occurs later, the account will be converted to Bright Banking or Fundamentals Checking Free access to over 2,400 BB&T ATMs Show Details. With a checking account focused on 16 and 17yearolds, First National Bank and Trust Company has no monthly fees and a $25 minimum balance to open To personalize the account for teens, the bank.

BB&T eSavings 001% Investors Deposit Account 001% $10,. The BB&T Bright Banking account only requires $50 to open the account You’ll incur a $12 monthly service fee for going below $1,500 BB&T Bright Banking customers will incur a $3 fee for using. Checking Accounts BB&T@Work Savings Accounts Prepaid Cards Credit Cards Debit Cards CDs Get cash back, miles and more Earn rewards for the things you buy every day with a BB&T credit card Learn more about BB&T credit Adult children of aging parents As you're getting older, so are your parents Set up a joint account with them now to.

If your savings account enrolled in Keep the Change ® is converted to a checking account, Keep the Change transfers will continue to be made into that account We may cancel or modify the Keep the Change service at any time without prior notice Keep the Change is not available for small business debit cards. The minimum age to open a checking account is up to the specific bank, but usually 18 for sole ownership and 13 or 14 for an account coowned by a minor and adult Banks often offer special teen checking accounts that will convert to the regular adult version when the minor becomes an adult. Once your child turns 13, he or she will be able to apply for a Teen Checking Account with Alliant This won’t replace the Kids Savings Account;.

As with most checking accounts, BB&T Student Checking Account does not pay interest $0 monthly fee This account does not charge a monthly maintenance fee Free bill pay Pay your bills to practically anyone in the United States through BB&T Hard credit pull BB&T may require a hard pull on your credit report to open a checking account. Customers can earn a $0 bonus for opening a BB&T Bright Banking or SunTrust Essential checking account They must complete two qualifying direct deposit of at least $500 within 75 days for the BB&T account or within three months for the SunTrust account The BB&T offer expires on Dec 31, The SunTrust offer expires on Jan 4, 21. BB&T Personal Credit, Personal and Business Debit, and MoneyAccount cards are eligible for BB&T Deals Credit cards are subject to credit approval There is no monthly fee and no charge for enrolling in BB&T Deals For complete details, refer to BB&T Deals Terms and Conditions 5 Fees from your mobile or data carrier may apply 6.

Withdraw cash at over 2,400 BB&T ATMs and most other ATMs. The account is intended to make personal banking less stressful for younger customers This account has no monthly maintenance fee, no minimum balance requirement, no direct deposit requirement, no fee for online statements and provides two feefree ATM transactions per month. This map is intended to provide state specific information regarding statutory requirements for the opening of bank accounts for minors Please click on a state for detailed information For questions, please contact the State Banking Department or CSBS Staff.

2 $5 deposit required to open account online or earn advertised rate No minimum balance required to keep account active 3 Text or data rates may apply 4 Youth Checking Accounts are only available to children 16 years or older with a parent or legal guardian on the account. At least one applicant must be 18 to 21 years old One applicant must be the legal age in the state where the account is being opened – also 18 to 21 in most states Most prepaid card services are completely free. HighPerformance Money Market Account Enjoy tiered money market rate savings to complement your BB&T checking account $1,000 minimum balance to avoid the monthly maintenance fee Young Savers Helps children under the age of 18 learn how to save.

A teen checking account can guide your child toward better saving and spending habits and make them more familiar with banking Keep in mind that children under 18 typically need an adult to be a. A teen checking account can guide your child toward better saving and spending habits and make them more familiar with banking Keep in mind that children under 18 typically need an adult to be a. BB&T offers a variety of checking accounts designed for businesses and community organizations based on their needs Look no further – we have the right business account for you All our business checking accounts come with free access to BB&T Small Business Online ® with unlimited bill payment Plus, you can pair any of our business.

Account Opening Personal Or Client Identification Bom A129p

Teaching Your Kids How To Start Saving Money Education Center T Bank

Student Checking Account Suntrust Personal Banking

The Best Student Checking Accounts Of 21 Mybanktracker

4 Best Savings Accounts For Kids Nerdwallet

T Customers Face Online Banking Outage Bankrate Com

T Ballpark Ranked Top Minor League Ballpark In U S Fox 46 Charlotte

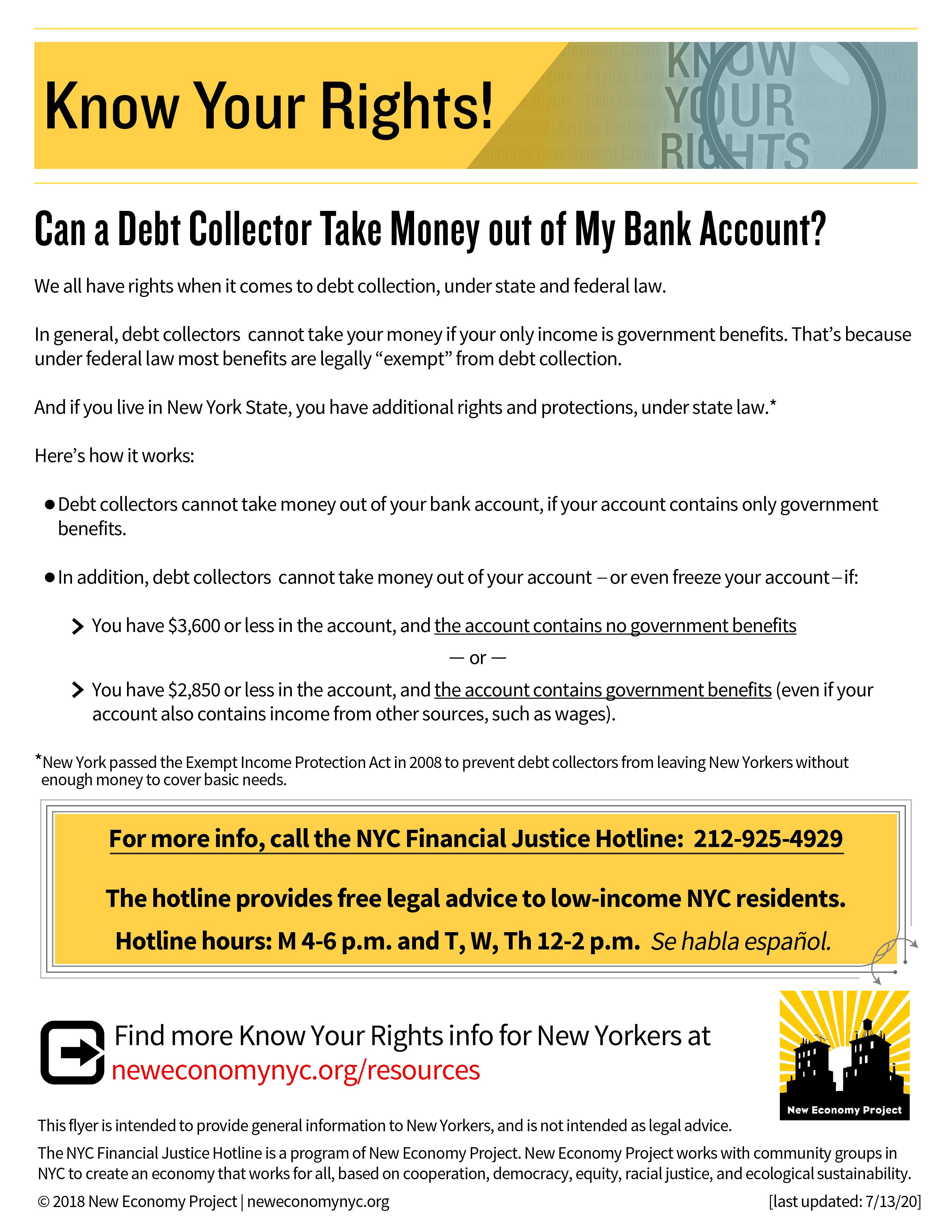

Frozen Bank Accounts New Economy Project

Account Opening Personal Or Client Identification Bom A129p

Young Savers Banking T Bank

10 Best Student Checking Accounts For February 21

Student Checking Account Suntrust Personal Banking

Best Banks In South Carolina 21 Smartasset Com

Bank Accounts For Teens Helping Your Teen Manage A Checking Account

Best Bank Accounts For College Students In 21

Account Opening Personal Or Client Identification Bom A129p

4 Best Savings Accounts For Kids Nerdwallet

Best Teen Checking Accounts 21 Valuepenguin

/best-banks-for-savings-accounts-4160384-Final2-795d397d38b94d5d947f28da8f8671f4.png)

Best Banks For Savings Accounts Of February 21

My Favorite Minor League Park T Ballpark Charlotte Nc Baseball

Checking Account Fee Comparison At The Top U S Banks Mybanktracker

T Bank Review Low Fee Savings Account Variety Of Cd Types Todayheadline

Checking Accounts Open A Checking Account Online Suntrust Checking

Student Checking Account Suntrust Personal Banking

/Regions-232876839f6b4d4bb93b6cb4baabe02e.png)

Regions Bank Review

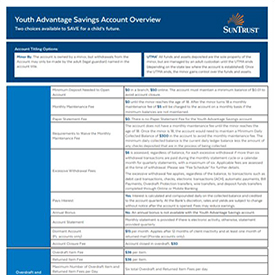

Youth Advantage Kids Savings Suntrust Personal Banking

Young Savers Banking T Bank

Essential Checking Account Avoid Fees Suntrust Personal Banking

T Bank Student Checking Review Students Age 23 Younger

T Prepaid Debit Card Open A Reloadable Money Account Debit Card Online

What Do You Need To Open A Bank Account Answered Checking Etc First Quarter Finance

Student Checking Account Suntrust Personal Banking

Personal Savings Accounts Suntrust Personal Banking

T Suntrust Unveil Postmerger Name That Nods To Legacies American Banker

4 Best Teen Checking Accounts Nerdwallet

Vintage Greenville Road Warriors Minor League Hockey Sga T Shirt Size Men Xl t Ebay

How Should I Structure And Execute My Will Education Center T Bank

:max_bytes(150000):strip_icc()/bbt_3x1-048f72366cea41f28df28a8d7f52662e.png)

Best Student Bank Accounts Of February 21

Student Checking Account Suntrust Personal Banking

Youth Advantage Kids Savings Suntrust Personal Banking

T Sponsors Bookbag To Briefcase At St Mary S College Of Maryland Smcm Newsroom

5 Questions To Ask Before You Open A Joint Bank Account Education Center T Bank

5 Options When You Can T Open A Bank Account

Student Checking Account Suntrust Personal Banking

10 Best Student Checking Accounts For February 21

Account Opening Personal Or Client Identification Bom A129p

The Best Prepaid And Debit Cards For Teens And Parents 21

529 College Savings Plan Retirement Investing T Bank

T Ceo Details Progress On Merger With Suntrust Wsj

13 Best Bank For Seniors Reviewed Pensionsweek

Account Opening Personal Or Client Identification Bom A129p

T Bank Student Checking Review Students Age 23 Younger

/charles-schwab-bank-9654292f6e72430194d0015a5c2ac7ba.png)

Best Online Banks Of 21

:max_bytes(150000):strip_icc()/bestbanksforstudentsdiscover-6ac73165571c4f989413376d169021e1.png)

Best Banks For Students In 21

Philadelphia Phillies Offseason Williamsport Crosscutters Move To Mlb Draft League

Mastercard Debit Cards Suntrust Personal Banking

Student Checking Account Suntrust Personal Banking

4 Best Teen Checking Accounts Nerdwallet

7 Things To Consider Before Opening A Kids Savings Account

4 Best Teen Checking Accounts Nerdwallet

Tcf Teen Checking Reviews Feb 21 Checking Accounts Supermoney

Child Savings Accounts A Savings Account For Kids

Youth Advantage Kids Savings Suntrust Personal Banking

Youth Advantage Kids Savings Suntrust Personal Banking

Bank Rules On Check Deposits With Multiple Payees Mybanktracker

Why And When Your Child Should Have A Debit Card The New York Times

U By T On The App Store

Coverdell Education Savings Account Retirement Investing T Bank

Minor Schedule Updates Tuesday Integrity Martial Arts Facebook

Truist Financial Is New Name For Combined T Suntrust Wsj

Suntrust And T Select Name For New Bank

4 Best Teen Checking Accounts Nerdwallet

T Bank Student Checking Review Students Age 23 Younger

4 Best Teen Checking Accounts Nerdwallet

Best Checking Accounts And Rates February 21 Us News Money

Covid 19 Complicates Ambitious Truist Merger Timeline Charlotte Observer

T Bank Review The Simple Dollar

Checking Banking Accounts For Minors Teens Students Huntington Bank

/chase-ffea0574ea7f44b6ac0e53fcae3f8146.png)

Best Student Bank Accounts Of February 21

10 Best Student Checking Accounts For February 21

Best Teen Checking Accounts 21 Valuepenguin

Youth Advantage Kids Savings Suntrust Personal Banking

What S Next As T And Suntrust Banks Become Truist Charlotte Observer

Best Banks In South Carolina 21 Smartasset Com

Layoffs Twitch Streams And Hope Checking In On The White Sox Minor Leagues The Athletic

Adding Value To Your Home Education Center T Bank

T Bank Student Checking Review Students Age 23 Younger

T Reviews Of Rates In February 21 Magnifymoney

Youth Advantage Kids Savings Suntrust Personal Banking

T Sends Warning After Nc Woman S Bank Account Drained Of 2 000 In 30 Minutes Cbs 17

Exhibit 4 10