Mt Bank Cashiers Check Fee

M T Offers Account Without Checking For Unbanked Customers Delaware Business Now

M T Bank Mychoice Checking

How Identifying Bogus Checks At M T Bank Is A Lot Like Hunting Cybercriminals Cyberscoop

Explore The M T Bank Help Center M T Bank

Expired Ct De Dc Md Nj Ny Pa Va Wv In Branch M T Bank 300 Business Checking Bonus Doctor Of Credit

Rising Bank Review Is It The Right Bank For You Gobankingrates

A bank representative then issues the cashier's check with the bank’s name and account information as well as the names of the payee and remitter The funds are usually then available to the.

Mt bank cashiers check fee. The teller made me a cashier's check for the balance of my savings and then told me that I'd used my check card recently and had two pending transactions on my checking two trips to Price Chopper (supermarket) totaling to $17 or so combined So, on a worried hunch, I check the M&T Web Banking thing today and sure enough, my current balance. 10/18/ Should bank fees (Cashier Check purchase fee of $600) paid by the customer in cash, be added to their current CTR?. If they can contact you, they can surely give adequate instructions to their bank and get a cashier’s check issued correctly If the excessive amount was, in fact, the buyer’s fault, wouldn’t the buyer rather pay the $8 (or whatever) fee to have an accurate check printed instead of giving you—a stranger—the opportunity to steal the cash?.

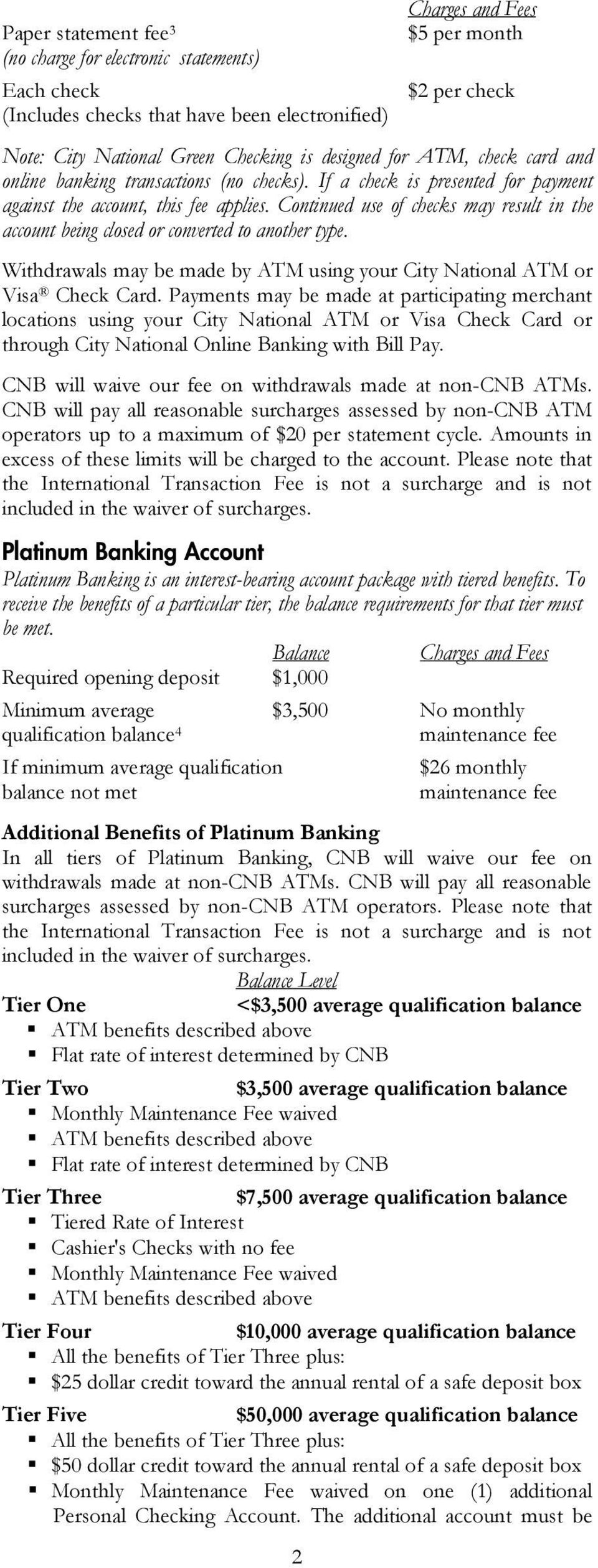

TD Bank $8, but fee is waived if customer has Select or Signature Advantage checking account US Bank $7 for cashier's check only Waived for Platinum or Premium checking account members Union Bank $10 for customers and $15 for noncustomers Cashier's checks only Wells Fargo. Refer to the Personal Schedule of Fees for complete details) Don't have a checking or savings account with us?. Welcome to the Account Pricing Center for Service Charges and Fees Enter your ZIP code and we will create a personalized pricing page that you can print If you don't have Acrobat Reader, click here for more information.

A cashier’s check, also known as an official bank check, is a payment instrument issued by a bank or credit union to a third party, usually on behalf of a bank customer who pays the bank the. TD Bank $8, but fee is waived if customer has Select or Signature Advantage checking account US Bank $7 for cashier's check only Waived for Platinum or Premium checking account members Union Bank $10 for customers and $15 for noncustomers Cashier's checks only Wells Fargo. Fee in Dollars (US) Free Checking Monthly Service Fee ¹ $ 000 Interest Checking Monthly Service Fee ¹ $ 500 Relationship Premier Checking Monthly Service Fee ¹ $ 1500 Paper Statement Fee $ 0 Foreign ATM Service Fee $ 0 Paid Overdraft or Return Check Individual $3900 Paid Overdraft or Return Check Business.

Bank Bags Lock (Business only) $2499 Bank Bags Zipper $799 Cashiers Checks $600 Check Cashing (noncustomer) per check $1000 Cashing Checks Drawn on this Bank No charge Check Printing Fee depends on style of checks ordered Check Printing for Golden Years and First Choice Club No charge Christmas Club Withdrawal Fee $00. A cashier's check was purchased and is considered “good funds", but it still has to traverse the same check processing that any other check does Most checks will clear in 48 hours If there is anything exceptional about the check and it requires. In that instance, the bank generally must make the first $5,525 available according to the availability schedule The bank can place a hold on the entire amount of the cashier's check if it has reasonable cause to believe the check is uncollectible from the paying bank The bank may put a longer hold on the check if it was.

M&T Bank Fee 2% of the total check amount (minimum $3) Mobile deposit available?. If you're a Bank of America customer with a checking or savings account, you can get a cashier's check for a $15 fee (which will be waived for customers enrolled in Preferred Rewards;. Cashier’s Check Fees Compared According to the banking analysis by MyBankTracker, the average.

3 $10 Check order fee for 25 checks 4 $30 stop payment fee for each order to stop payment of a check or preauthorized payment to be made by an electronic fund transfer from the account, and for each renewal of such an order 5 $10 returned deposited item fee for each check or other item deposited in the account and returned unpaid. Cashier's Checks A cashier's check is a draft drawn by a Bank on itself, which the Bank agrees to honor when properly presented for payment The Bank, not its customer, signs the check (UCC Sec 3104(3) (g)) This means that the Bank is liable to pay the check. Aside from being sad to see you go, to close an account you'll just need to give us a call at BANK (2265) or visit at any of our community offices.

Welcome to the Account Pricing Center for Service Charges and Fees Enter your ZIP code and we will create a personalized pricing page that you can print If you don't have Acrobat Reader, click here for more information. In This Section COVID19 Updates > Get the latest on our COVID19 response Contact M&T Bank > Get in touch with M&T Customer Service or access other helpful M&T Bank contact information tools and resources Current Rates > View and compare today's interest rates and fees for M&T Bank products F A Qs > Get answers, quickly and easily, to many frequently asked questions. View and compare today's interest rates and fees for M&T Bank products Select an account type from the list below Rates are good as of March 16, Current M&T Bank Prime Rate 325%.

A cashier’s check is a check drawn from the bank’s own funds and signed by a cashier or teller Unlike a regular check, the bank, not the check writer, guarantees payment of a cashier’s check. Fees Expect to pay a modest fee for cashier’s checks Banks and credit unions typically charge around $10 or so per check Banks and credit unions typically charge around $10 or so per check To cover that cost, you need extra money in cash, or available in your account. No Fee for M&T Bank ATMs $300 for Non M&T Bank ATMs located in the United States The greater of $500 or 3% of the US dollar amount of the transaction for withdrawals and cash advances if the ATM is located outside of the 50 United States or District of Columbia ATM Balance Inquiry No Fee for M&T Bank ATMs.

Check cashing fees vary depending on the retailer, check type, check amount, and state laws While you can typically cash a check for free at a bank where you have an account, at most other places, you will pay a fee. If you deposit more than $5,000 in checks, the first $5,000 must be made available according to the bank's standard holding policy, but a longer hold can apply to the remaining amount For example, when the checks are government checks, cashier's checks, or another lowrisk item, the bank should make the first $5,000 available on the next. Browse personal checking accounts, choose the SunTrust checking option best for you or use our tool to select the best checking account for your needs, and open a checking account online today.

SunTrust Bank Fee $7 for SunTrust checks;. Tip If you need to send more than $1,000 on a regular basis, consider opening a checking account at a bank so you can obtain cashier’s checks International money orders cost $450 for any amount. The teller made me a cashier's check for the balance of my savings and then told me that I'd used my check card recently and had two pending transactions on my checking two trips to Price Chopper (supermarket) totaling to $17 or so combined So, on a worried hunch, I check the M&T Web Banking thing today and sure enough, my current balance.

If the person already obtained the cashier's check, ask her to go with you to the issuing bank so you can cash the check before handing over the goods Recognize the Signs Watch out if someone sends you a cashier's check for more than he owes and requests you to mail the excess funds back to him. 3 Perday fee applies to each business day after the first business day that the account remains in a negative collected balance See fee schedule for current overdraft charges Platinum Checking 1 Monthly maintenance fee if account falls below minimum balance requirement 2 Free cashier's checks and free money orders limited to 1 each per day. 10% of the check amount ($3 minimum and $25 maximum) M&T Bank the deposit speeds of personal checks, cashier’s checks charge check cashing fees, depending on which bank you go to, you.

How to Complete a CTR for Local Diocese 10/18/. The teller made me a cashier's check for the balance of my savings and then told me that I'd used my check card recently and had two pending transactions on my checking two trips to Price Chopper (supermarket) totaling to $17 or so combined So, on a worried hunch, I check the M&T Web Banking thing today and sure enough, my current balance. A bank representative then issues the cashier's check with the bank’s name and account information as well as the names of the payee and remitter The funds are usually then available to the.

In that instance, the bank generally must make the first $5,525 available according to the availability schedule The bank can place a hold on the entire amount of the cashier's check if it has reasonable cause to believe the check is uncollectible from the paying bank The bank may put a longer hold on the check if it was. Otherwise, it is 1% to 3% of the check amount;. How do I get a money order or cashier's check?.

Cashier's Checks A cashier's check is a draft drawn by a Bank on itself, which the Bank agrees to honor when properly presented for payment The Bank, not its customer, signs the check (UCC Sec 3104(3) (g)) This means that the Bank is liable to pay the check. You can get a cashier's check at a bank, for a small fee (often around ten dollars), by following a very simple process Steps Part 1 of 3 Preparing the Necessary Information and Documentation 1 Know the “payee”, the name of the person you will give the check to. Are you a student or young adult ages 17 through 23?.

Step 3 Pay The Piper – You’ll need to pay the check’s full face value as well as any applicable fees upfront The fee is between $3 and $10 or a percentage of the check amount The table below lists which payment types are typically accepted *Requires obtaining cash advance, which is very costly on its own. View and understand the important features of your account At A Glance documents and Service Pricing Guides provide information about all banking products offered by BB&T in your state. That's an easy one just visit any of our community offices and we'd be happy to help Schedule An Appointment How can I close my account?.

That's an easy one just visit any of our community offices and we'd be happy to help Schedule An Appointment How can I close my account?. Fees and check limits will vary from store to store, but all will require a form of government ID Most won’t let you cash personal checks because of fraud risk, but if you’re trying to cash a government check, payroll check, cashier’s check , or money order, then your odds are good. If so, would the bank be the benefactor and the customer the transactor?.

A cashier’s check is when a bank withdraws available cash from your account and issues an official bank check from the bank made out to a certain person or business That money is guaranteed by. Regions Bank Fee 1% to 4% of the total check amount, depending on the check type;. Bank of America $8 per check for amounts greater.

Depending on whether the US dollar check is drawn on a Canadian, US or foreign bank account, your bank can hold the check until funds are released Scotiabank, for example, states that the maximum hold it will place on a US dollar check drawn on a bank branch in Canada is 10 business days, compared to five days for a Canadian dollar check. Bank NonCustomer Check Cashing Fee;. Add Bank Fees Paid in Cash to CTR?.

Fees Expect to pay a modest fee for cashier’s checks Banks and credit unions typically charge around $10 or so per check Banks and credit unions typically charge around $10 or so per check To cover that cost, you need extra money in cash, or available in your account. • Nonrefundable fee to M & T Bank in the form of a certified, cashier’s or other official bank check in the amount of (NYC properties) $1, or (outside of NYC) $ is due at application • Fee to Fentin Goldman Turk & Davidoff LLP is $ The nonrefundable. How do I get a money order or cashier's check?.

Aside from being sad to see you go, to close an account you'll just need to give us a call at BANK (2265) or visit at any of our community offices.

M T Bank Mychoice Checking

Where Can I Cash A Third Party Check 18 Options Detailed First Quarter Finance

M T Bank Mychoice Checking

Certified Checks Everything You Need To Know Smartasset

M T Bank T Commercial Bank Branch T Text Branch Png Pngegg

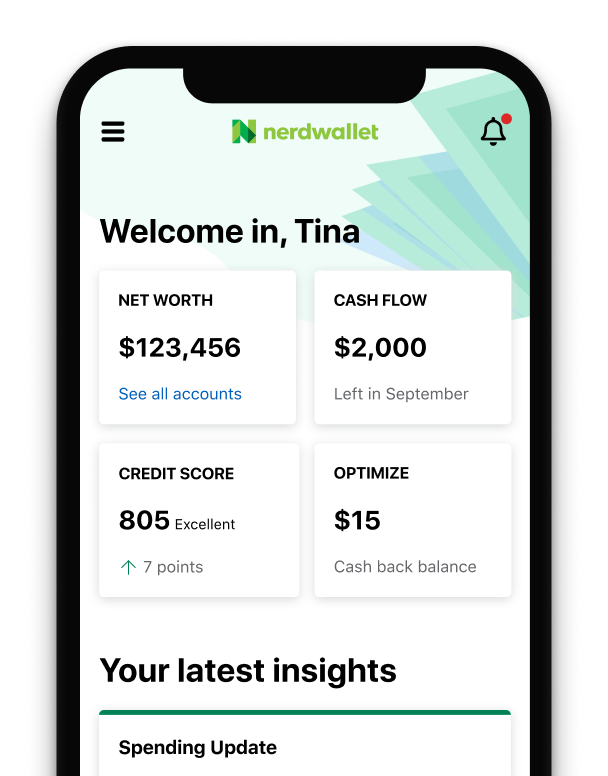

Best Banks To Avoid Atm Fees Nerdwallet

Cheapest Way To Cash A Personal Check Without A Bank Account

Cashier S Check 101 When You Need One And How To Get It The Motley Fool

Covid 19 Resources Understanding Your Resilience Covid 19 Resources M T Bank

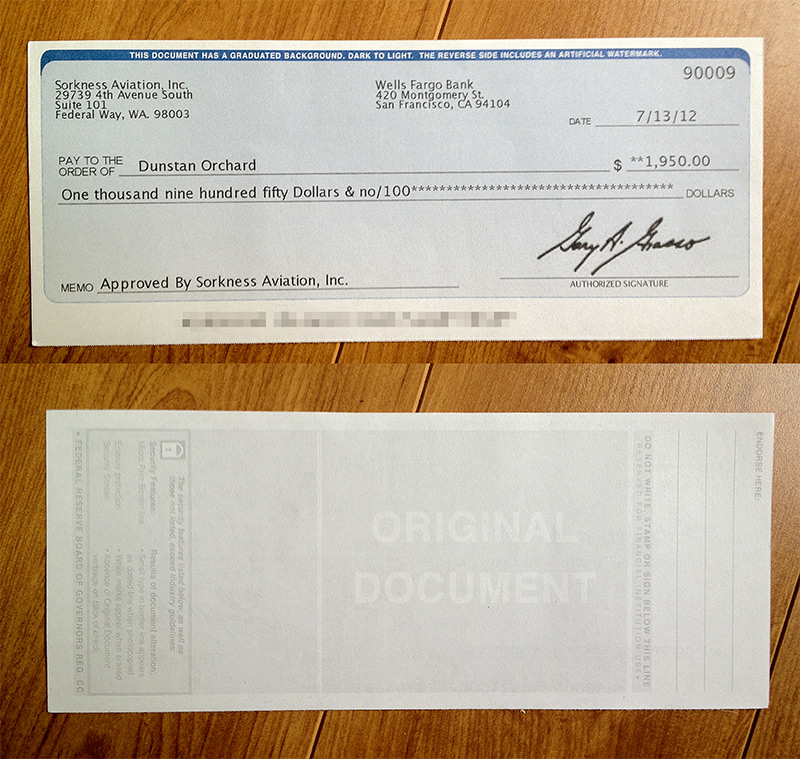

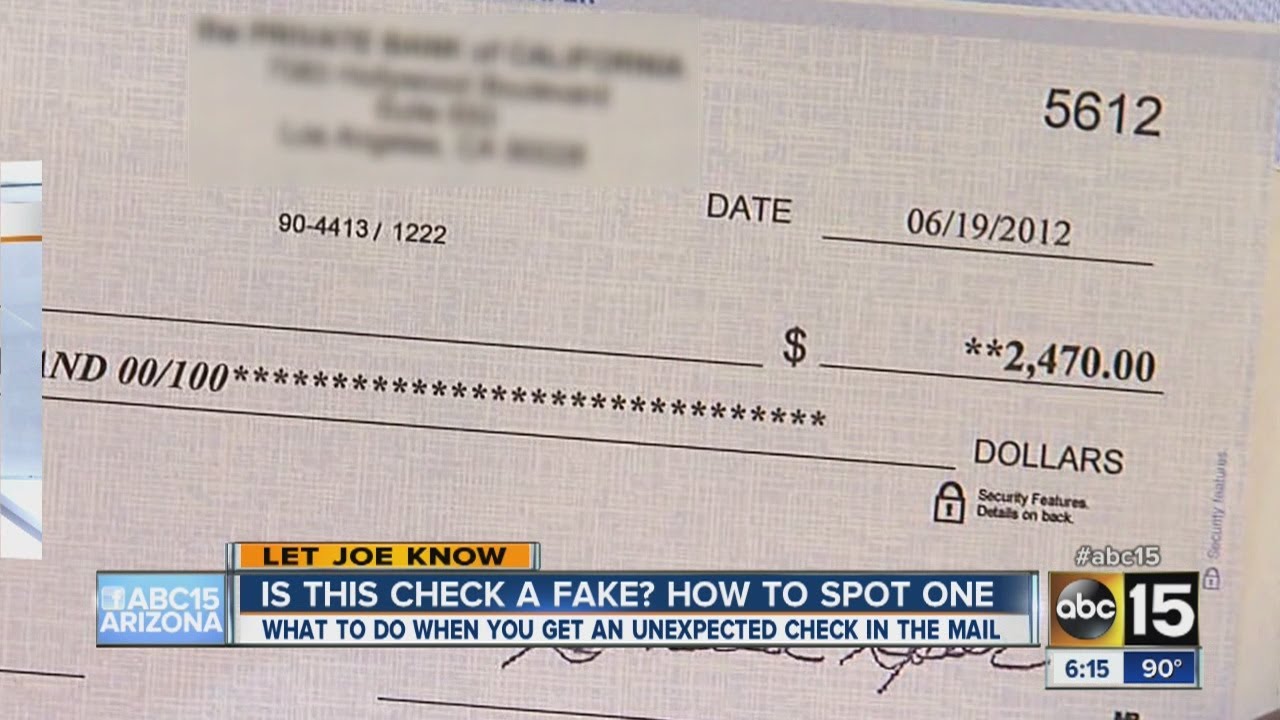

Got An Unexpected Check In The Mail It May Be Fake The New York Times

What Is A Certified Check Nerdwallet

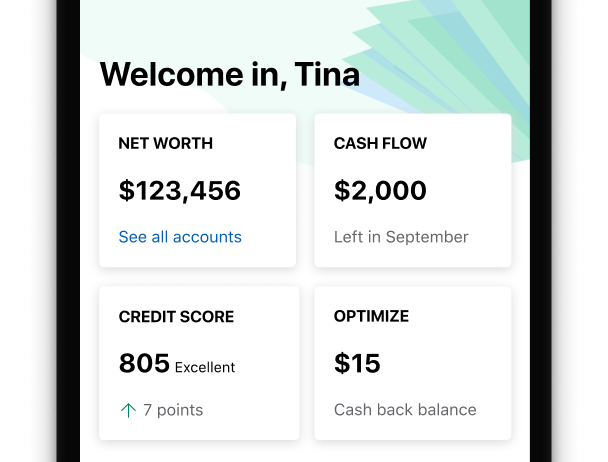

M T Mobile Banking Apps On Google Play

/GettyImages-949219696-e4c7b0e0b92847cb91ac7cc928362bad.jpg)

Best Ways To Get A Cashier S Check

M T Bank Review Insuffiecent Funds Complaintsboard Com

How Banks Are Supporting Businesses Impacted By Covid 19 Divvy

How Banks Are Supporting Businesses Impacted By Covid 19 Divvy

M T Bank Mychoice Checking

Fees To Cash Checks For Non Customers At The Top Banks Mybanktracker

M T Bank Mychoice Checking

Best Banks In Baltimore 21 Smartasset Com

How To Cash A Check At Walmart Mybanktracker

Beware Of M T Bank Scam Wgrz Com

How Do I Order New Checks From M T Bank

M T Bank Vs Capital One Which Is Better

How Long It Takes A Check To Clear At Regional Banks Mybanktracker

Routing Number What It Is And Where To Find It Magnifymoney

West Broad Branch Atm In Richmond Va M T Bank

What Is A Certified Check And How Do You Get One Thestreet

Chase Vs Pnc Bank Which Is Better

Covid 19 Resources Understanding Your Resilience Covid 19 Resources M T Bank

Debit Card Foreign Transaction And Atm Fees Nerdwallet

How To Fill Out A Money Order 7 Easy Steps Gobankingrates

/Balance_8_Simple_Rules_For_Using_Your_Debit_Card_In_Europe_4167622_V1-0c3056f6fa844c07a1cec5015a0b04b7.png)

8 Simple Rules For Using Your Debit Card In Europe

M T Bank Vs Capital One Which Is Better

What Is A Cashier S Check When You Need One And How To Get It

Cashier S Check Vs Money Order What S The Difference Bankrate

Cashier S Check Fee Comparison At Top 10 U S Banks Mybanktracker

37 Places That Cash Personal Checks Fees Limits Etc Detailed First Quarter Finance

Enochnoland S Blog Film

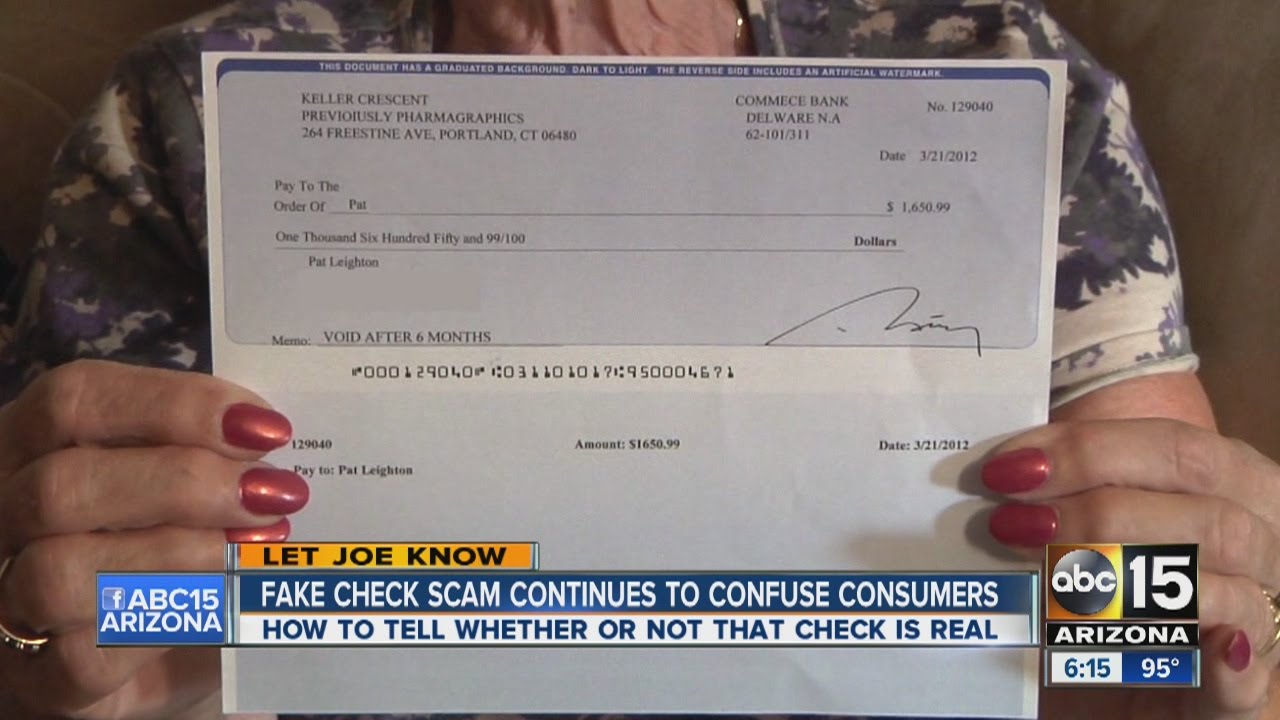

Fake Check Scam Continues To Confuse Consumers Youtube

Beware Of M T Bank Scam Wgrz Com

Bardy Cole Mark Dowell S Fake Check Craigslist Scam

M And T Bank Cashier Check Logo Page 1 Line 17qq Com

:max_bytes(150000):strip_icc()/cashier-s-check-79474537-5a1f063f7d4be80019ed3b90.jpg)

Best Ways To Get A Cashier S Check

Fee Schedule Personal Products Services Pdf Free Download

M T Mobile Banking Apps On Google Play

Best Checking Accounts And Rates February 21 Us News Money

Best 24 Hour Check Cashing Near Me 27 Best Places Open Now Frugal Living Coupons And Free Stuff

Lot 5 Pc Lot Of Vintage Bank Bags Commonwealth Nat L Bank M T Bank Federal Reserve More

Where To Get A Money Order Compare Usps Bank Fees Mybanktracker

Cashier S Check Vs Certified Check What S The Difference Keybank

People S United Bank Review Is It The Right Bank For You Gobankingrates

M And T Bank Cashier Check Logo Page 1 Line 17qq Com

Counter Checks Fees Compared At The Top U S Banks Mybanktracker

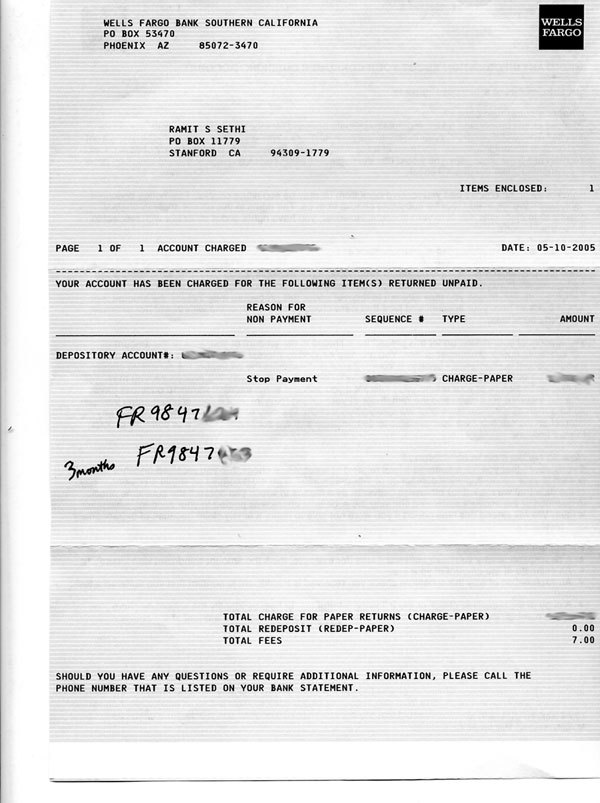

Do Banks Trap You Into Overdraft Fees Consumerismcommentary Com

How To Spot Avoid And Report Fake Check Scams Ftc Consumer Information

How Bank Transactions Are Processed M T Bank

Cashier S Check Vs Money Order How To Decide Nerdwallet

Where Can I Cash A Check Banking Advice Us News

12 Banks That Accept Third Party Checks Fees Requirements Detailed First Quarter Finance

How To Get A Cashier S Check 10 Steps With Pictures Wikihow

Overdraft Fees Compare What Banks Charge Nerdwallet

The Difference Between A Cashier S Check And Money Order Gobankingrates

Bank Atm Fees How Much Do Banks Charge And How Can I Avoid Them Valuepenguin

How To Cash A Large Check Without A Hold Or Even A Bank Account First Quarter Finance

15 Cheapest Place To Cash A Check In 21 The Wealth Circle

Fee Schedule Personal Products Services Pdf Free Download

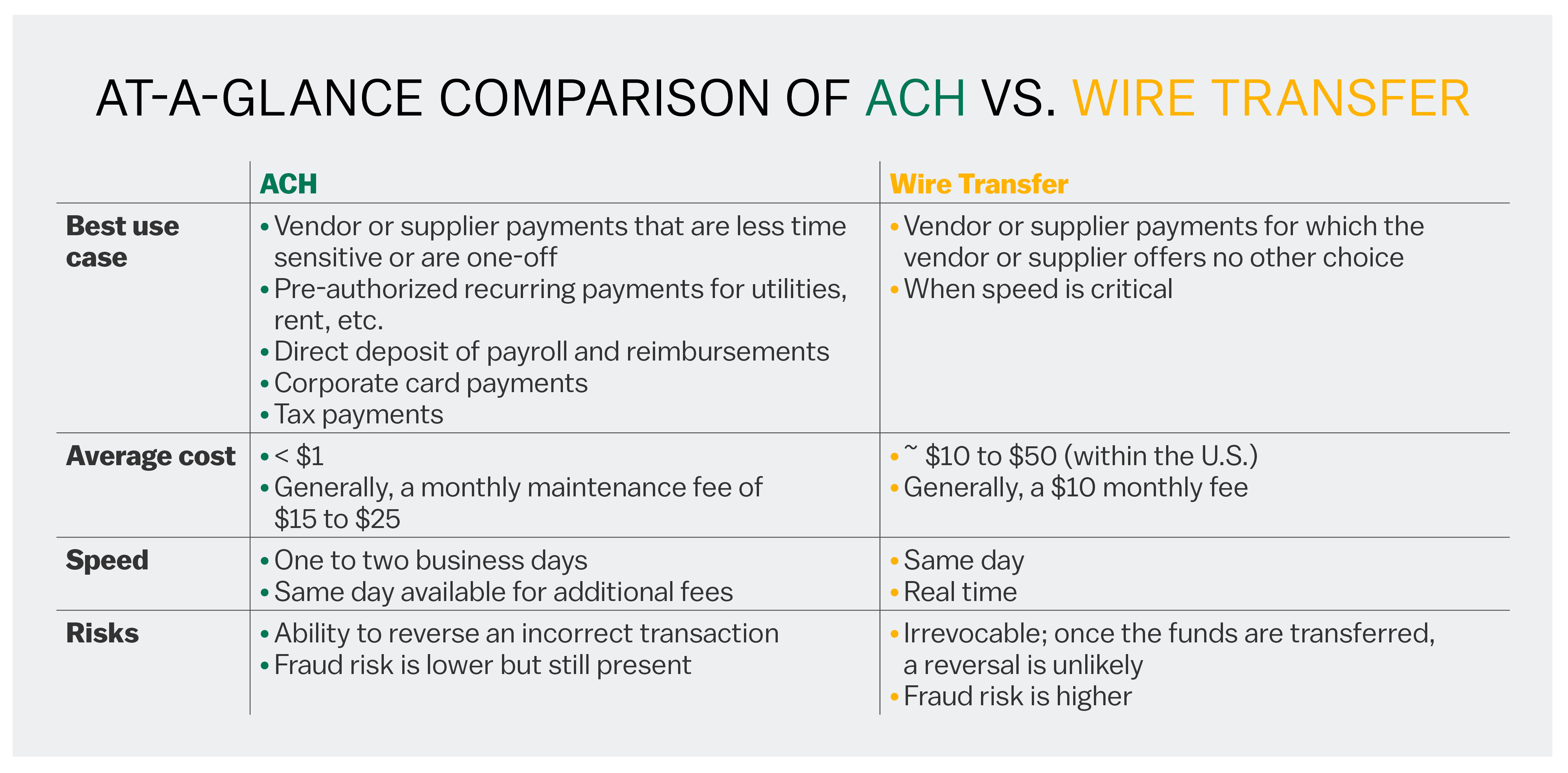

Ach Vs Wire Transfers Uses Costs And Risks M T Bank

21 M T Bank Reviews Checking Accounts

Rising Bank Review Is It The Right Bank For You Gobankingrates

24 Hour Check Cashing Near Me Best Places To Cash A Check 24 7

M T Bank Mychoice Checking

/how-to-fill-out-a-deposit-slip-315429-FINAL-88cd427461ed43c6b5b7fc93d74030d2.png)

How To Fill Out A Deposit Slip

12 Banks That Accept Third Party Checks Fees Requirements Detailed First Quarter Finance

M T Mobile Banking Apps On Google Play

24 Hour Check Cashing Stores Located Near You

Covid 19 Personal Covid 19 Be Informed Help Center M T Bank

M T Bank Rates Fees Review

Covid 19 Resources Understanding Your Resilience Covid 19 Resources M T Bank

Fee Schedule Personal Products Services Pdf Free Download

Overdraft Fees Compare What Banks Charge Nerdwallet

Quotes About Cheque 59 Quotes

Us Bank Routing Number Locate Your Number Gobankingrates

Where To Go For Late Night Check Cashing 28 Options Listed First Quarter Finance

/how-to-fill-out-a-deposit-slip-315429-FINAL-88cd427461ed43c6b5b7fc93d74030d2.png)

How To Fill Out A Deposit Slip

The Best National Banks Of 21

Got A Check In The Mail How To Make Sure It S The Real Deal Youtube

M T Bank Mychoice Checking

M T Bank Checking Account Review Should You Open

68 Places With Check Cashing Services Fees Limits Included First Quarter Finance