5 8 13 21 Ema Strategy

/dotdash_Final_Strategies_Applications_Behind_The_50_Day_EMA_INTC_AAPL_Jul_2020-01-0c5fd4e9cb8b49ec9f48cb37d116adfd.jpg)

Strategies Applications Behind The 50 Day Ema Intc pl

Revealed Secrets Of Moving Averages Bullbull

Top 3 Simple Moving Average Trading Strategies Tradingsim

Moving Average Strategy Guide 5 Moving Average Strategies

Exponential Moving Average 5 Simple Trading Strategies Infographic

Moving Averages Simple And Exponential Chartschool

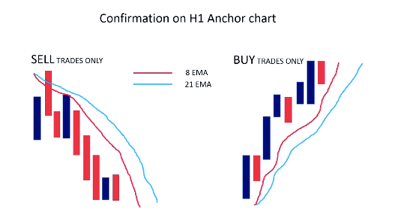

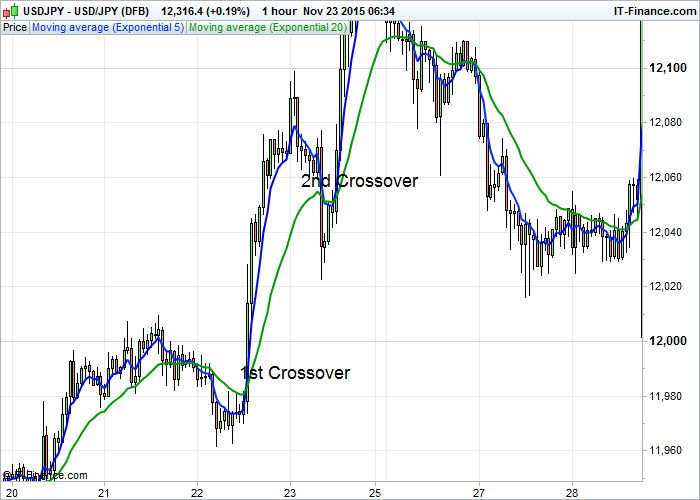

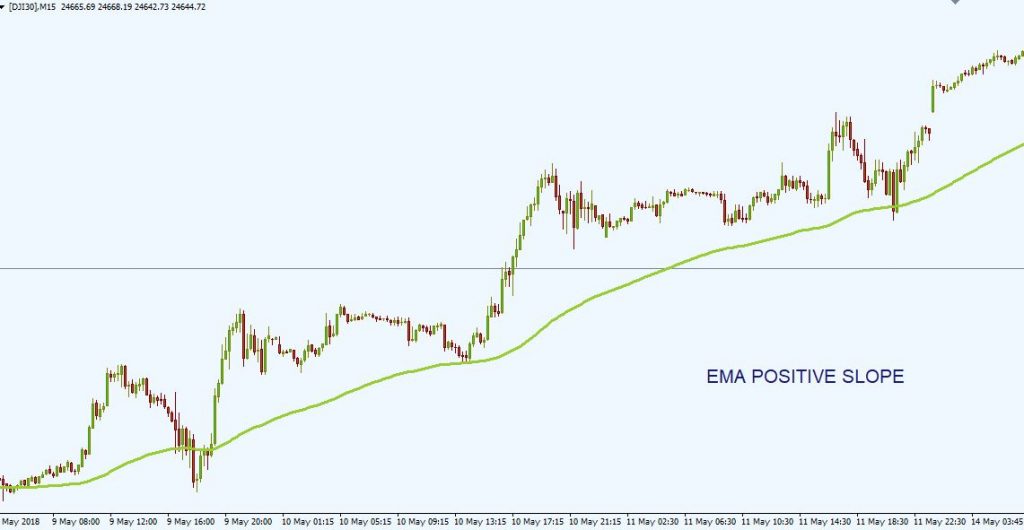

EMA Crossover Strategy This strategy will enter a long trade when the 21 EMA crosses over the 55 EMA and both EMAs and the close price are above the 0 EMA (longterm trend) It will enter a short trade when the 21 EMA crosses under the 55 EMA and both EMAs and the close price are below the 0 EMA.

5 8 13 21 ema strategy. Stochastic oscillator with a setting of (5,3,3) Strategy Overview Let’s take a look at the 3 main steps of our 1minute Forex scalping strategy Step 1 Identify the shortterm trend. 3 EMA scalping Strategy Set up Predictive EMA (25, 8) Predictive EMA (50, 15) Predictive EMA (100, 30) Download 3 Predictive EMA>> 3 EMA scalping system Strategy Rules Long Set up 25 EMA crosses above 50 and both 25 and 50 are above 100;. 21 EMA & MACD Scalping Forex Trading Strategy Simple Scalping Strategy of 5 & 15 EMA Crossover Scalping Strategy of Stochastic with Candlestick Pattern Candlestick Scalping Trading Strategy with 45 EMA Scalping Strategy of Trend Line Breakout with 45 EMA.

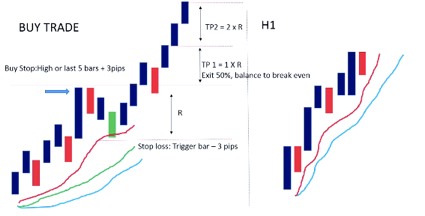

50Period exponential moving average;. Apple Inc builds a basing pattern above $105 (A) on the 5minute chart and breaks out in a shortterm rally over the lunch hour (B) 5, 8 and 13bar SMAs point to higher ground, while the. Indicators used in this trading strategy (9) EMA, (13) EMA, (21) EMA Average True Range (ATR) Long Signals Take a long position when a minimum of 5 candles in a row are above all three EMA's and once a candle touches the EMA, count the previous 5 candles and take the highest close price as the next trigger entry.

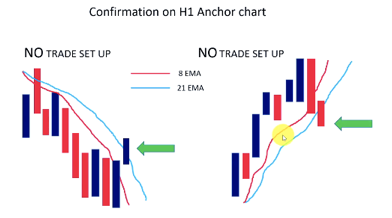

1 for the signal line. Here the strategy We look to H4 and for some guys Daily can be also We need three type of indicators MA MACD RSI Buy rules 8EMA>21EMA MACD (5,13,1)>0 (wait for second candly close on MACD) RSI 21 >50 Sell rules 8EMA. Strategy Long Entry Rules Place a buy order when the following chart rules or conditions are in display If the 5 EMA (red) crosses the 8 EMA (blue) and the 13 EMA (magenta) upwards and they tend to form an intersection, it indicates that price is about to take an upward spin.

#FreeTipsChannelLinkInDescriptionAndFreeMT4DataFeed Join below FREE Telegram Channel for MCX, Cash, Fut. Moving Average Cross Forex trading strategy — is a simple system that is based on the cross of the two standard indicators — the fast EMA (exponential moving average) and the slow EMAYou can also use our free Adjustable Moving Average Cross expert advisor to trade this strategy automatically in MetaTrader platform Features Very easy strategy to follow. Indicators used in this trading strategy (9) EMA, (13) EMA, (21) EMA Average True Range (ATR) Long Signals Take a long position when a minimum of 5 candles in a row are above all three EMA's and once a candle touches the EMA, count the previous 5 candles and take the highest close price as the next trigger entry.

Hi, I am using 9 EMA and EMA and do good for me ,TF D1, but please explain to me clearly how ATR 14 really work , Thanks Trading Systems SMA 0SMA 55SMA 5 is very profitable. When 21 EMA upside breakout complete, then look at MACD indicator At the same time, if MACD stay above 00 level, then open buy entry Set SL below moving average or set manually 1525 pips Set TP 100 pips for every buy entry Sell Setup Rules First market price needs to cross 21 EMA from upper to lower When 21 EMA downside breakout complete. EMA Crossover Trading Strategy A crossover between 2 moving average is probably one of the most wellknown technical analysis signal used by traders The strategy is simple, we take 2 exponential moving averages, one with a shorter period and the other with a longer period and we track the signals when a crossover occurs.

Recently, Sea tested support near its 21day EMA during a swift earlySeptember selloff But shares have propped back above the key technical lately and trades just 5% below an alltime high of. 50Period exponential moving average;. We are not forgetting the namesake of this trading strategy The settings for MACD are 5 for fast EMA;.

Setup work for an exponential moving average, the 50bar highlow range, and the 3 retracements The setups, entries, and exits are defined next Setup a) Calculate a 15bar exponential moving average (EMA) of closes b) Calculate the highlow range of the last 50 bars and 3 retracements from the high and low. 13 for slow EMA;. The exponential moving average (EMA) is a type of moving average that considers the weighted average of a series of recent data to reflect the ongoing trend in the market The weight of the EMA is exponentially tilted towards more recent occurrences, giving the recent data greater influence over the reading.

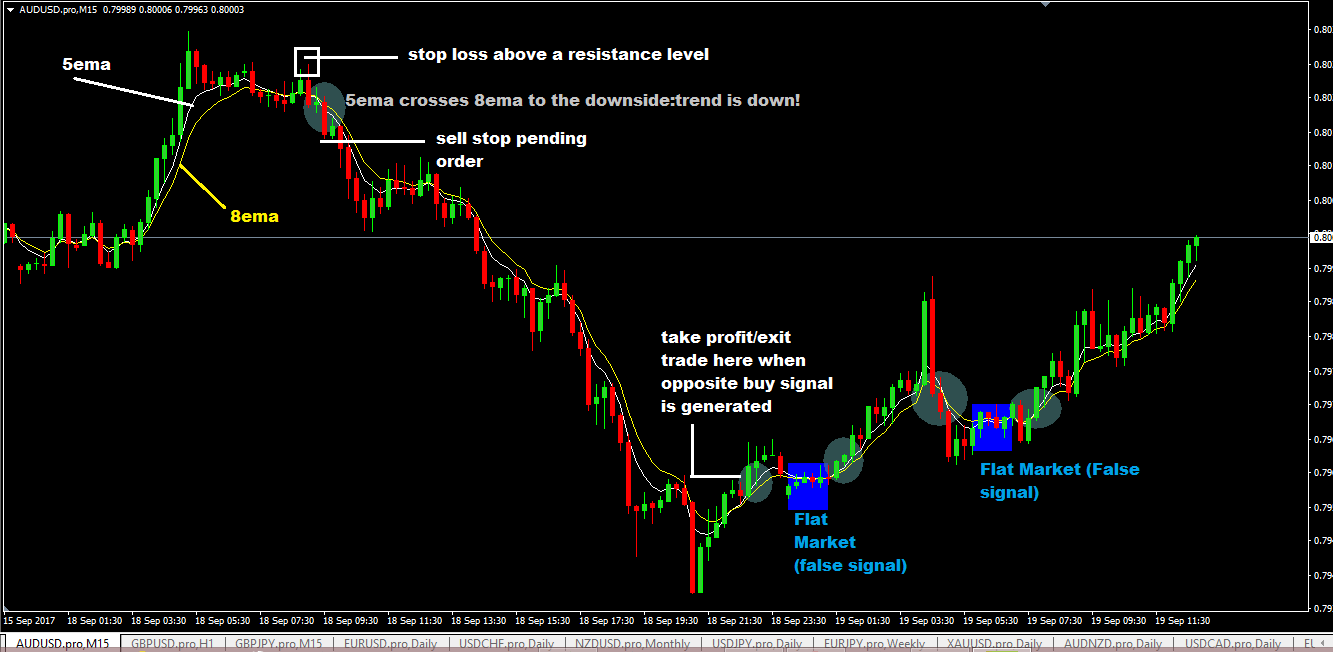

Let’s see a confirmed BUY trade only on the 5 minutes chart below;. 100Period exponential moving average;. · Exponential Moving Average – 21 Period · Exponential Moving Average – 50 The 50 EMA is our indicator to determine the short term trend, and the 10 and 21 period EMA’s provide us with strong support and resistance levels which we will use for entry signals.

Buy on the next candle after the cross over;. One such strategy makes use of exponential moving averages (EMAs), and more specifically, the 5 and period EMAs Exponential moving averages provide you with a good indication of the current trend, and when you get a shortterm moving average crossing a longer term moving average, ie the 5 crossing the in this case, it is a good. Read on to learn more about this innovative strategy Background Traders use many different moving averages as support and resistance Some of the most commonly used moving averages are the 10day simple moving average (10 SMA), the SMA, the 50 SMA, and the 0 SMA, but there are many others (21 EMA, 34 EMA, 72 EMA, 100 SMA, to name a few.

I just use the laws of nature I take from Fibonacci sequence numbers 5 and 13 as the parameters for moving averagesWhen you wish to determine the price movement, the time for opening and closing the positions, use Exponential Moving Average (Exponential moving average) 5 and 13 indicators and follow these rules1 Open the position when EMA5 has crossed EMA13. New EMA value = SF X New Price (1 SF) X Previous EMA value Software programs perform the necessary computational work Two EMA lines are presented below calculated using two different periods ( Red = 28, Blue = 13 ) Software platforms generally place the EMA indicators along side the existing candlestick formations as depicted in the diagram. The Strategy Step 3 Analyzing the BUY trade on a 5minute chart There are three moving averages on the 5minute chart;.

Strategy #2 – RealLife Example going against the primary trend using the Simple Moving Average The exponential moving average, however, adjusts as it moves to a greater degree based on the price action October 13, 18 at 504 pm. Plot a 9 and period EMA on your chart ( I prefer 5 min or 15 min charts ) Long entry the 9 EMA must be above the EMA, wait for a bar to pull back and close between the 9 EMA and EMA Place a long order 1 or 2 pips above the highest high of the bar that closed under the 9 EMA The opposite apply for going short Below is a chart. An Exponential Moving Average (EMA) is very similar to (and is a type of) a weighted moving average The major difference with the EMA is that old data points never leave the average To clarify, old data points retain a multiplier (albeit declining to almost nothing) even if they are outside of the selected data series length.

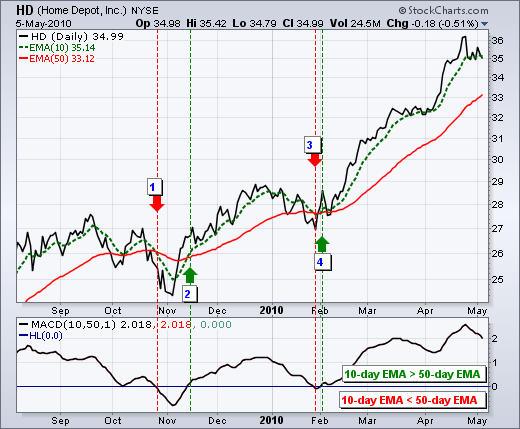

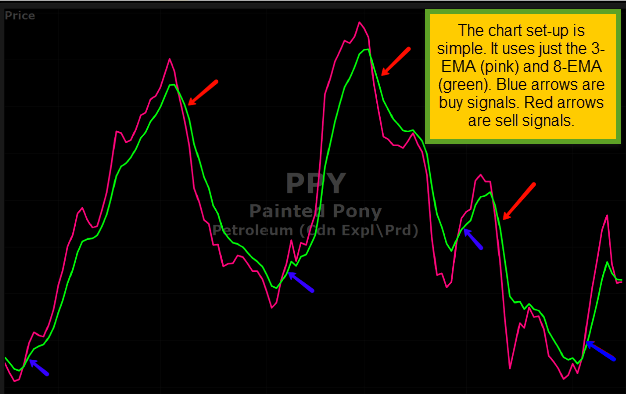

Let’s assume over the last 5 days, Apple shares closed at 100, 90, 95, 105, and 100 So, the 5period MA is 100 90 95 105 100 / 5 = 98 And when you “string” together these 5period MA values together, you get a smooth line on your chart Now the concept is the same for the 0 day moving average. 5 and 8 EMA trading strategy – Chart set up In this strategy, we do not wait for the moving averages to tell us when to buy or when to sell On the contrary, we will look at price when it is at an extreme from the two moving averages Following this, we then look for a reversal (bullish or bearish) candlesticks and then enter the trade. In Figure 1, we have applied a green colored 13 period EMA and a red colored 21 period EMA on the 5minute chart of Ford Motor Company (NYSEF) As you can see, in the far left, when the green line moved above the red line, the price soon gained bullish momentum and started to move up.

This is a price action trading system that uses EMA and it is called the EMA Bounce Forex Trading Strategy and it is a really simple trading system even a completely new forex trader can follow easily The only forex indicator you need is the exponential moving average For trade entries, you are going to use price actionClick Here for my free price action trading course. EMA and the Heads of Medicines Agencies (HMA) have published their joint strategy for the next five years, following its recent adoption by the HMA and EMA Management Board The strategy details how the European medicines regulatory network can continue to enable the supply of safe and effective medicines that meet patients’ needs in the face of challenges posed by everaccelerating. An exponential moving average gives recent prices a bigger weight, so it does a better job of measuring recent momentum Going forward in this article, we will only use exponential moving averages The 8 day moving average will be shown in magenta And the 21 day moving average will be in red.

Exponential Moving Average CrossOver Snapshot 3 Day Above 13 Day EMA 5 Day Above Day EMA 13 Day Above 34 Day EMA 15 Day Above 50 Day EMA Day Above 50 Day EMA 15 Day Above 100 Day EMA 50 Day Above 100 Day EMA 50 Day Above 0 Day EMA. Read on to learn more about this innovative strategy Background Traders use many different moving averages as support and resistance Some of the most commonly used moving averages are the 10day simple moving average (10 SMA), the SMA, the 50 SMA, and the 0 SMA, but there are many others (21 EMA, 34 EMA, 72 EMA, 100 SMA, to name a few. Using EMA Crossovers as a Buy/Sell Indicator When considering strategy, a trader might use crossovers of the 50 EMA by the 10 or EMA as trading signals Another strategy that forex traders use.

Orchidconsolidation Consolidation using ema(5,13,26) Good stocks for jeevan Observe price crossing above ema or sma for the last 8/9 days 50 days ema/sma below 0 days ema/sma;. Satya strong steady safe scan 26 (sssss26) germinating seedlings Germinating seedlings. In Figure 1, we have applied a green colored 13 period EMA and a red colored 21 period EMA on the 5minute chart of Ford Motor Company (NYSEF) As you can see, in the far left, when the green line moved above the red line, the price soon gained bullish momentum and started to move up.

Indicators used in this trading strategy (9) EMA, (13) EMA, (21) EMA Average True Range (ATR) Long Signals Take a long position when a minimum of 5 candles in a row are above all three EMA's and once a candle touches the EMA, count the previous 5 candles and take the highest close price as the next trigger entry. Looking at the 50/0 day crossover, the best moving average was the exponential moving average (EMA) which gave a annualised return of 596% with a maximum drawdown of 17% The worst performing moving average was tied between the Hull moving average and the least squares moving average. Drmrtalaak Thank you for this great strategy,it works ) Deriv is the best for trading nowadays news free 24/7 365,i do everyday,using my system which is 90% accurate,M1 is fantastic for hedging,you now speaking my languagesynthetic is the boss,PM me,i will add you to my channel and show all the trading resultsI'm not here to share anything,else,respect to the thread starter's channel.

Using the exponential moving average (EMA) can enhance almost any trading strategy Learn the 3bar EMA strategy that combines the power of two shortterm exponential moving averages Throughout this EMA trading guide, we’re going to reveal some unconventional EMA techniques that can dramatically improve your trading outcomes This EMA stock trading strategy uses 2 EMAs with the same period. The 8 EMA, the 13 EMA, and the 21 EMA Say, we have confirmed a BUY trade on the H1 chart, and have a nicely laid out 5minute chart. The European Medicines Agency's (EMA) 'Regulatory Science to 25' strategy is a plan for advancing EMA's engagement with regulatory science over the next five to ten years, covering both human and veterinary medicines The strategy aims to build a more adaptive regulatory system that will encourage innovation in human and veterinary medicine.

Target 5 – 10 pips, stop loss 9 – 12 pips;. Stochastic oscillator with a setting of (5,3,3) Strategy Overview Let’s take a look at the 3 main steps of our 1minute Forex scalping strategy Step 1 Identify the shortterm trend. 2109 Gold Bullish Low High of The EMA trading strategy discussed below will revolve around the use of a series of EMA’s (Exponential Moving Average) These averages work.

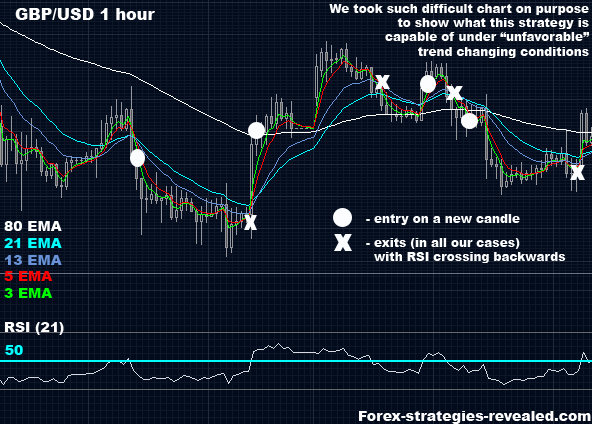

The EMAs 21 and 13 gives us the current tredn direction If the EMA 13 is above the EMA 21, the current trend is bullish and if the opposite happens, the current trend is bearish The RSI 21 value below 50 indicates a bullish market while under 50 indicates a bearish market These are the basics of this system and should be well understood. Ema 3 Ema 5 Ema 7 Ema 9 Ema 11 Ema 13 Color yellow Ema 21 Ema 24 Ema 27 Ema 30 Ema 33 Ema 36 color Green Ema 55 Color Red And Way Works is Buy Or Sell When the Group of Ema`s Yellow Breaks Ema 55 Take Benefit When Yellow Group Touches The Group Green If The Yellow group does Pull Back in Ema 55 or In Green Group Buy or sell again. I created this video with the YouTube Slideshow Creator (https//wwwyoutubecom/upload) Simple 5 EMA High & Low scalping strategy,email list ,email database.

Simple 5 EMA And 12 EMA With 21 RSI Forex Trading Strategy Never be mislead by the terms “simple Forex trading strategy” thinking that it means easy There is nothing easy about trading but that does not mean you can’t have a simple trading strategy for Forex, Futures, Stocks, or any market and one that works if you follow the rules. I used to scalp on 5 min charts entering with 9 EMA, now I use it successfully for daily charts with the same good result Traders can use whatever Moving average they like 5 EMA, 10 SMA etc I like 9 EMA Besides entries, 9 EMA can also be used for exits, where the same principle works once price Closes on the opposite side of 9 EMA, you exit. 100Period exponential moving average;.

While you can use any moving average, be it the combination of 5 and 10, or 15 and 30, the best crosses are always based on the Fibonacci sequences such as 5, 8, 13, 21 etc Since professional and institutional traders often use Fibonacci numbers moving average crosses, it ends up acting as a selffulfilling prophecy as well.

Exponential Moving Average 5 Simple Trading Strategies Infographic

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Moving Average Strategy Guide 5 Moving Average Strategies

Study Determines The Best Moving Average Crossover Trading Strategy

Beginners Guide To Trading With Moving Averages Whale Reports

Top 3 Simple Moving Average Trading Strategies Tradingsim

5 Ema And 13 Ema Fibonacci Numbers Trading System Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast

How To Use Moving Averages To Trade Bybit Blog

Moving Average Intraday Best Strategy 5 8 13 Ema Trick Trading Strategy Youtube

Moving Average Strategy Guide 5 Moving Average Strategies

Managing Positions Using 3 Ema 8 Ema Crossovers Vectorvest Canada Blog

/dotdash_Final_Top_Indicators_for_a_Scalping_Trading_Strategy_Sep_2020-01-c530bea4f4a84a34a89a4d74fdae1be8.jpg)

Top Indicators For A Scalping Trading Strategy

Study Determines The Best Moving Average Crossover Trading Strategy

The Best Back Tested Trading Strategies With Moving Averages New Trader U

How To Use Moving Averages To Trade Bybit Blog

A 5 Step Scalping Strategy Forexsignals Com Blog

5 8 13ema Indicators And Signals Tradingview

How To Use Moving Averages To Trade Bybit Blog

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Beginners Guide To Trading With Moving Averages Whale Reports

Forex Moving Average Classic Formula For Success

8 13 21 55 Indicators And Signals Tradingview

Beginners Guide To Trading With Moving Averages Whale Reports

3 Simple Fibonacci Trading Strategies Infographic

Exponential Moving Average 5 Simple Trading Strategies Infographic

How To Use Moving Averages To Trade Bybit Blog

The Moving Average Indicator Guide How It Improves Your Trading Strategy And Helps You Beat The Markets

Dual Moving Average Crossover Dmac Trading Strategy

5ema And 8ema Forex Trading Strategy Ema Forex Strategy

The Moving Average Strategy Guide For Trading In 21

Simple Rsi Ema High Profitable Ratio Strategy Forex Factory

Moving Average Strategy Guide 5 Moving Average Strategies

/dotdash_Final_The_Perfect_Moving_Averages_for_Day_Trading_Sep_2020-01-c9c1fceec6944d47af7f87f7927dc0c2.jpg)

The Perfect Moving Averages For Day Trading

Price Action Indicator Wanted Forex Factory

Exponential Moving Average Ema Defined And Explained

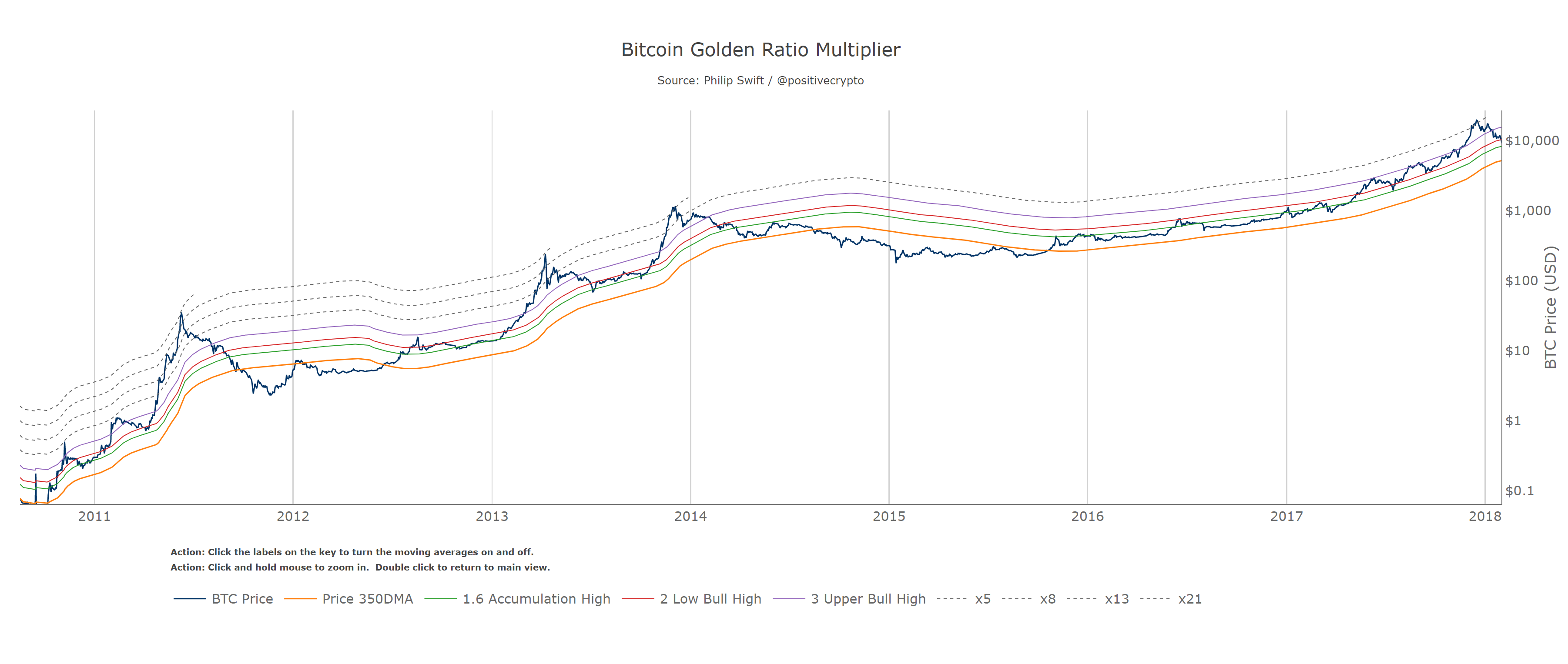

The Golden Ratio Multiplier Unlocking The Mathematically Organic By Philip Swift Positivecrypto Medium

Forex Moving Average Classic Formula For Success

:max_bytes(150000):strip_icc()/dotdash_Final_The_Perfect_Moving_Averages_for_Day_Trading_Sep_2020-02-b64a1ea406794bb38847ecbdd5b6e2e2.jpg)

The Perfect Moving Averages For Day Trading

Tradingfibonacci Com Combining Fibonacci With Major Technical Analysis Tools

The Ema 5 And Ema Crossover Trading Strategy

Ema 5 8 13 21 Indicator By Eleccrypto Tradingview

How To Use Moving Averages To Trade Bybit Blog

Exponential Moving Average 5 Simple Trading Strategies Infographic

Anatomy Of Popular Moving Averages In Forex Forex Training Group

The Golden Ratio Multiplier Unlocking The Mathematically Organic By Philip Swift Positivecrypto Medium

Which Moving Average Works Best For Intraday Trading In Stocks Quora

Ema 21 13 8 Scalping Indicator By Odalhousani Tradingview

How To Trade With The Exponential Moving Average Strategy

Exponential Moving Average Best Combination For Technical Analysis Hindi Youtube

Which Moving Average Works Best For Intraday Trading In Stocks Quora

6 Killer Combinations For Trading Strategies Fx Leaders

5 Ema And 13 Ema Fibonacci Numbers Trading System Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast

5 8 13 0 Ema Cross Over Indicator By Sharemarketraja Tradingview India

A 5 Step Scalping Strategy Forexsignals Com Blog

Complex Trading System 4 Trend Trading With Emas Forex Strategies Systems Revealed

Exponential Moving Average 5 Simple Trading Strategies Infographic

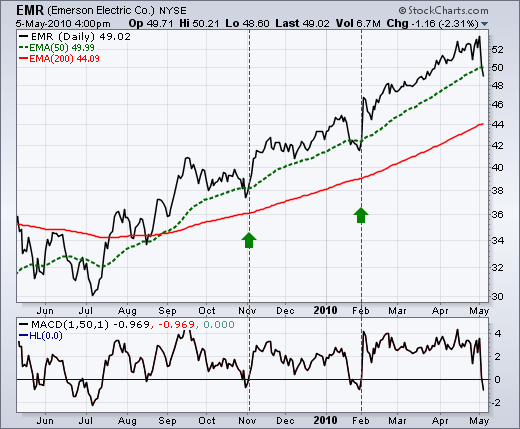

The Best Charts For Swing Trading

The Moving Average Strategy Guide For Trading In 21

5 Ema And 12 Ema With 21 Rsi Forex Swing Trading Strategy For Mt4 With Download

Which Moving Average Works Best For Intraday Trading In Stocks Quora

8 Ema 5 Ema Trading Strategy

Philakone Indicators And Signals Tradingview

5 Ema And 13 Ema Fibonacci Numbers Trading System Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast

A 5 Step Scalping Strategy Forexsignals Com Blog

5 8 13 Moving Average Strategy For Trading In Hindi Stock Market Youtube

Golden Cross Trading 5 Best Golden Cross Strategies Trading In Depth

Moving Average Strategy Guide 5 Moving Average Strategies

/professional-profession-chart-font-diagram-multimedia-1163690-pxhere.com1-f9ca2bfa361044e9a3d6292b691e3835.jpg)

Most Commonly Used Periods In Creating Moving Average Ma Lines

5 8 13 Forex Scalping Trading Strategy

5 Ema And 13 Ema Fibonacci Numbers Trading System Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast

Golden Cross Trading 5 Best Golden Cross Strategies Trading In Depth

Exponential Moving Average 5 Simple Trading Strategies Infographic

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

5 8 13 Forex Scalping Trading Strategy

The Moving Average Indicator Guide How It Improves Your Trading Strategy And Helps You Beat The Markets

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Moving Average Intraday Best Strategy 5 8 13 Ema Trick Hindi Urdu Trading Strategy Top Trading Directory

How To Use Moving Averages Moving Average Trading 101

Beginners Guide To Trading With Moving Averages Whale Reports

Moving Average Strategy Guide 5 Moving Average Strategies

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Philakone Indicators And Signals Tradingview

The Moving Average Indicator Guide How It Improves Your Trading Strategy And Helps You Beat The Markets

Moving Averages Simple And Exponential Chartschool

How To Trade With The Exponential Moving Average Strategy

How To Trade With The Exponential Moving Average Strategy

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Secrets Of Trend Analysis The Power Of The 8 21 Day Moving Averages T3 Live

5 Ema And 13 Ema Fibonacci Numbers Trading System Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast

Exponential Moving Average Ema Technical Indicators Indicators And Signals Tradingview India

Secrets Of Trend Analysis The Power Of The 8 21 Day Moving Averages T3 Live

A Zero To A Million Trading Strategy Trading Strategy Guides

Exponential Moving Average 5 Simple Trading Strategies Infographic

Ema 5 8 13 21 Indicator By Elecbotcrypto Tradingview